- United States

- /

- Professional Services

- /

- NYSE:TRU

Did Integrating Snappt's Fraud Detection Into TruVision Just Shift TransUnion's (TRU) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this week, TransUnion announced a partnership with Snappt to integrate Snappt's Applicant Trust Platform into its TruVision Resident Screening, offering property managers built-in income verification and fraud detection alongside traditional tenant screening.

- This collaboration provides property management clients with a unified workflow that aims to streamline efficiency and improve confidence in lease decisions by reducing fraudulent documentation.

- We'll examine how the integration of advanced fraud detection into TruVision may influence TransUnion's investment narrative and future growth potential.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

TransUnion Investment Narrative Recap

To be a shareholder in TransUnion, you need to believe in the company’s ability to maintain its position as a leader in risk analytics and consumer data, fueled by constant product innovation and expansion of high-value solutions. The partnership with Snappt represents an incremental positive for TransUnion's identity and fraud portfolio, strengthening its value proposition in property management, but it is unlikely to be a decisive short-term catalyst or fundamentally reduce the top risk of regulatory and data privacy pressures.

Of TransUnion’s latest developments, the recent launch of its Credit Washing Solution stands out for its relevance to the Snappt partnership, as both highlight the company’s commitment to advanced fraud detection and verification. By addressing the growth of fraud and data integrity challenges through machine learning and real-time analytics, TransUnion aims to deepen client trust, an essential factor for supporting earnings growth and defending market share.

Yet, despite these technological advances, investors should also consider how new regulatory requirements around data collection...

Read the full narrative on TransUnion (it's free!)

TransUnion's narrative projects $5.6 billion revenue and $869.9 million earnings by 2028. This requires 8.4% yearly revenue growth and a $477.9 million earnings increase from $392.0 million today.

Uncover how TransUnion's forecasts yield a $106.95 fair value, a 28% upside to its current price.

Exploring Other Perspectives

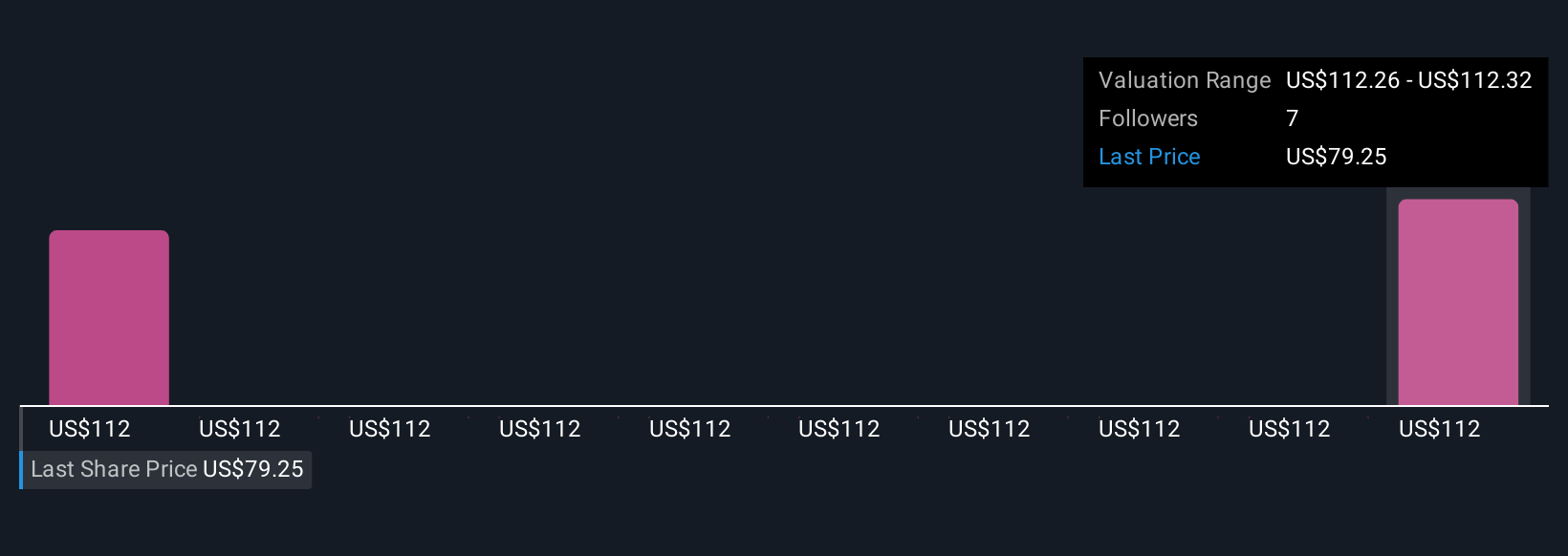

Simply Wall St Community members offered two fair value estimates for TransUnion, ranging from US$106.95 to US$136.43. As participants’ views vary, remember that regulatory scrutiny remains a meaningful influence on the company’s long-term performance and may affect how these estimates play out.

Explore 2 other fair value estimates on TransUnion - why the stock might be worth as much as 63% more than the current price!

Build Your Own TransUnion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TransUnion research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TransUnion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TransUnion's overall financial health at a glance.

No Opportunity In TransUnion?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransUnion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRU

TransUnion

Operates as a global consumer credit reporting agency that provides risk and information solutions.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives