- United States

- /

- Professional Services

- /

- NYSE:TRU

A Closer Look at TransUnion (TRU) Valuation Following Recent Share Price Gains

Reviewed by Simply Wall St

TransUnion (TRU) stock has shown some movement over the past month, capturing investor attention as they assess its recent performance. Shares have risen about 5% in that period, even as longer-term results remain mixed.

See our latest analysis for TransUnion.

After a bumpy ride earlier this year, TransUnion’s recent 1-month share price return of nearly 5% brings a bit of momentum. However, the 1-year total shareholder return remains in negative territory. For now, confidence is picking up, but investors are still weighing longer-term headwinds against potential upside.

If you’re open to new possibilities beyond the usual suspects, consider broadening your perspective and discover fast growing stocks with high insider ownership

With the stock still trading nearly 25% below its average analyst price target, the question remains: are investors overlooking hidden value, or has the market already accounted for all the growth ahead?

Most Popular Narrative: 23.9% Undervalued

TransUnion’s most widely followed narrative suggests there is still significant upside compared to its last closing price of $81.18. As expectations for earnings growth increase, the market’s current skepticism sets the stage for a potential rerating.

Strategic innovation investments, including AI, machine learning, and the roll-out of the global cloud-native OneTru platform, are driving efficiency, faster product launches, better cross-sell opportunities, and improved customer retention. These efforts position TransUnion to grow earnings with higher operating leverage and net margins as technology transformation costs subside after 2025.

What is behind the optimism? There is a bold projection for sustained earnings growth, margin improvements, and a future profit multiple that is higher than industry peers. Want to know what powers this ambitious fair value? Dive in to discover why this narrative rests on numbers that could redefine TransUnion’s story.

Result: Fair Value of $106.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, evolving data privacy regulations and growing competition could challenge TransUnion’s optimistic outlook. These factors could potentially pressure revenue growth and profit margins ahead.

Find out about the key risks to this TransUnion narrative.

Another View: Is TransUnion Really a Bargain?

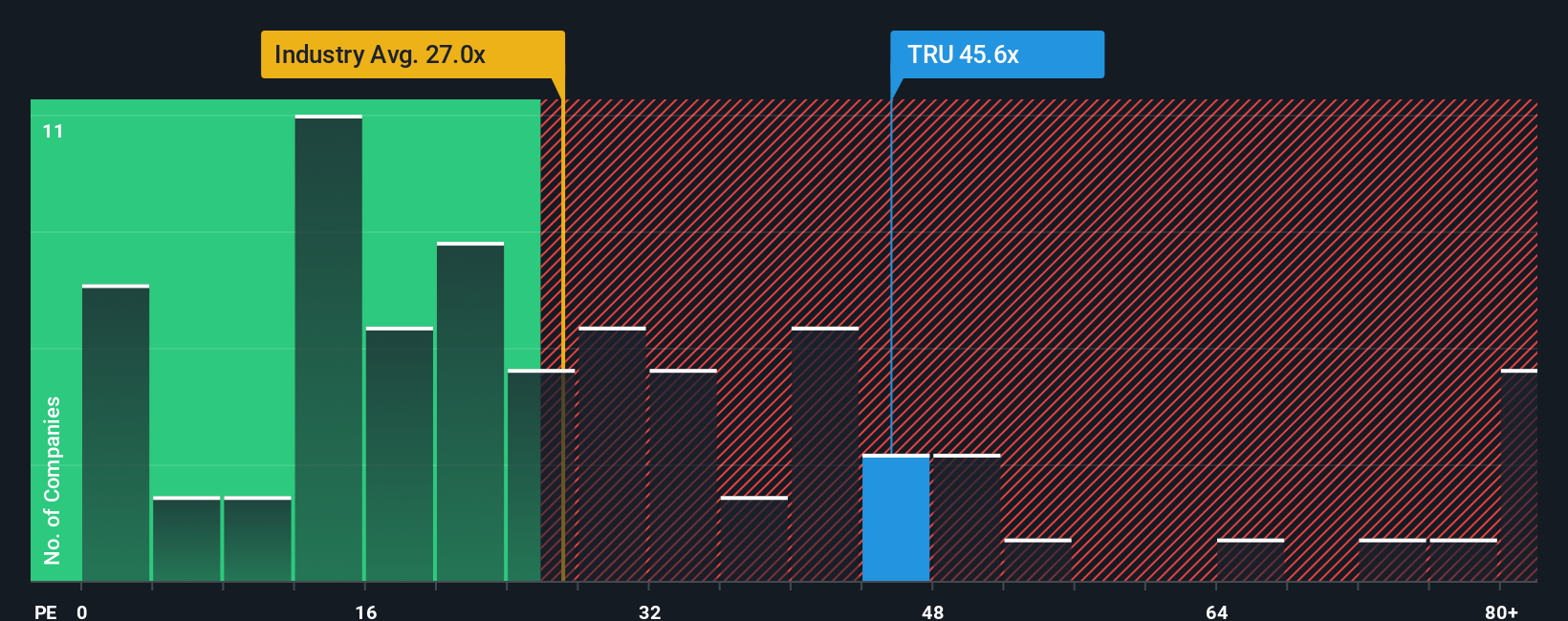

While analysts see clear upside, looking through the lens of price-to-earnings, the stock seems expensive versus both its industry and peers. TransUnion trades at 37.5 times earnings, compared to 25.4 for its sector, 25.7 for peers, and a fair ratio of 31.6. This wide gap could signal valuation risk if growth does not meet expectations. Does the market know something others do not, or is optimism simply running too far ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TransUnion Narrative

If you would rather analyze the numbers firsthand or put your own perspective on TransUnion’s outlook, building a personal narrative can take less than three minutes. Do it your way

A great starting point for your TransUnion research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the crowd. Take the lead and upgrade your investment game with strategies and stocks you might be missing out on today.

- Unlock stable income streams when you check out these 22 dividend stocks with yields > 3%, offering yields over 3% and consistent financial health.

- Spot early movers in next-generation intelligence by reviewing these 26 AI penny stocks, paving the way in artificial intelligence and machine learning.

- Snap up hidden gems trading below fair value with these 840 undervalued stocks based on cash flows, positioning yourself ahead of potential market reratings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransUnion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRU

TransUnion

Operates as a global consumer credit reporting agency that provides risk and information solutions.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives