- United States

- /

- Professional Services

- /

- NYSE:TNET

TriNet Group (TNET) Valuation in Focus as Option Volatility Climbs and Analyst Forecasts Diverge

Reviewed by Simply Wall St

Most Popular Narrative: 11.5% Undervalued

According to the community narrative, TriNet Group is seen as undervalued by 11.5% when factoring in expectations for earnings growth, profit margin expansion, and industry challenges. These projections reflect an optimistic long-term outlook, but also highlight underlying risks and debates between analysts.

“Strategic enhancements to TriNet's go-to-market and broker channel strategy, including new national and local broker partnerships and AI-enabled sales tools, are projected to improve sales momentum and customer onboarding. This is expected to support revenue and earnings growth in future periods."

Is the real story in TriNet's transformation? Behind this valuation is a bold profit outlook and a leaner company model that analysts believe could redefine industry norms. But what are the financial moves powering this optimistic target, and what assumptions must remain valid for it to hold? The full narrative explores the calculations behind the positive outlook.

Result: Fair Value of $78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising healthcare costs and continued softness in client hiring could undermine TriNet’s growth story and challenge even the most optimistic projections.

Find out about the key risks to this TriNet Group narrative.Another View: What the SWS DCF Model Suggests

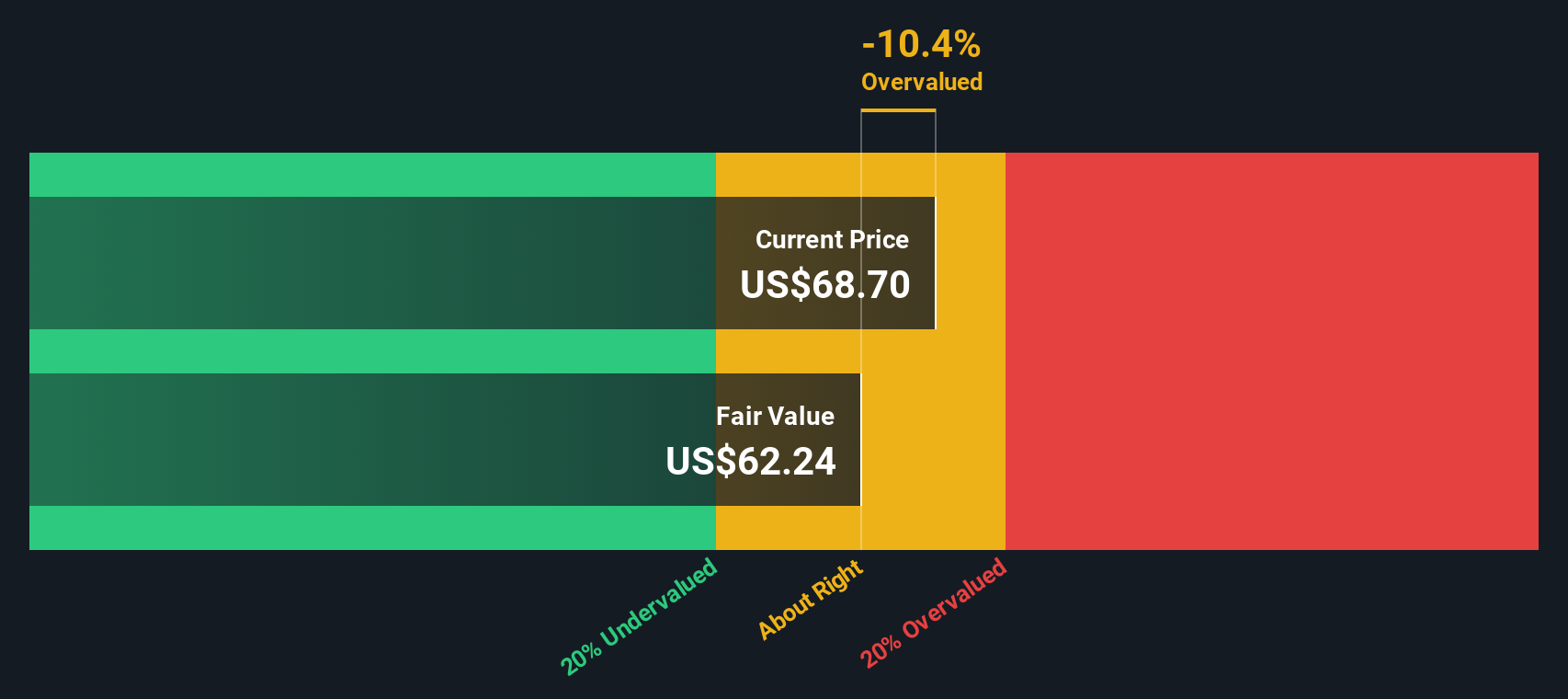

While the earlier valuation paints an optimistic picture, the SWS DCF model arrives at a different conclusion and suggests TriNet could be priced above its true worth. Does this method reveal risks that the first one overlooked?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TriNet Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TriNet Group Narrative

If this analysis does not align with your perspective or you value independent research, you have the tools to craft your own assessment in just a few minutes, so why not do it your way?

A great starting point for your TriNet Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Stay ahead by expanding your search beyond TriNet Group. Make the most of Simply Wall Street’s powerful tools to find promising opportunities others may overlook. Here are some standout ideas that can help you build a stronger and more resilient portfolio right now:

- Target reliable passive income streams as you check out high-yield opportunities among dividend stocks with yields > 3%.

- Jump on the AI trend with rapid innovators leading healthcare breakthroughs through healthcare AI stocks.

- Seek companies with compelling value by weighing options presented in undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TriNet Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNET

TriNet Group

Provides comprehensive and flexible human capital management services for small and medium size businesses in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives