- United States

- /

- Professional Services

- /

- NYSE:TIXT

TELUS International (Cda) Inc. (NYSE:TIXT) Not Doing Enough For Some Investors As Its Shares Slump 25%

TELUS International (Cda) Inc. (NYSE:TIXT) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 71% share price decline.

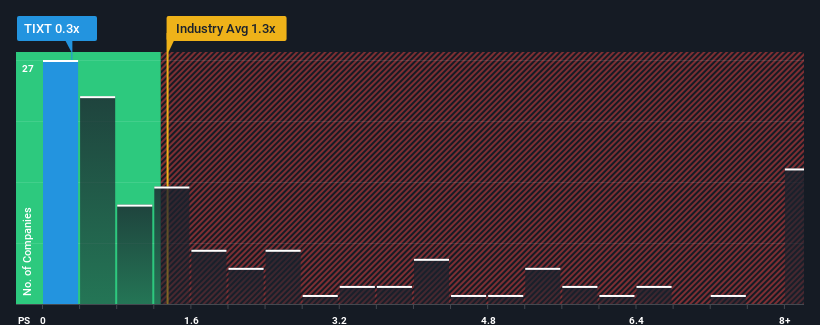

Following the heavy fall in price, TELUS International (Cda)'s price-to-sales (or "P/S") ratio of 0.3x might make it look like a buy right now compared to the Professional Services industry in the United States, where around half of the companies have P/S ratios above 1.3x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for TELUS International (Cda)

How TELUS International (Cda) Has Been Performing

TELUS International (Cda) could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on TELUS International (Cda).What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, TELUS International (Cda) would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 1.8% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 21% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 4.4% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 6.9% per year, which is noticeably more attractive.

In light of this, it's understandable that TELUS International (Cda)'s P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

TELUS International (Cda)'s recently weak share price has pulled its P/S back below other Professional Services companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of TELUS International (Cda)'s analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for TELUS International (Cda) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if TELUS International (Cda) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TIXT

TELUS International (Cda)

Offers digital customer experience and digital solutions in the Asia-Pacific, the Central America, Europe, Africa, North America, and internationally.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives