- United States

- /

- Professional Services

- /

- NYSE:TIXT

Is TELUS International Stock Poised for a Turnaround After 17% Rally This Year?

Reviewed by Bailey Pemberton

Trying to decide what to do with TELUS International (Cda) stock? You are not alone. This is one of those names that has people wondering if the tides are finally turning, or if caution is still the right call. After a challenging few years, TELUS International's share price has caught some positive momentum, climbing 12.0% year-to-date and up 17.3% over the past year. But let’s be real. The memory of that steep 82.3% drop over the last three years is hard to ignore for any investor who’s been following along.

Recent market developments have started to shift perceptions of risk around digital transformation and technology services, helping TELUS International's reputation recover a bit. At the same time, this movement in the share price hints at renewed optimism and an appetite for potential growth. It is worth acknowledging just how much ground there is left to make up. If you are taking a step back to gauge whether the stock is attractively valued right now, you are not alone there, either.

That brings us right to the numbers. Using a rigorous valuation framework that assesses six separate checks to see if the company is trading below its true worth, TELUS International comes in with a solid value score of 5. This suggests the stock is undervalued on nearly every front analysts care about. However, no number tells the whole story on its own, so let’s dig into why TELUS International earned such a high score based on different valuation approaches. Before we finish, I will share a smarter way to look at value that goes beyond traditional metrics.

Approach 1: TELUS International (Cda) Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used approach for valuing companies by forecasting their future cash flows and then discounting those amounts back to today's dollars. This method reflects the time value of money. Essentially, it attempts to answer the question: what is the business worth today, based on the cash it is expected to generate over the years?

For TELUS International (Cda), the current Free Cash Flow stands at $294.8 million. Analysts provide cash flow forecasts up to 2027, and projections continue for up to 10 years, reaching a forecasted $374.3 million by 2035. These later estimates are calculated using moderate growth assumptions and not direct analyst coverage. This model estimates slow but steady increases in Free Cash Flow over the decade.

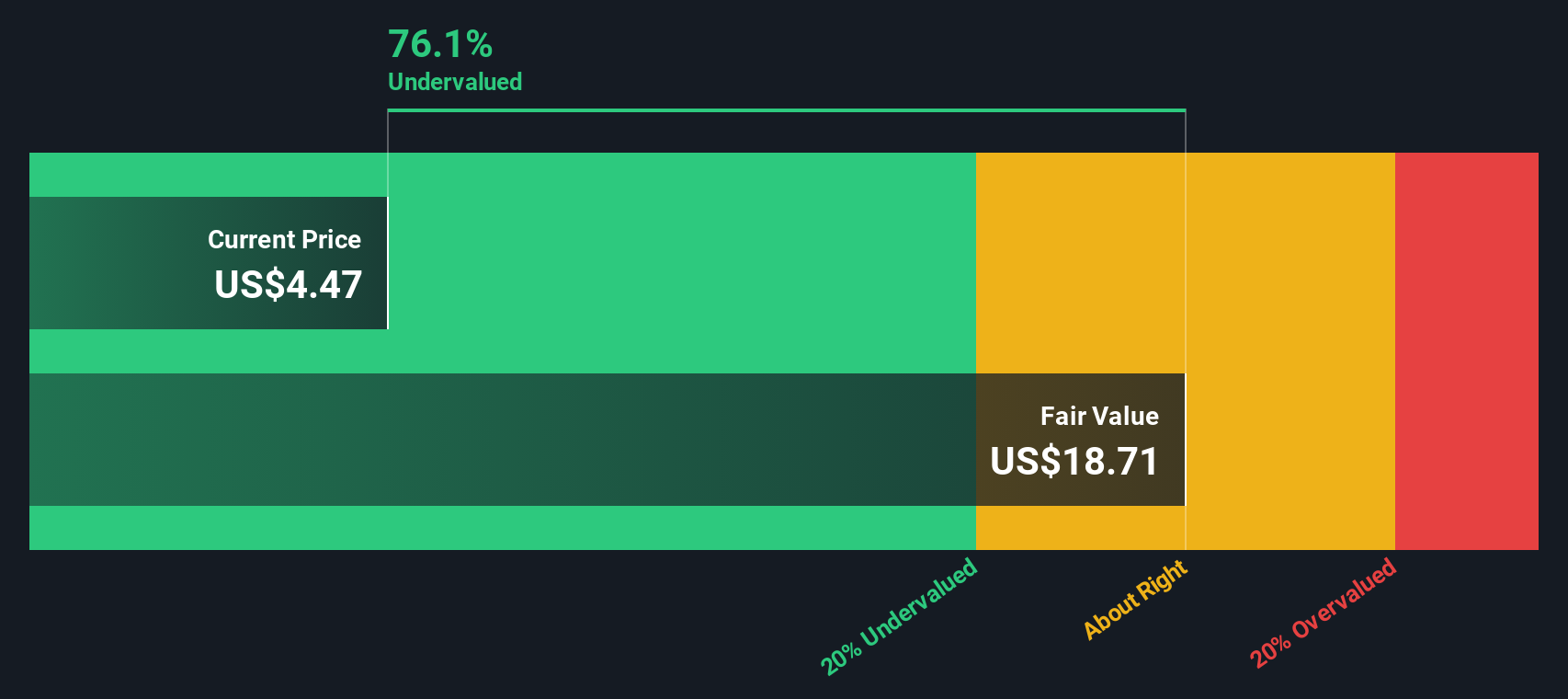

Based on these projections and discounting all future cash flows back to the present, the intrinsic value calculated for TELUS International (Cda) stock is $18.75 per share. At current prices, this suggests the company is trading at a 76.1% discount to its estimated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests TELUS International (Cda) is undervalued by 76.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: TELUS International (Cda) Price vs Sales

For many profitable companies, the Price-to-Sales (P/S) ratio is a solid measure of valuation, especially in technology and service businesses where earnings can be volatile but sales tend to be consistent and less subject to accounting adjustments. The P/S ratio helps investors gauge what they are paying for each dollar of revenue the company generates. Higher growth and lower risk typically command higher multiples in the market.

Currently, TELUS International (Cda) is trading at a P/S ratio of 0.46x, which stands out against both its peer average of 1.53x and the broader industry average of 1.29x in Professional Services. While comparing these numbers can flag if a stock is “cheap” or “expensive,” it can overlook important factors like the company’s unique growth prospects, profitability, market cap, and associated risks. This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for TELUS International is calculated at 0.64x. This reflects an adjusted benchmark tailored to its specific situation, factoring in future earnings growth, profit margins, its market size, and other risk measures.

Because the Fair Ratio is both data-driven and company-specific, it offers a more reliable baseline than rough peer or sector averages. Comparing TELUS International (Cda)’s actual P/S ratio of 0.46x to its Fair Ratio of 0.64x reveals that the stock is trading at a notable discount. This suggests there is some built-in margin of safety at this level.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your TELUS International (Cda) Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story behind your investment view, connecting your assumptions about a company's future revenue, earnings, and margins to a fair value calculation.

Narratives give you the chance to put your perspective front and center by explaining why you think TELUS International is undervalued, fairly priced, or even risky, all based on your expectations for how the business will perform. This approach goes beyond static ratios and lets you personalize your view while seeing the financial implications right away.

On Simply Wall St’s Community page (used by millions of investors), Narratives are easy to use and continually updated as fresh news or earnings data arrives, so your valuation can adjust dynamically over time.

For example, one investor might believe that TELUS International will expand rapidly by embracing digital and AI, supporting a fair value well above the current price. Another could be more cautious due to margin pressures and competitive risks, arriving at a much lower fair value. Narratives make it simple to compare these viewpoints, helping you decide if now is the right time to buy, hold, or sell, all with a clear link from story to forecast to fair value.

Do you think there's more to the story for TELUS International (Cda)? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TELUS International (Cda) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TIXT

TELUS International (Cda)

Offers digital customer experience and digital solutions in the Asia-Pacific, the Central America, Europe, Africa, North America, the United Arab Emirates, and internationally.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives