RB Global, Inc. (NYSE:RBA) has announced that it will pay a dividend of $0.27 per share on the 1st of March. This makes the dividend yield 1.7%, which will augment investor returns quite nicely.

Check out our latest analysis for RB Global

RB Global's Payment Has Solid Earnings Coverage

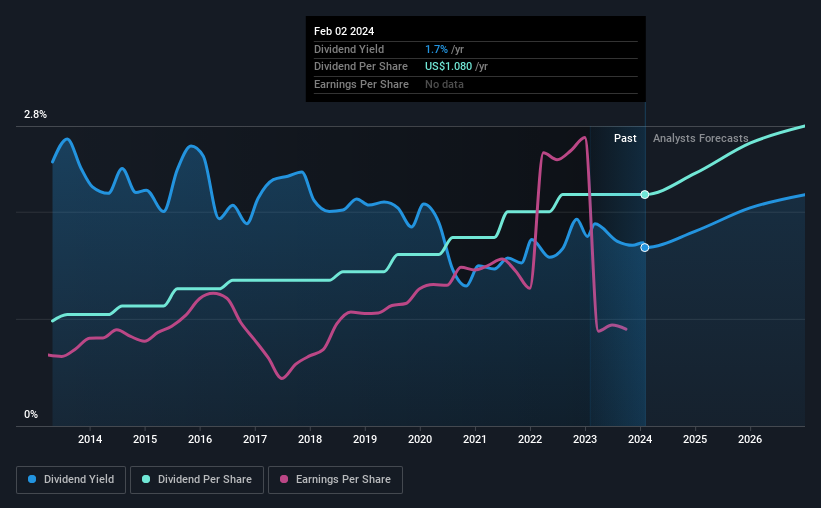

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, the company was paying out 111% of what it was earning. This situation certainly isn't ideal, and could place significant strain on the balance sheet if it continues.

Over the next year, EPS is forecast to expand rapidly. If the dividend continues along recent trends, we believe we could see the payout ratio reaching 75%, which is definitely on the higher side, but still sustainable.

RB Global Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The dividend has gone from an annual total of $0.49 in 2014 to the most recent total annual payment of $1.08. This means that it has been growing its distributions at 8.2% per annum over that time. The growth of the dividend has been pretty reliable, so we think this can offer investors some nice additional income in their portfolio.

Dividend Growth Is Doubtful

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Unfortunately things aren't as good as they seem. It's not great to see that RB Global's earnings per share has fallen at approximately 7.1% per year over the past five years. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits. Earnings are predicted to grow over the next year, but we would remain cautious until a track record of earnings growth is established.

An additional note is that the company has been raising capital by issuing stock equal to 64% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. We don't think RB Global is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 6 warning signs for RB Global (3 shouldn't be ignored!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RBA

RB Global

An omnichannel marketplace, provides insights, services, and transaction solutions for buyers and sellers of commercial assets and vehicles worldwide.

Solid track record with adequate balance sheet and pays a dividend.