- United States

- /

- Commercial Services

- /

- NYSE:RBA

Assessing RB Global's (NYSE:RBA) Valuation Following FTSE All-World Index Inclusion

Reviewed by Kshitija Bhandaru

If you own RB Global (NYSE:RBA) or have it on your watchlist, you might be paying extra attention this week. The company was just added to the FTSE All-World Index, a widely followed benchmark by institutional money managers and global ETFs. Moves like this often mean more visibility for the stock, which can sometimes translate to higher trading volumes and increased demand as index funds rebalance their holdings.

Looking over the past year, RB Global has already shown steady momentum, with the stock gaining 38% over twelve months. Even in the shorter term, it has achieved an 8% climb in the past three months, indicating continued investor interest. Annual revenue and net income growth have also strengthened, helping to support these gains alongside the new index inclusion.

The bigger question now is whether the recent index-driven rally presents a real buying opportunity or if the market has already factored in RB Global’s future growth. What do you think?

Most Popular Narrative: 6.4% Undervalued

The most widely followed narrative sees RB Global as undervalued, pricing in strong future growth, improving margins, and strategic global expansion.

Strategic global expansion and technology investments are enhancing operational efficiency. These initiatives are supporting higher transaction volumes and driving long-term revenue and margin growth. Growing demand for sustainability and expanded value-added services are boosting service revenues and strengthening RB Global's positioning in the pre-owned asset marketplace.

Curious how RB Global’s valuation gets this boost? The secret power in this consensus is a bold recipe of growth and profit margin assumptions that drive the fair value higher than today’s market price. Want to see how these catalysts and precise financial projections work together to set the target above current levels?

Result: Fair Value of $122.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing macroeconomic uncertainty and increased digital competition could challenge RB Global’s growth prospects and pressure its valuation outlook in the coming years.

Find out about the key risks to this RB Global narrative.Another View: Looking at Market Comparisons

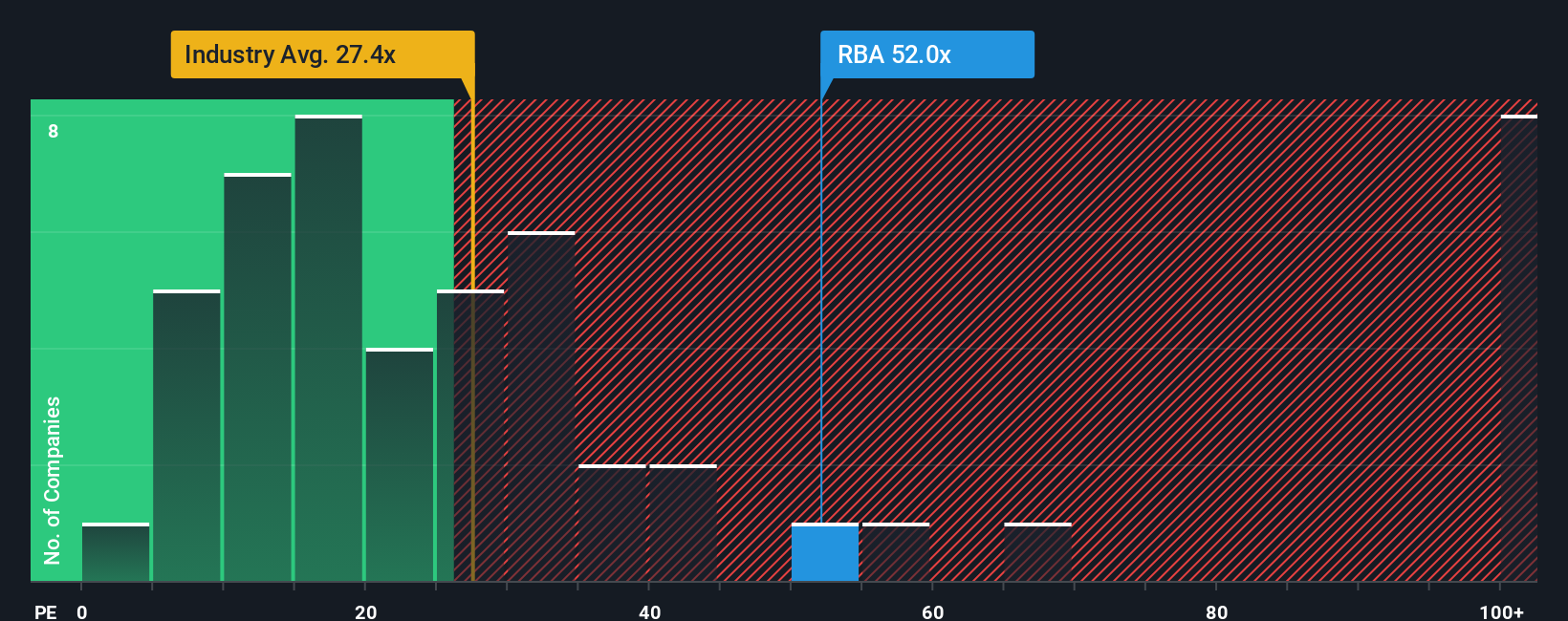

But here is a different angle. When measured against other companies in its industry, RB Global currently looks pricey. This method suggests the stock may not offer the same upside as some think. Which lens feels more convincing to you?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RB Global Narrative

If you see things differently or want to dig into the numbers your own way, you can build a personal RB Global story in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding RB Global.

Looking for More Smart Investment Opportunities?

Don't settle for just one angle. The best investors scan beyond the obvious for tomorrow’s winners. Expand your horizons and find stocks few are even thinking about.

- Uncover hidden gems with rapid growth potential and strong fundamentals by tapping into screener containing undiscovered stocks with strong fundamentals.

- Position yourself for the future of innovation in healthcare by scanning companies driving breakthroughs in medical AI using healthcare AI stocks.

- Capture the rewards of steady passive income by targeting reliable businesses paying attractive yields with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBA

RB Global

Operates a marketplace that provides insights, services, and transaction solutions for buyers and sellers of commercial assets and vehicles worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives