- United States

- /

- Professional Services

- /

- NYSE:PL

Planet Labs (PL) Q3 2026 EPS Worsening Challenges Bullish Profitability Narratives

Reviewed by Simply Wall St

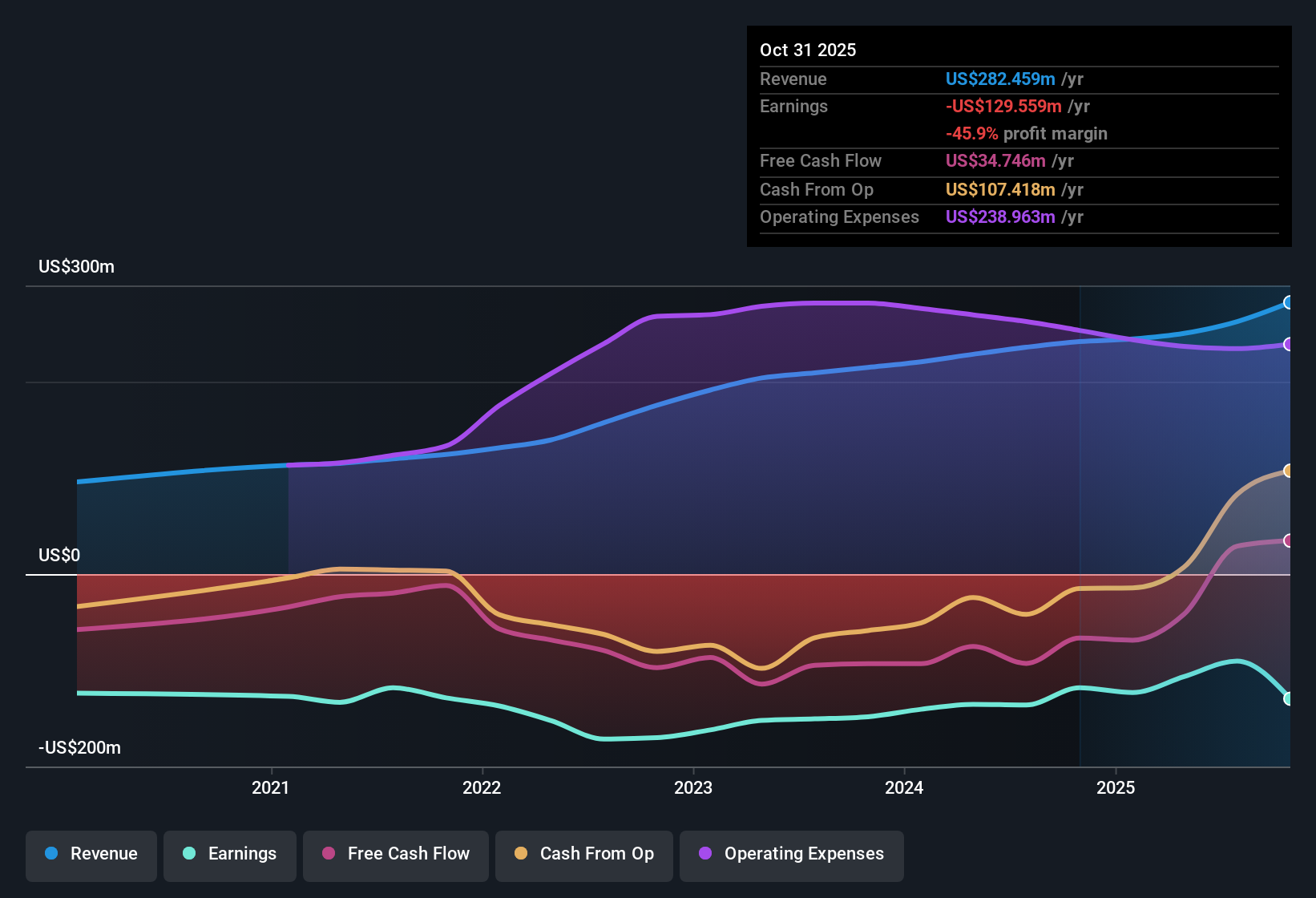

Planet Labs PBC (PL) just posted another quarterly update with Q3 2026 revenue of about $81.3 million, basic EPS of roughly -$0.19, and trailing-12-month revenue sitting near $282.5 million alongside TTM EPS of around -$0.43. This keeps the profitability story clearly in the red even as the top line builds. The company has seen revenue move from about $61.3 million in Q3 2025 to $81.3 million in Q3 2026, while quarterly EPS has slid from roughly -$0.07 to -$0.19 over the same stretch, underscoring a trade off between scale and stubbornly negative margins that investors will read as a classic growth versus profitability tug of war.

See our full analysis for Planet Labs PBC.With the headline numbers set, the next step is to see how this mix of stronger sales and ongoing losses lines up against the most widely held narratives about Planet Labs, and which parts of the story those fresh margins quietly challenge.

See what the community is saying about Planet Labs PBC

Revenue Growth Outpaces Profit Progress

- On a trailing 12 month basis, revenue has climbed from about $235.8 million in Q2 2025 to roughly $282.5 million in Q3 2026, while TTM net loss has stayed large at around $129.6 million.

- Consensus narrative highlights strategic partnerships and higher value solutions as potential drivers of stronger margins. However, the current TTM net loss of about $129.6 million against $282.5 million in revenue shows that, so far, the shift to solutions and larger contracts has not visibly translated into improved overall profitability.

- Supporters point to a move toward more predictable, solution based revenue and contracts like the $230 million JSAT deal as future margin drivers. Even so, the latest TTM EPS of about -$0.43 still reflects a business model that is not yet breaking even.

- The same narrative expects expanding satellite capacity and AI enabled offerings to accelerate growth. The move from roughly $241.7 million to $282.5 million in TTM revenue over the last year does support the growth angle, even though losses remain substantial.

Persistent Losses Despite 3.8 Percent Improvement Trend

- TTM net loss sits near $129.6 million in Q3 2026 with TTM EPS around -$0.43, and analysis data notes that historically losses have narrowed by about 3.8 percent per year over five years. Yet the company is still forecast to remain unprofitable for at least the next three years.

- Bears focus on this ongoing unprofitability and the lack of a forecast path to positive earnings, and the current Q3 2026 net loss of about $59.2 million, versus revenue of $81.3 million, shows that even with growth the income statement is still dominated by red ink.

- Critics highlight that analysts do not expect Planet Labs to reach profitability within three years, and the TTM net loss of roughly $129.6 million underlines how far margins would need to move to match the US Professional Services industry average profit margin of 7.1 percent that is used in the longer term scenario work.

- What stands out is that even scenario based assumptions aiming for about $29.2 million in earnings by around 2028 require a large swing from today's loss position. The current negative EPS trend in 2026, moving from about -$0.04 to roughly -$0.19 quarter on quarter, does not yet show that turnaround in the reported figures.

Rich Valuation Versus 19 Point 4 Times Sales

- The stock trades on a price to sales multiple of about 19.4 times compared with a peer average of roughly 2.8 times and a US Professional Services industry average near 1.4 times. A DCF fair value of about $2.06 sits well below the current share price of $17.47.

- Bullish views lean on forecast revenue growth of roughly 21.6 percent per year and the potential for margins to converge toward industry levels. However, the current combination of a 19.4 times sales multiple and a TTM net loss of about $129.6 million suggests the market is already paying a premium that leaves little room for execution missteps.

- Consensus narrative outlines a path where revenues could rise to about $409.3 million and earnings to around $29.2 million in the medium term. Achieving that from today's $282.5 million of TTM revenue and negative earnings would require consistently strong growth and margin expansion that are not yet visible in reported Q3 2026 EPS of about -$0.19.

- Analysis data also notes that even under those future earnings assumptions, investors would effectively be paying a high implied price to earnings multiple relative to the broader US Professional Services industry, which currently has a lower typical PE. This reinforces that the present premium pricing is tightly linked to optimistic growth and profitability scenarios.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Planet Labs PBC on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the figures that shifts your view? Shape that outlook into a full narrative in just a few minutes, Do it your way.

A great starting point for your Planet Labs PBC research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Planet Labs combines rapid revenue expansion with deep, persistent losses and a rich valuation, leaving investors exposed if the profitability narrative fails to materialize.

If you want a margin of safety instead of paying up for uncertain earnings, use our these 905 undervalued stocks based on cash flows to quickly uncover businesses where cash flow strength already supports the price you pay.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PL

Planet Labs PBC

Engages in the design, construction, and launch constellations of satellites with the intent of providing high cadence geospatial data delivered to customers through an online platform the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion