- United States

- /

- Specialty Stores

- /

- NYSE:CANG

Cango And 2 Other Promising US Penny Stocks

Reviewed by Simply Wall St

As the U.S. market digests earnings reports and experiences a surge in Bitcoin prices, stock futures are on the rise, reflecting investor optimism. In this context, penny stocks remain an intriguing segment of the market, offering potential growth opportunities despite their somewhat outdated label. Typically associated with smaller or newer companies, these stocks can offer a blend of affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8005 | $6.01M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $144.65M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.70 | $133.43M | ★★★★★☆ |

| So-Young International (NasdaqGM:SY) | $1.25 | $90.8M | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.21 | $9.77M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.33 | $529.41M | ★★★★★★ |

| Puma Biotechnology (NasdaqGS:PBYI) | $2.84 | $134.5M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $1.78 | $2.97M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8518 | $79.14M | ★★★★★☆ |

Click here to see the full list of 742 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Cango (NYSE:CANG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cango Inc. operates an automotive transaction service platform in the People's Republic of China, connecting various stakeholders in the automotive industry, with a market cap of approximately $365.28 million.

Operations: The company generates revenue of CN¥266.69 million from its retail segment, specifically gasoline and auto dealers.

Market Cap: $365.28M

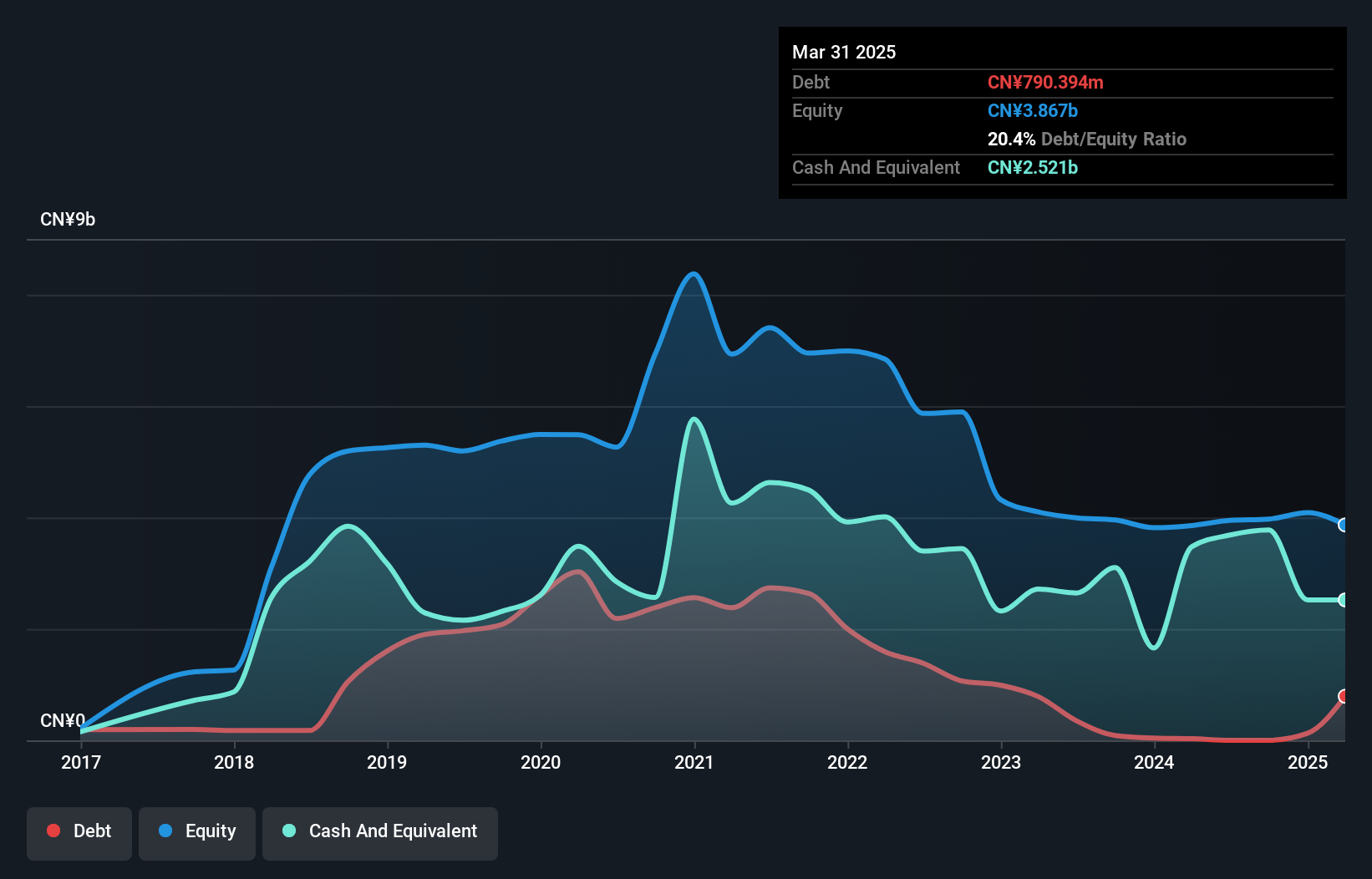

Cango Inc., with a market cap of US$365.28 million, has experienced significant earnings volatility but recently turned profitable. Despite a decline in revenue from CN¥1,571.68 million to CN¥136.46 million for the first nine months of 2024 compared to the previous year, net income improved substantially from a loss to CN¥243.93 million. The company has reduced its debt significantly and maintains more cash than total debt, indicating solid financial management amidst high share price volatility and trading below estimated fair value by 85%. Recent auditor changes were made without disagreements on financial practices or disclosures.

- Unlock comprehensive insights into our analysis of Cango stock in this financial health report.

- Gain insights into Cango's historical outcomes by reviewing our past performance report.

Planet Labs PBC (NYSE:PL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Planet Labs PBC designs, constructs, and launches satellite constellations to provide high cadence geospatial data via an online platform globally, with a market cap of approximately $933.25 million.

Operations: The company generates revenue primarily from its data processing segment, which amounted to $235.76 million.

Market Cap: $933.25M

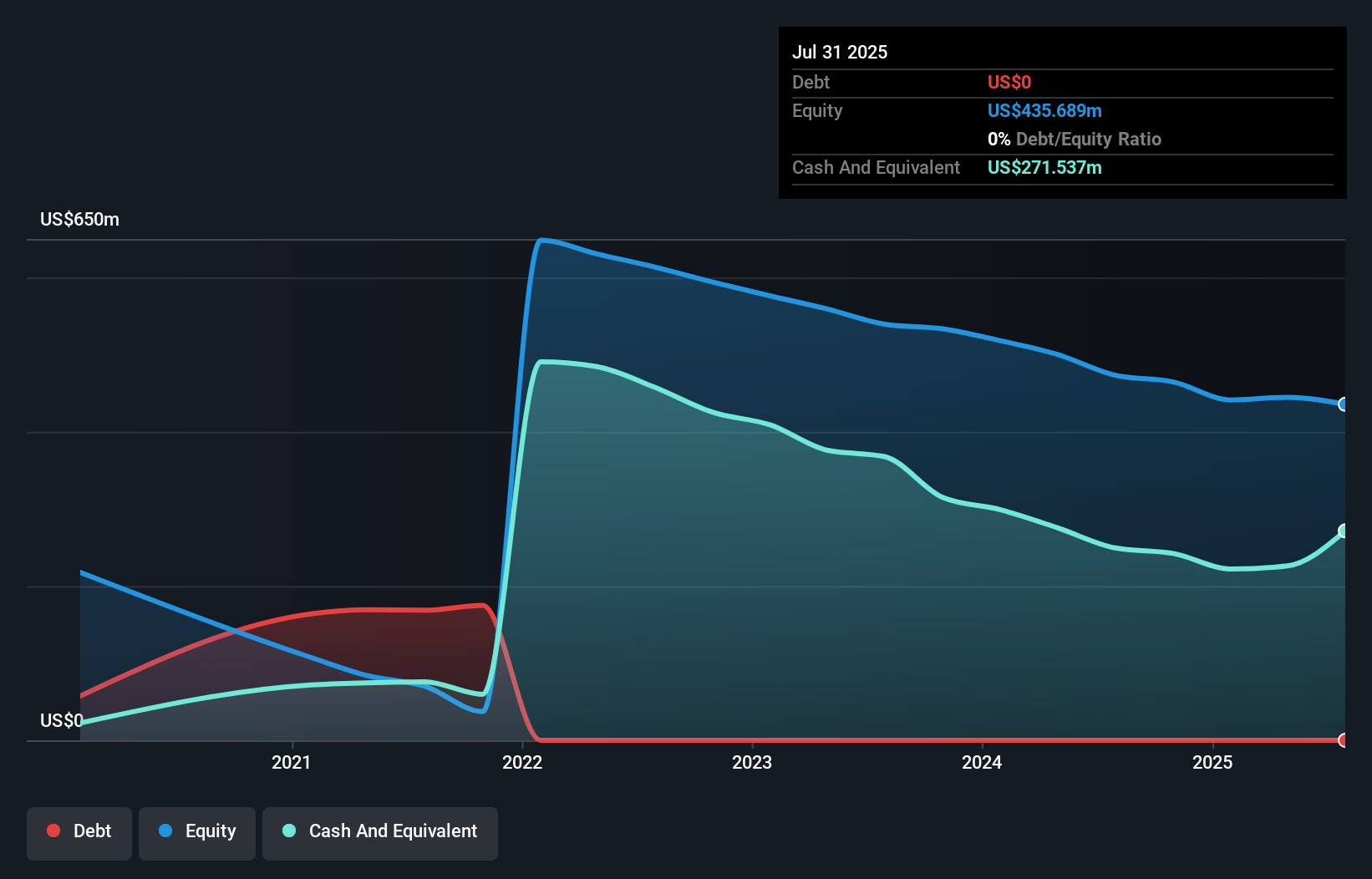

Planet Labs PBC, with a market cap of approximately US$933.25 million, is actively leveraging its satellite data capabilities across diverse sectors. Despite being unprofitable and experiencing increased losses over the past five years, the company maintains a strong cash position with short-term assets exceeding liabilities and no debt. Recent initiatives include launching Analysis-Ready PlanetScope for enhanced geospatial analysis and securing contracts such as with American Crystal Sugar for precision agriculture insights. The company's revenue reached US$235.76 million primarily from data processing services, reflecting steady growth despite financial challenges and shareholder dilution over the past year.

- Dive into the specifics of Planet Labs PBC here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Planet Labs PBC's future.

Tuya (NYSE:TUYA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tuya Inc. operates an Internet of Things (IoT) cloud development platform serving both the People's Republic of China and international markets, with a market cap of approximately $890.18 million.

Operations: No specific revenue segments are reported for the company.

Market Cap: $890.18M

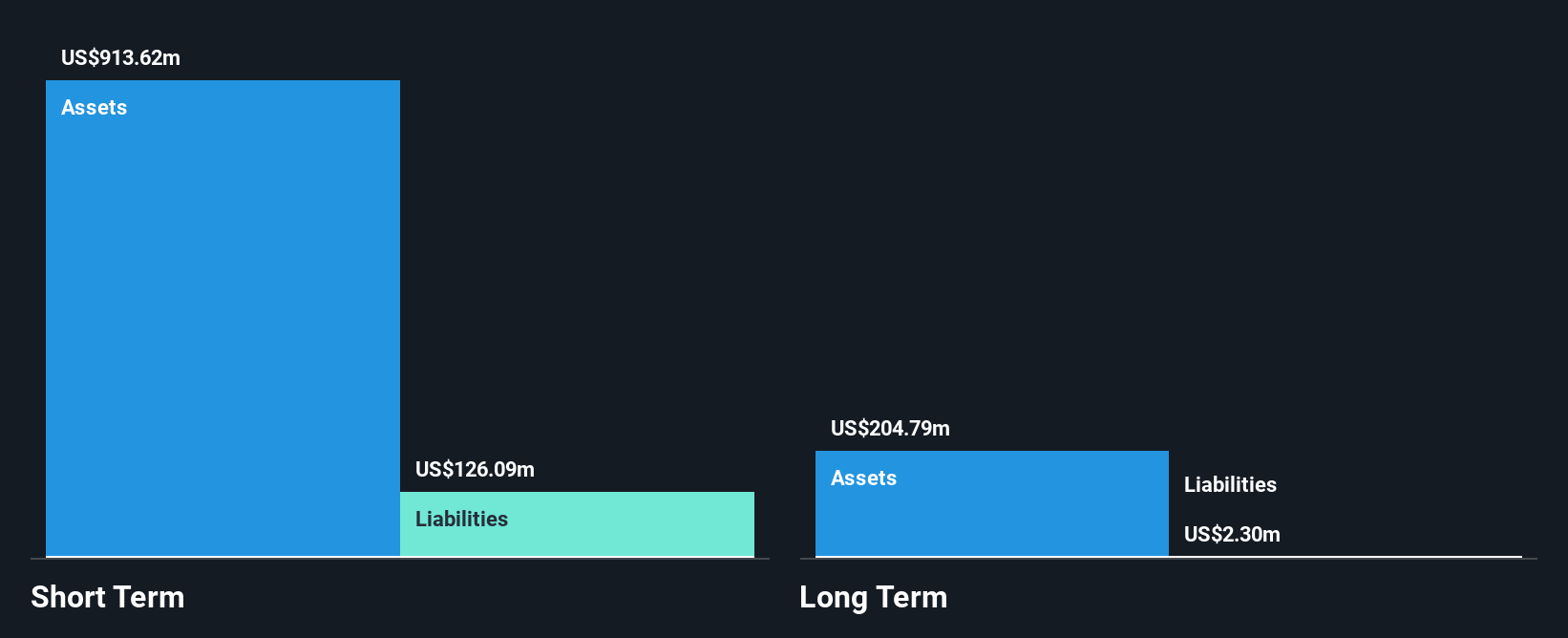

Tuya Inc., with a market cap of approximately US$890.18 million, has shown resilience despite being unprofitable, reducing its losses by 13.1% annually over the past five years. The company maintains a robust financial position with short-term assets of US$875.4 million significantly exceeding both short and long-term liabilities, and it is debt-free. Recent strategic partnerships in the Middle East aim to enhance smart city solutions through its IoT platform, potentially expanding revenue streams beyond current sales of US$216.56 million for nine months ending September 2024. Analysts anticipate substantial earnings growth, though board experience remains limited with an average tenure of 2.3 years.

- Navigate through the intricacies of Tuya with our comprehensive balance sheet health report here.

- Explore Tuya's analyst forecasts in our growth report.

Key Takeaways

- Discover the full array of 742 US Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CANG

Cango

Operates an automotive transaction service platform that connects dealers, original equipment manufacturers, financial institutions, car buyers, insurance brokers, and companies in the People’s Republic of China.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives