- United States

- /

- Professional Services

- /

- NYSE:PL

A Fresh Look at Planet Labs (PL) Valuation Following Strong Q2 Results and Satellite Launches

Reviewed by Simply Wall St

If you’ve been keeping tabs on Planet Labs PBC (PL) lately, it’s tough to ignore the flurry of news giving investors plenty to consider. The company just released its second quarter earnings, delivering not only a healthy year-on-year increase in revenue but also a sharply narrowed net loss. For many investors, these results help paint a picture of a business making meaningful progress. In addition, the launch of their new Pelican-3 and Pelican-4 satellites and updated guidance projecting ongoing revenue growth make it clear why PL has landed on more watchlists.

Looking back over the past year, Planet Labs PBC’s stock price has climbed about 4%, with most of the momentum gathering over the past month and throughout the past three months. The positive developments come from both the financial and operational side, as revenue is up, losses are shrinking, and the company’s latest satellites demonstrate its ability to execute ambitious technology plans. The market appears to be responding to these signals, as investors try to weigh the pace of improvement against the remaining risks.

With tangible progress now showing up in both the earnings and the operational updates, the question is whether the current share price still offers value to those eyeing growth, or if the market has already priced in Planet Labs PBC’s next chapter.

Most Popular Narrative: 14.6% Undervalued

The prevailing narrative sees Planet Labs as undervalued, with a fair value above current levels. This view is based on strong projected growth and leading market position.

Planet Labs leads the EO market with the largest satellite constellation. The company is positioned to capitalize on the growing demand for Earth Observation and geospatial data from companies and governments.

Wondering what is driving this surge in optimism? The fair value calculation behind this narrative quietly relies on aggressive growth forecasts and profit margins more often seen in top-performing tech disruptors. What are the bold numbers and hidden assumptions setting this stock apart in the race to space? Read on to discover the figures that might push Planet Labs into a higher orbit.

Result: Fair Value of $11.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifting demand in Earth Observation or delays in scaling commercial contracts could challenge Planet Labs' path to sustained growth.

Find out about the key risks to this Planet Labs PBC narrative.Another View: What Do Market Ratios Tell Us?

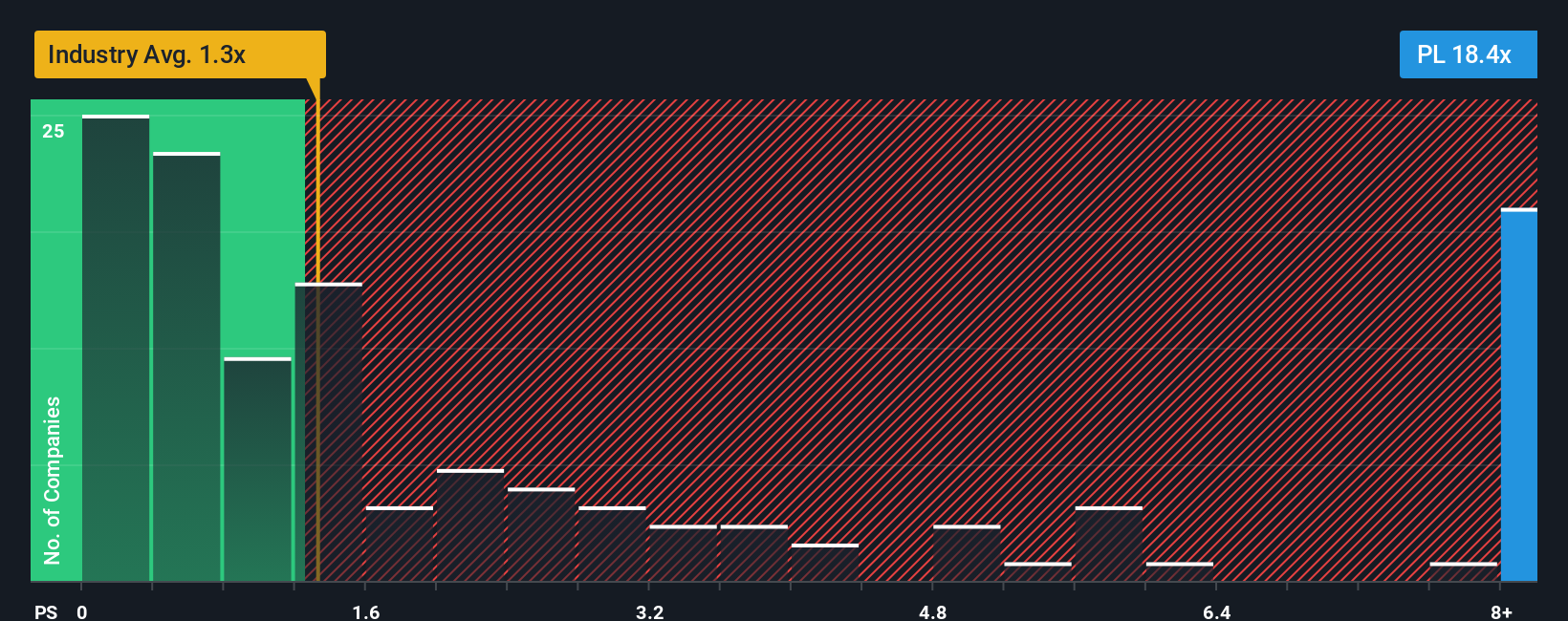

While growth forecasts suggest upside, another look at Planet Labs’ current market value using industry-standard price-to-sales ratios presents a much less optimistic picture. Could the market, in fact, be overestimating the company’s prospects?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Planet Labs PBC to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Planet Labs PBC Narrative

If this perspective does not quite fit your outlook or you want to follow your own research path, there is always the opportunity to craft a personalized take in just a few minutes. Do it your way.

A great starting point for your Planet Labs PBC research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve and unlock your next big opportunity by tracking today’s most exciting market trends. The right stock could be just a click away. Don’t let tomorrow’s winners pass you by.

- Access untapped value by jumping into undervalued stocks based on cash flows and spot stocks trading below their true worth before the crowd catches on.

- Power your portfolio with the future of healthcare by uncovering innovations in AI-driven medicine through our healthcare AI stocks.

- Amplify your returns with reliable income. Secure enduring payments from companies offering dividend stocks with yields > 3% and fortify your investment strategy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:PL

Planet Labs PBC

Engages in the design, construction, and launch constellations of satellites with the intent of providing high cadence geospatial data delivered to customers through an online platform the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)