- United States

- /

- Professional Services

- /

- NYSE:PAYC

Is Paycom Software (PAYC) Offering Value After Multi‑Year Share Price Declines

Reviewed by Bailey Pemberton

- If you are wondering whether Paycom Software's current share price lines up with its underlying value, you are not alone. This article is built to help you size that up clearly.

- The stock closed at US$147.48, with returns of a 6.4% decline over 7 days, a 9.4% decline over 30 days, a 3.2% decline year to date and a 29.0% decline over 1 year, alongside a 53.0% decline over 3 years and a 61.6% decline over 5 years, which may have shifted how investors view its risk and potential reward.

- Recent coverage of Paycom Software has focused on its share price performance and how investors are reassessing expectations for the business, which adds useful context to these returns. This mix of sentiment and price movement is exactly why a closer look at valuation is timely for anyone following the stock.

- On Simply Wall St's valuation checks, Paycom Software records a value score of 6 out of 6. Next we will break down what that means using several valuation approaches, before finishing with an even more practical way to think about what the shares might be worth to you.

Find out why Paycom Software's -29.0% return over the last year is lagging behind its peers.

Approach 1: Paycom Software Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company might be worth today by projecting its future cash flows and then discounting them back to a present value using a required rate of return.

For Paycom Software, the latest twelve month free cash flow is about $409.8 million. Simply Wall St uses a 2 Stage Free Cash Flow to Equity model, combining analyst forecasts for the next few years with its own extrapolated estimates further out. For example, projected free cash flow in 2030 is $904 million, with intermediate annual projections between 2026 and 2035 all below $1b and expressed in millions of dollars.

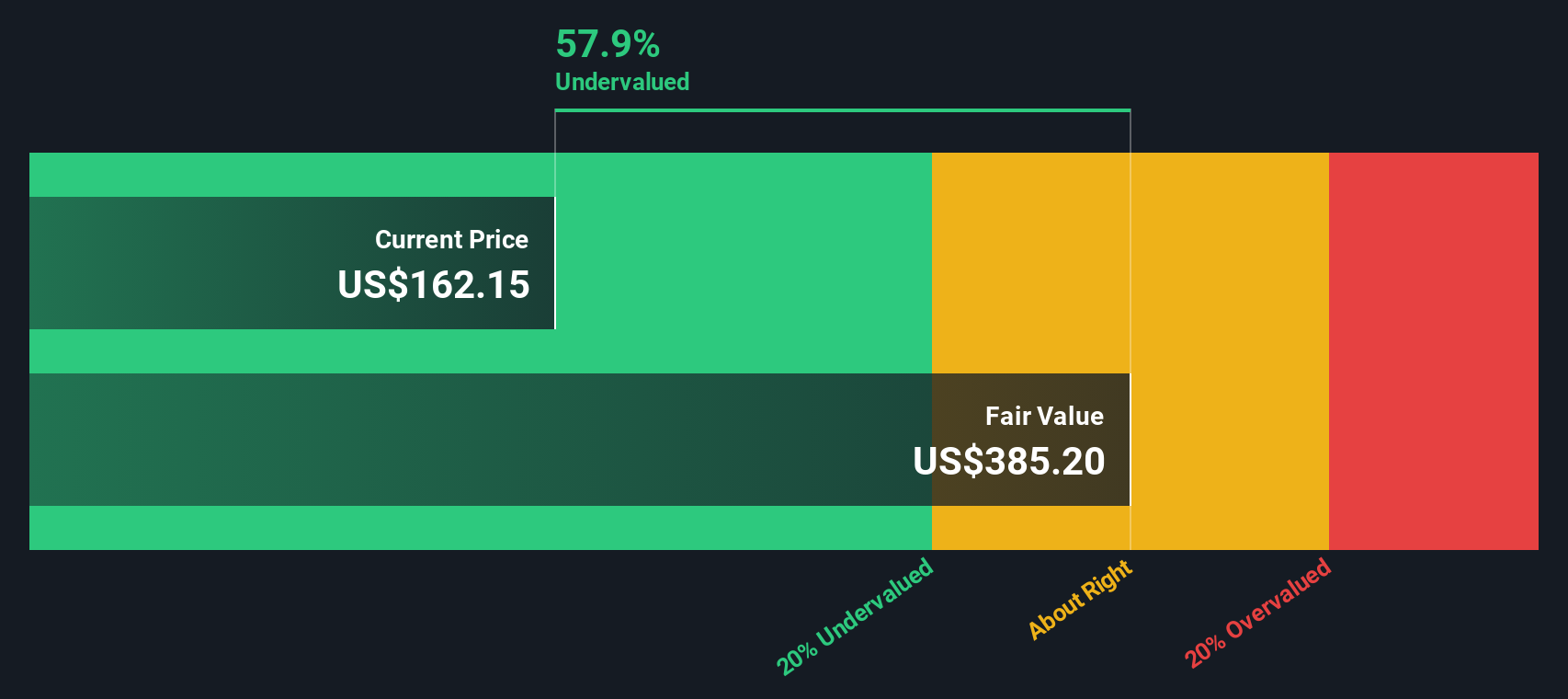

When these projected cash flows are discounted back to today, the model suggests an estimated intrinsic value of about $411.97 per share. Compared with the recent share price of $147.48, the DCF output implies the stock is about 64.2% undervalued based on these assumptions.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Paycom Software is undervalued by 64.2%. Track this in your watchlist or portfolio, or discover 878 more undervalued stocks based on cash flows.

Approach 2: Paycom Software Price vs Earnings

For a profitable company like Paycom Software, the P/E ratio is a useful way to relate what you are paying for each share to the earnings the business is currently generating. It gives you a quick sense of how many years of current earnings the market is pricing in.

What counts as a “normal” P/E depends on how quickly earnings are expected to grow and how risky those earnings are. Higher expected growth or lower perceived risk can justify a higher P/E, while slower growth or higher risk usually calls for a lower one.

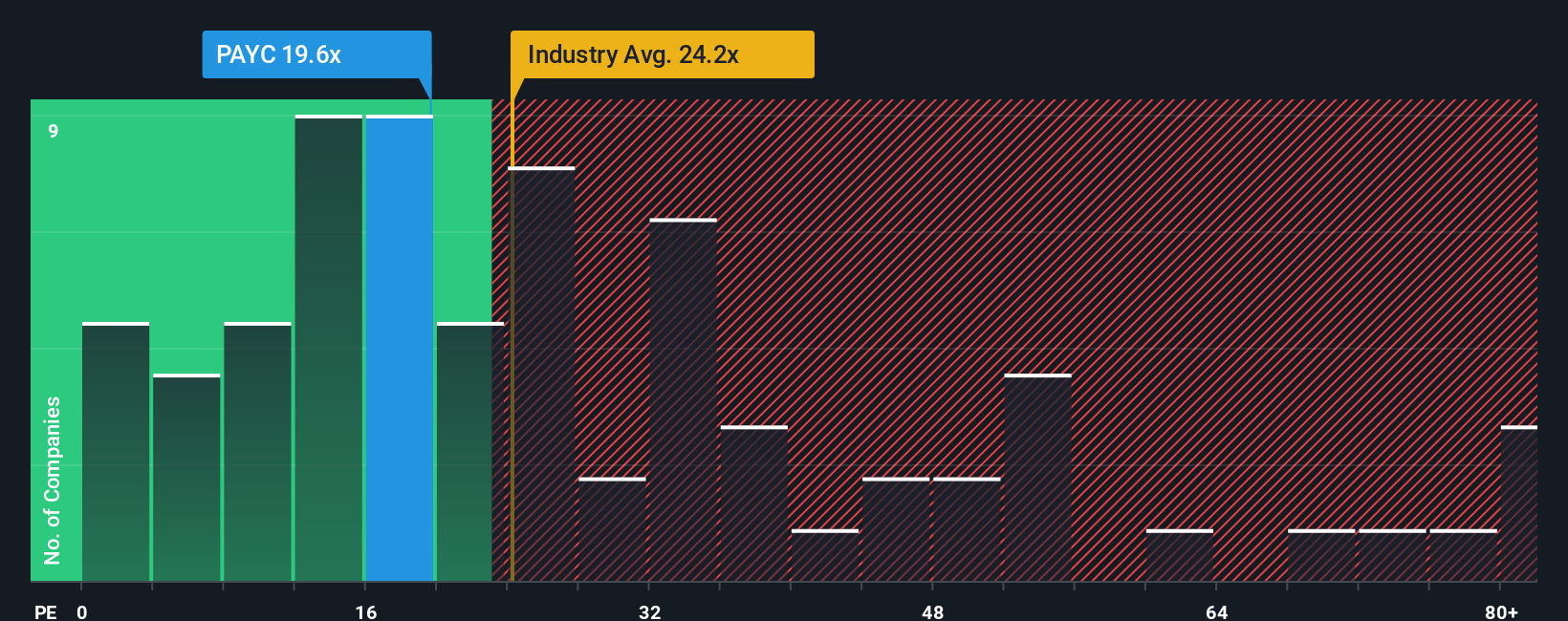

Paycom Software currently trades on a P/E of 17.87x. That sits below both the Professional Services industry average of 24.13x and the peer average of 20.43x, suggesting the market is pricing its earnings at a discount to those benchmarks.

Simply Wall St’s Fair Ratio of 24.16x is a proprietary estimate of what Paycom Software’s P/E might be, given factors like its earnings growth profile, industry, profit margins, market cap and specific risks. This is often more informative than a simple peer or industry comparison because it adjusts for the company’s own characteristics rather than assuming all businesses in the group deserve the same multiple.

Comparing the Fair Ratio of 24.16x with the current P/E of 17.87x indicates the shares are trading below that modelled “fair” level.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Paycom Software Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are simply your story about a company, written in numbers through your own fair value, revenue, earnings and margin assumptions.

A Narrative connects what you believe about Paycom Software as a business to a clear financial forecast, then ties that forecast to a fair value that you can compare with the current share price.

On Simply Wall St’s Community page, used by millions of investors, Narratives are an easy tool you can use to set your own assumptions, see the fair value that flows from them, and decide whether the gap between fair value and price suggests you might want to buy, hold or sell.

Because Narratives update automatically when fresh information such as earnings releases or news is added to the platform, your view on Paycom Software can stay aligned with what is actually happening without you rebuilding a model each time. One investor might set very optimistic revenue and margin assumptions that lead to a much higher fair value, while another might use more cautious inputs and arrive at a far lower figure for the same stock.

Do you think there's more to the story for Paycom Software? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAYC

Paycom Software

Provides cloud-based human capital management (HCM) solution delivered as software-as-a-service for small to mid-sized companies in the United States.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Nova Ljubljanska Banka d.d. future looks bright with a profit margin change of 38%

Viohalco S.A. (VIO.AT): Greece's Leading Integrated Metals Processor

M&A machine with a relentless focus on operational excellence

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!

with the recent increase in Yttrium over the course of 2025 and it's now apparent value perceived by the market, Rainbow Rare Earths states this would add approx. 30M USD (@Ex rate 0.75USD - 1GBP of 0.75)/22.5M GBP to EBITDA per annum. Therefore I adjust my fair value price to MORE than previous - how much more? Who cares... I'm simply allowing for 40% of this figure to fall to the bottom line in my estimation of fair value. I now now estimate the fair value of >£1.20 - that's all I need to know.