- United States

- /

- Professional Services

- /

- NYSE:MAN

ManpowerGroup (MAN): Losses Worsen, but EPS Forecasts Challenge Bearish Market Narratives

Reviewed by Simply Wall St

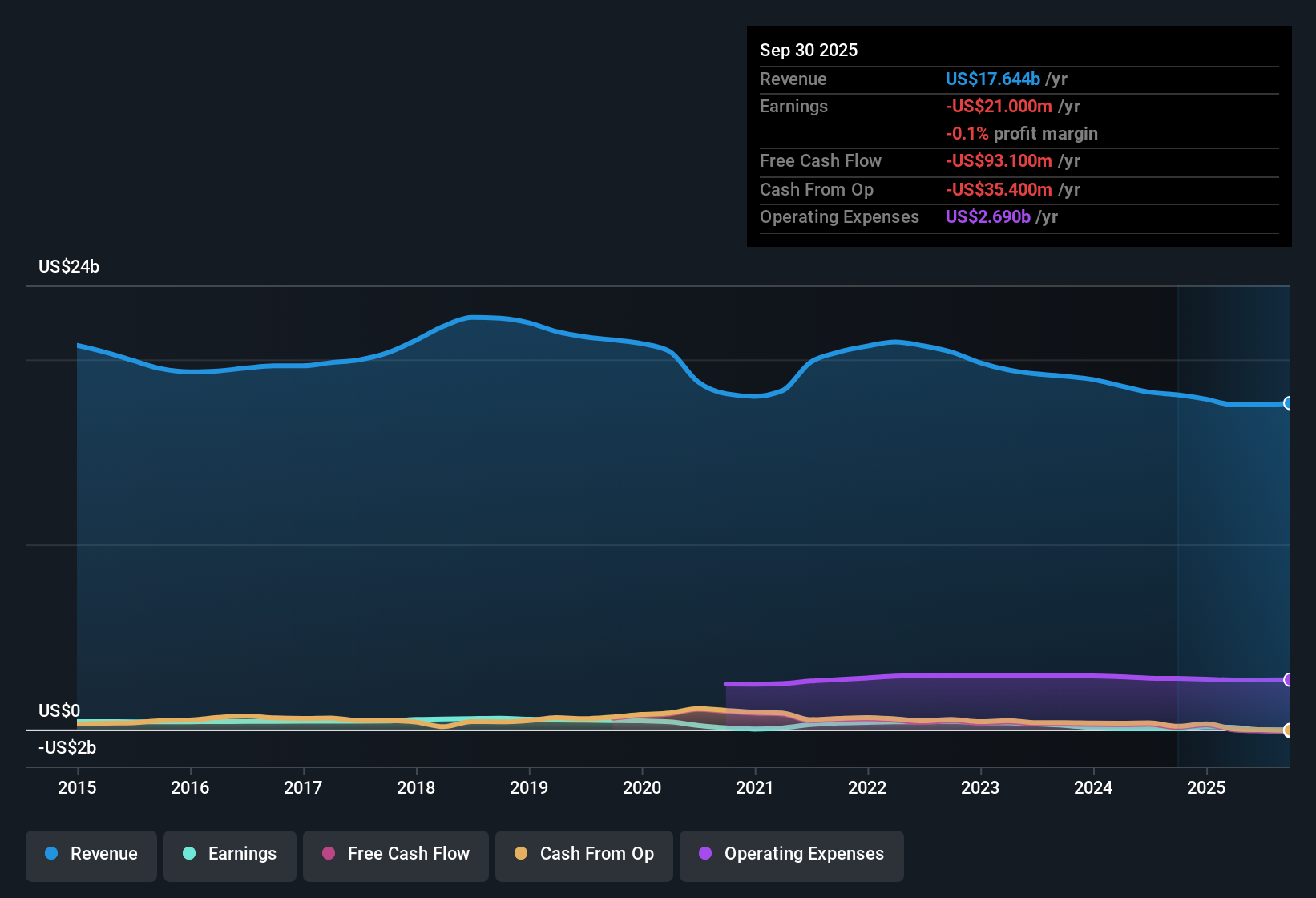

ManpowerGroup (MAN) remains unprofitable, with losses deepening at an annual rate of 17.8% over the past five years. Even so, EPS is forecast to surge by 73.18% per year, and the company is expected to cross into profitability within three years, a pace considered well above the broader market. While revenue growth is projected at just 3.7% per year, trailing the 10% per year US market average, the company’s share price of $35.54 is well below its estimated fair value of $80.6 and analyst targets, catching the eye of value-focused investors. The current setup leaves investors weighing these upside prospects against ongoing concerns about the company’s financial position and dividend sustainability.

See our full analysis for ManpowerGroup.The next section puts these headline earnings and outlook figures side by side with the key narratives tracking ManpowerGroup's journey, highlighting where the numbers either support or challenge broader market sentiment.

See what the community is saying about ManpowerGroup

Margins Expected to Flip Positive by 2028

- Analysts forecast profit margins rising from -0.1% today to 2.3% in three years, with earnings expected to reach $446.4 million and earnings per share at $5.54 by September 2028.

- The analysts' consensus view emphasizes that efficiency gains from AI platforms and automation should support scalable, higher-margin revenue growth.

- Ongoing investment in digital solutions like PowerSuite is expected to enable margin expansion as automation is rolled out across regions.

- However, sustained losses over the past five years and restructuring costs in challenging markets create uncertainty about delivering on these margin targets.

Consensus sees these margin gains as pivotal to reversing recent losses, but progress will depend on how successfully ManpowerGroup manages costs while scaling new tech-enabled services. 📊 Read the full ManpowerGroup Consensus Narrative.

Peer Discount Signals Untapped Value

- At a Price-To-Sales Ratio of just 0.1x, ManpowerGroup trades far below both the US Professional Services industry average of 1.3x and its peer group at 1.2x.

- According to analysts' consensus view, this deep valuation discount could support a value-driven recovery as long as the company delivers on efficiency and growth.

- Consensus notes expansion into high-growth markets and new service lines may help close the valuation gap to peers if execution risk is managed.

- Still, weak revenue growth forecasts and ongoing doubts about earnings power hold back a more bullish re-rating. For now, the low multiple mainly reflects skepticism about near-term turnaround.

Balance Sheet and Dividend Worries Remain

- Recent negative free cash flow in the first half of 2025, elevated debt, and questions about dividend sustainability highlight ongoing concerns about financial resilience.

- The analysts' consensus view warns that while new growth initiatives are promising, exposure to market downturns, interest rate rises, or delayed recoveries could further strain margins and limit investment capacity.

- Persistently weak performance in Northern Europe, coupled with restructuring charges, stands out as a key operational risk.

- Reduced dividend payments and ongoing debt pressure may weigh on investor confidence until profitability and cash flows stabilize.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ManpowerGroup on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique perspective on these figures? Take just three minutes to build and share your own story of what lies ahead. Do it your way

A great starting point for your ManpowerGroup research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

ManpowerGroup’s persistent losses, debt load, and recent worries about dividend stability all signal that financial resilience remains a major concern. Find stronger candidates for your portfolio with solid balance sheet and fundamentals stocks screener (1985 results), highlighting companies with robust balance sheets and healthier fundamentals designed to withstand volatile markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAN

ManpowerGroup

Provides workforce solutions and services under the Talent Solutions, Manpower, and Experis brands worldwide.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)