- United States

- /

- Professional Services

- /

- NYSE:LDOS

Leidos (LDOS): Evaluating Valuation After the Launch of Sea Dagger Maritime Autonomy Platform

Reviewed by Simply Wall St

If you’ve been eyeing Leidos Holdings (LDOS) lately, the unveiling of their Sea Dagger Commando Insertion Craft might be what just tipped your hand. The company’s announcement is not just another product drop; it signals a decisive step into next-gen maritime autonomy, combining Leidos’ signature modular tech, AI, and integrated weapon systems for the Royal Navy. For investors, this could be more than military hardware news. It is a real-world nod to Leidos’ expanding influence in strategic defense, potentially shifting the risk and reward calculus for the stock.

The Sea Dagger news lands at a curious moment for Leidos. After cruising higher over the past year, shares have jumped 19% from last September and delivered a strong 28% climb year-to-date, showing momentum not just in short-term trading but in the broader outlook as well. That is on top of three- and five-year returns that handily outpace the market. Investors have already seen Leidos secure steady revenue and net income growth, and now, with defense innovation in the headlines, the narrative appears to be building in their favor.

But with the stock up so much, the real question is whether there is still room to run. Is Leidos underappreciated or is the market already factoring future growth into the price?

Most Popular Narrative: 3.3% Undervalued

The consensus among analysts is that Leidos Holdings is currently undervalued by a small margin, with its fair value sitting just above the current share price. These views hinge on future growth drivers in both government funding and the digital transformation of core business segments.

Leidos is positioned to benefit from increased, multi-year government funding focused on national security, defense modernization, border protection, and infrastructure, particularly through the One Big Beautiful Bill and related initiatives (e.g., FAA air traffic modernization, Golden Dome, maritime autonomy). These are expected to drive robust future revenue growth across core projects.

Curious what is fueling this analyst optimism? There is a not-so-obvious combination of forward-looking growth numbers and a valuation multiple more often seen in faster-growing industries backing this fair value estimate. The blueprint relies on specific projections for earnings, revenue, and margin trends, each carefully woven into the narrative’s math. Want the full story behind the numbers? Look closer to discover which assumptions really move the needle on Leidos’ potential upside.

Result: Fair Value of $190.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks to this view remain, including the potential for unexpected U.S. government funding cuts or increased pressure from industry rivals, which could erode margins.

Find out about the key risks to this Leidos Holdings narrative.Another View: SWS DCF Model Weighs In

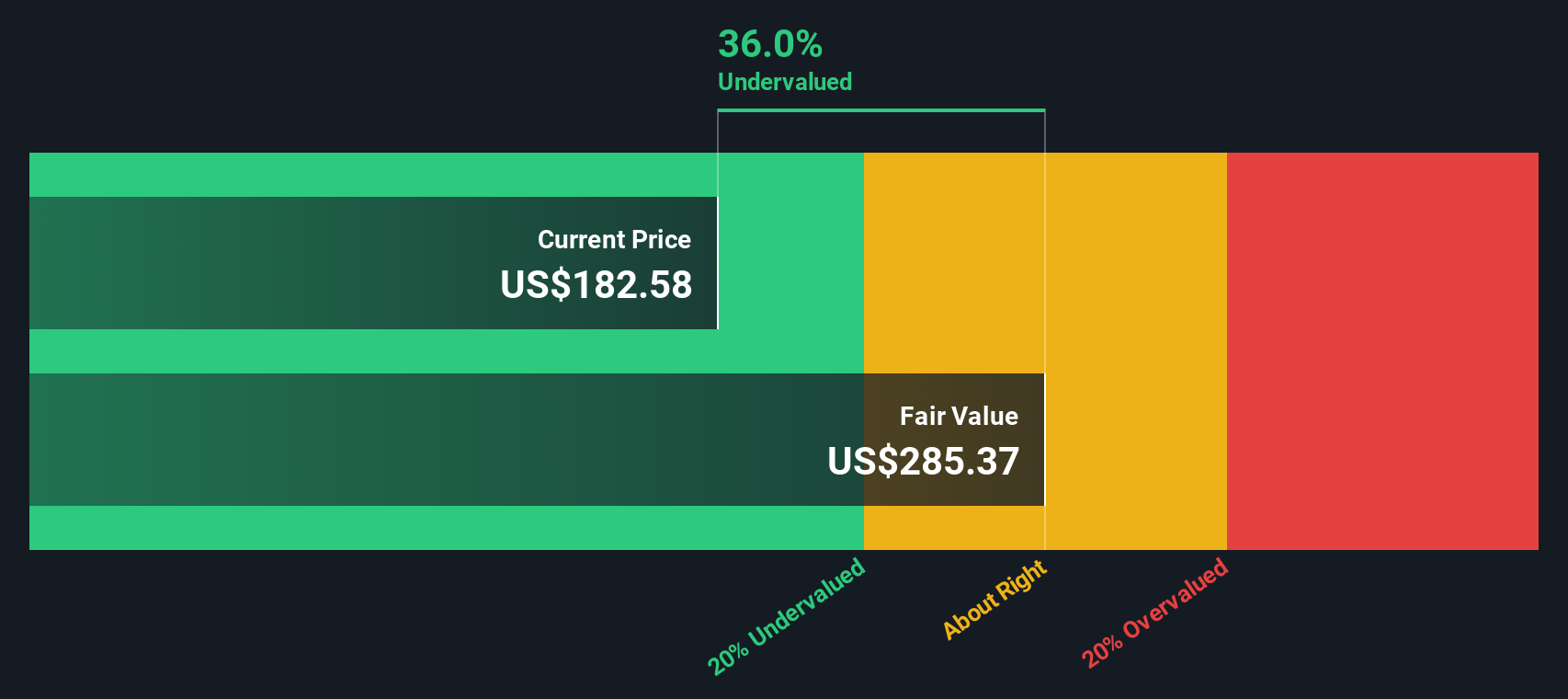

While analysts rely on forward earnings estimates to judge Leidos’ value, our DCF model offers a different perspective, measuring worth based on future free cash flows. This approach also points to undervaluation, so which method deserves more trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Leidos Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Leidos Holdings Narrative

If you are not aligned with this perspective or would rather dive into your own analysis, it takes less than three minutes to build your version of the story. Do it your way

A great starting point for your Leidos Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Move beyond the obvious and set yourself up for success by targeting unique investment angles the average investor overlooks. Make your next smart move with these powerful opportunities:

- Unlock untapped potential by tapping into penny stocks with strong financials through penny stocks with strong financials and see which companies are breaking through the noise.

- Capture the future of healthcare innovation by scanning for breakthrough businesses among healthcare AI stocks, where AI is transforming diagnostics and patient outcomes.

- Supercharge your passive income with dividend stocks with yields > 3%, showcasing companies delivering yields above 3%, all handpicked for reliability and consistent returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LDOS

Leidos Holdings

Provides services and solutions for government and commercial customers in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives