- United States

- /

- Commercial Services

- /

- NYSE:GEO

GEO Group Jumps 4.7% After New Contracts Are Recent Lows Now an Opportunity?

Reviewed by Bailey Pemberton

- Wondering if GEO Group is a hidden bargain or a value trap? You are not alone, especially with all the recent headlines and market chatter about this stock.

- After a volatile period, GEO Group has seen its stock price bounce 4.7% in the last week, even though it is still down 44.3% year-to-date and 44.7% over the past year.

- Recent moves can be traced back to news surrounding the company’s evolving operations, including new contract wins and ongoing scrutiny around the private prison sector. These developments have caught investors’ attention and may be fueling both optimism and concern about GEO Group's outlook.

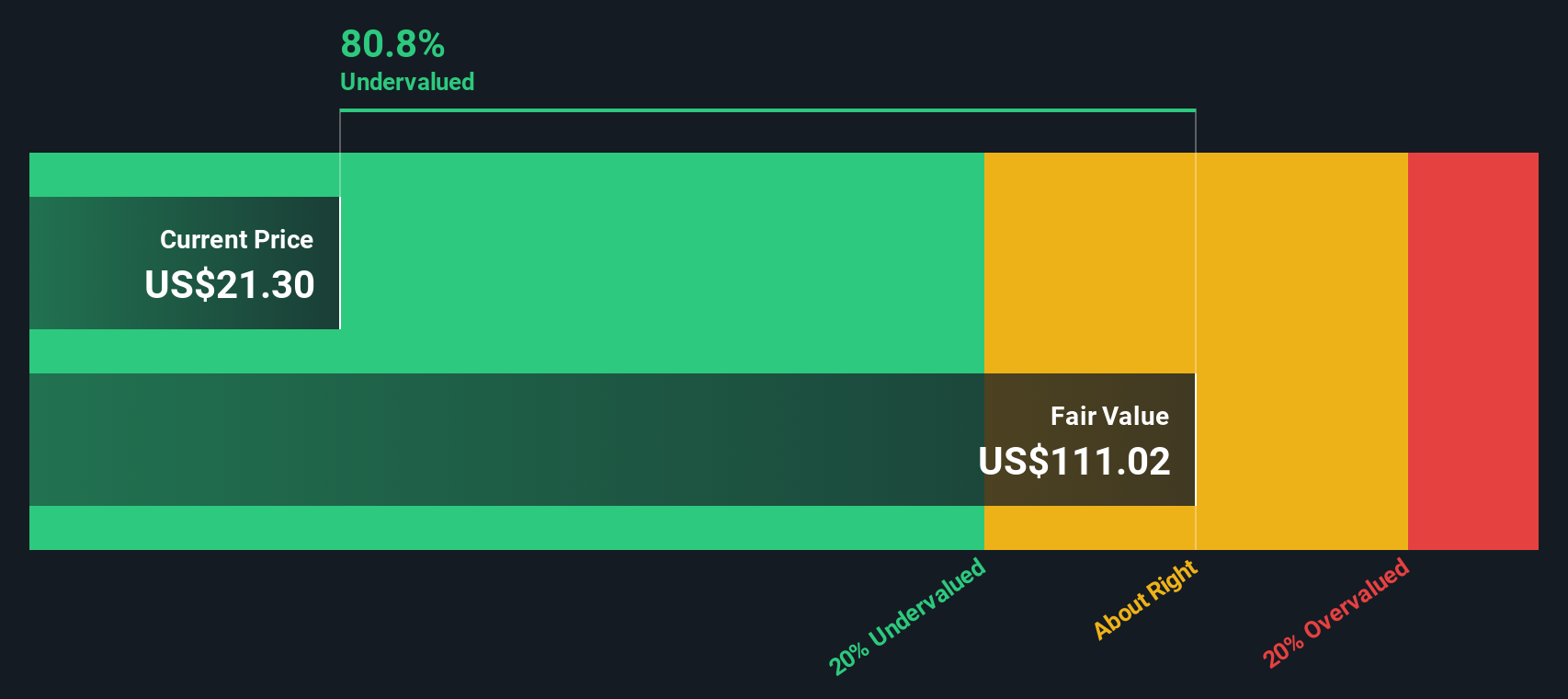

- When it comes to value checks, GEO Group currently lands a perfect 6 out of 6 valuation score, which suggests strong undervaluation across several measures. Before you decide if that makes GEO Group a compelling buy, it may be useful to break down the standard valuation approaches and then introduce a smarter way to look at the company’s worth.

Find out why GEO Group's -44.7% return over the last year is lagging behind its peers.

Approach 1: GEO Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation method that estimates a company's intrinsic value by projecting its future cash flows and discounting those amounts back to today’s dollars. This approach helps investors determine whether a stock is undervalued or overvalued based on future expectations rather than just current performance.

For GEO Group, the DCF analysis starts with a current Free Cash Flow of $94.97 million. Looking ahead, analysts forecast strong growth, with cash flows expected to reach approximately $279.2 million by 2035. These projections factor in estimates up to 2027, with subsequent years extrapolated using moderate growth assumptions provided by Simply Wall St.

Based on the 2 Stage Free Cash Flow to Equity model, GEO Group’s intrinsic, or “fair,” value is calculated at $31.89 per share. Compared to the current share price, this suggests the stock is trading at a sizable 50.6% discount to its estimated value. This significant margin may reflect continued caution from the market about the company’s future potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests GEO Group is undervalued by 50.6%. Track this in your watchlist or portfolio, or discover 921 more undervalued stocks based on cash flows.

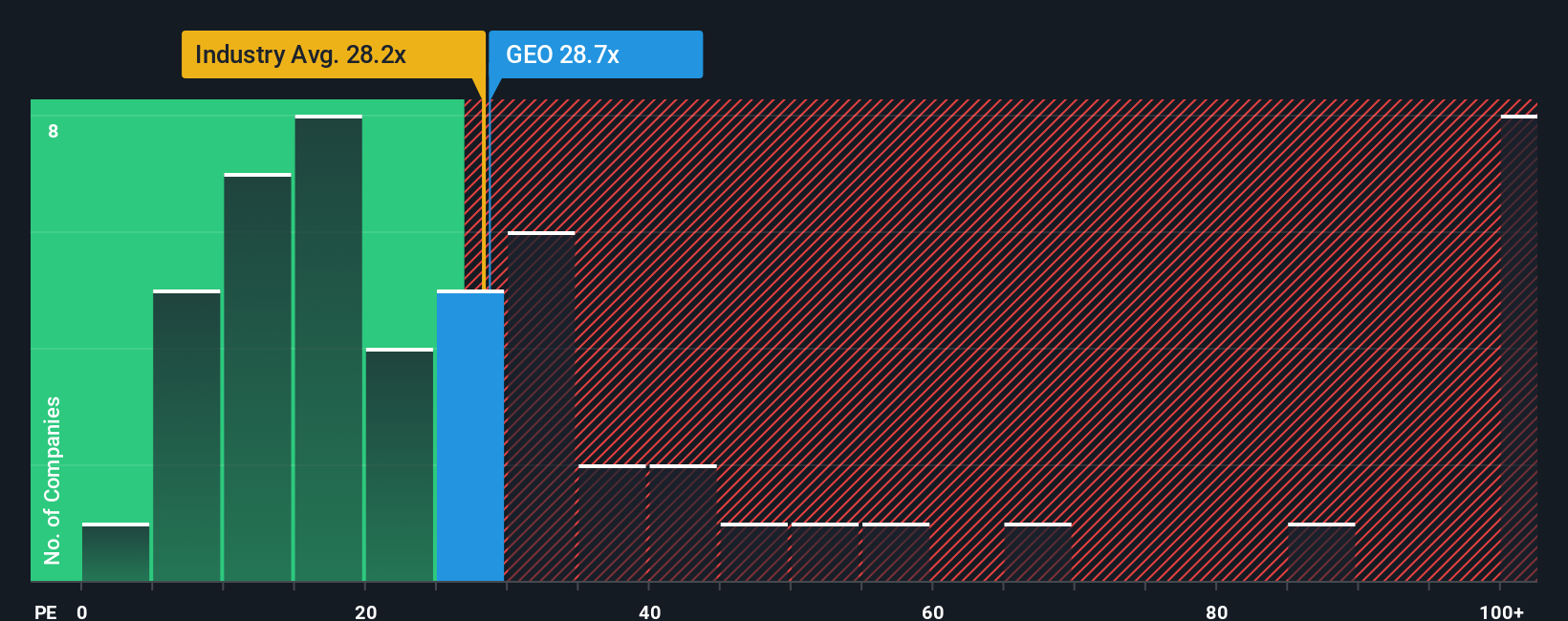

Approach 2: GEO Group Price vs Earnings

The Price-to-Earnings (PE) ratio is a common valuation tool for profitable companies like GEO Group because it directly reflects how much investors are willing to pay for each dollar of earnings. This metric is particularly useful since it aligns closely with bottom-line profitability, making it an effective quick-check for whether a stock is being fairly valued based on its earnings power.

What is considered a "normal" or "fair" PE ratio can differ widely depending on a company’s growth outlook and risk profile. Firms with faster expected earnings growth or lower risk profiles typically trade at higher PE ratios, while slower-growing or riskier businesses command lower valuations.

Currently, GEO Group trades at a PE ratio of 9.1x. That is significantly below both the industry average of 22.6x and the peer average of 19.6x. At first glance, this steep discount might look like a bargain, but benchmarks alone do not tell the whole story.

Simply Wall St calculates a proprietary "Fair Ratio" for GEO Group at 14.3x. Unlike basic peer or industry comparisons, this Fair Ratio incorporates not just growth and profitability, but also unique risk factors, profit margins, market cap, and the nuances of GEO's industry. That robust analysis provides a more tailored benchmark for what the stock’s PE should be.

Comparing the actual PE ratio of 9.1x with the Fair Ratio of 14.3x suggests GEO Group’s shares may be undervalued at current levels, offering potential value for investors taking a balanced view of risks and rewards.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1438 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your GEO Group Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company, your perspective on where it's headed, what numbers (like future profits or margins) you think are realistic, and what price you believe the business is truly worth. Narratives let you link GEO Group’s story with your financial assumptions, automatically turning them into a Fair Value that you can compare to the current market price.

On Simply Wall St’s Community page, millions of investors use Narratives to clearly lay out their views and test how real-world changes (such as earnings reports or news events) impact their forecast and valuation, all updated in real time. Narratives make it easy for any investor, experienced or not, to check if their story still “adds up” and to see what other investors believe.

For example, one GEO Group Narrative might assume rapid contract wins and margin expansion, supporting a bullish fair value of $45.00 per share. A more cautious view, assuming stagnant facility utilization and regulatory risks, could justify a fair value as low as $35.00. Narratives let you choose which scenario best reflects your reality, helping you decide how to respond with up-to-date insights.

Do you think there's more to the story for GEO Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEO

GEO Group

The GEO Group, Inc. (NYSE: GEO) is a leading diversified government service provider, specializing in design, financing, development, and support services for secure facilities, processing centers, and community reentry centers in the United States, Australia, South Africa, and the United Kingdom.

Very undervalued with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)