Genpact (G): Assessing Valuation Following Launch of AI-Driven Insurance Policy Suite Powered by Microsoft Azure AI

Reviewed by Kshitija Bhandaru

Genpact (NYSE:G) just rolled out its Genpact Insurance Policy Suite, tapping into Microsoft Azure AI to power a new wave of automation in commercial and specialty insurance. This suite aims to cut administrative cycle times by up to 75%, while boosting underwriting capacity with more touchless processing and streamlined decision support. For investors, this kind of product launch signals Genpact’s ambitions to be a force in agentic AI for the insurance sector, a space that is primed for digital transformation.

The announcement comes as Genpact’s stock has moved upward over the past twelve months, with a 10% return, even as its momentum had slowed in recent months. Year to date, shares have dipped slightly, and in the past month the price has pulled back by 7%. This new AI product could re-invigorate growth expectations, especially following a period where the company’s headline numbers have not made big waves. That makes today’s move feel like a real pivot point for the stock narrative.

After a year of steady gains and fresh innovation in its pipeline, does Genpact offer investors real upside from here, or have markets already priced in a future shaped by AI-driven growth?

Most Popular Narrative: 19.5% Undervalued

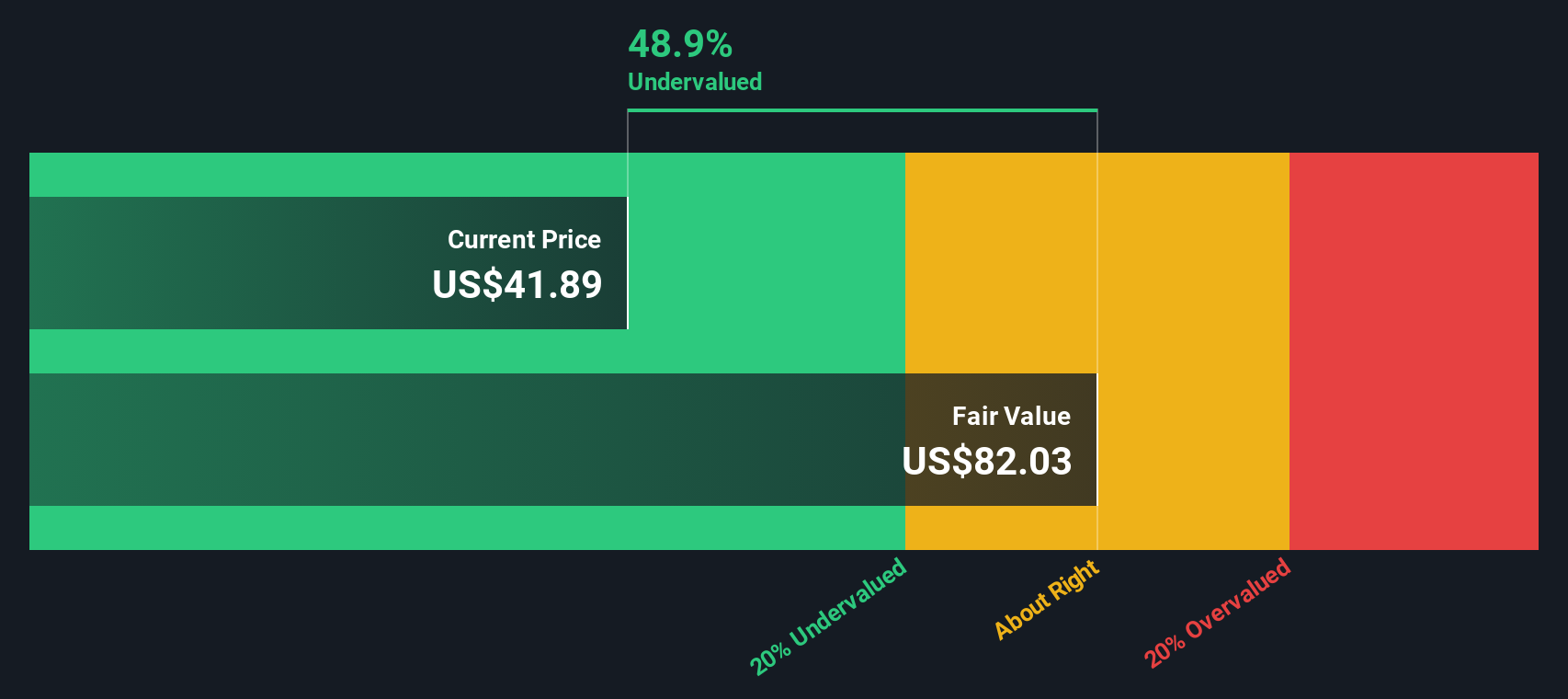

According to the most widely followed narrative, Genpact is trading below its estimated fair value, with significant room for upside if expectations are met.

“Accelerated client adoption of Genpact's Advanced Technology Solutions, particularly in data and AI, should drive higher growth and improved margins. These offerings deliver over twice the revenue per headcount compared to legacy services and are expanding at over twice the company's overall rate. This points toward robust long-term revenue and margin expansion.”

Curious about what’s fueling this bullish price target? The secret ingredient is a bold forecast for future earnings and profit margins, with numbers rarely seen outside of high-growth sectors. The narrative hinges on a mix of ambitious growth assumptions and a forward-looking valuation multiple. Want to see how these projected leaps in value could push Genpact’s stock far beyond today’s levels? The details will surprise you.

Result: Fair Value of $52.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, decelerating legacy business growth and challenging macroeconomic conditions could still threaten Genpact’s ability to fully deliver on these bullish projections.

Find out about the key risks to this Genpact narrative.Another View: What Does Our DCF Model Say?

Stepping back from analyst price targets, the SWS DCF model performs a detailed analysis of Genpact’s future cash flows and signals significant undervaluation. Could Genpact’s long-term fundamentals be more important than short-term expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Genpact for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Genpact Narrative

If you’re not convinced by these perspectives or simply want to dig deeper into the numbers, you can craft your own story in under three minutes, your way. Do it your way.

A great starting point for your Genpact research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Broaden your strategy and sharpen your portfolio by tapping into market shifts now. The right tools put you one step ahead of tomorrow’s winners. Don’t let the best ideas pass you by.

- Spot overlooked growth gems with untapped potential by checking out undervalued stocks based on cash flows among today’s most attractively priced companies.

- Capture reliable income streams as you add dividend stocks with yields > 3% featuring strong yields and cash returns above 3%.

- Ride the momentum of rapid innovation in artificial intelligence and see which companies are building the future with AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:G

Genpact

Provides business process outsourcing and information technology services in India, rest of Asia, North and Latin America, and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)