Does Genpact's (G) Q3 2025 Dividend Declaration Change The Bull Case For The Stock?

Reviewed by Simply Wall St

- On July 10, 2025, Genpact Limited announced that its board of directors declared a cash dividend of US$0.17 per common share for the third quarter of 2025, payable on September 25, 2025 to shareholders of record as of September 11, 2025.

- This dividend declaration highlights the company's continued focus on rewarding shareholders, reflecting management's confidence in Genpact's financial health and cash flow generation.

- With this dividend declaration signaling ongoing shareholder returns, let's examine its potential impact on Genpact's investment narrative and future prospects.

Genpact Investment Narrative Recap

Genpact’s investment case centers on believing in the company’s ability to drive steady growth through digital transformation and advanced AI solutions, while maintaining efficient capital allocation. The latest dividend announcement, although underscoring management’s confidence and shareholder commitment, does not materially affect the most important short-term catalyst, successful scaling and monetization of its GenAI-powered offerings, or the biggest risk, which remains limited visibility in a sizable portion of its revenue pipeline.

Genpact’s recent launch of the Genpact AP Suite, leveraging Microsoft Azure’s AI, ties in directly with its digital operations focus and acts as a concrete step toward realizing the short-term catalyst of AI-driven growth. While the dividend adds reassurance regarding financial stability, investors continue to watch how effectively product innovations translate into greater revenue predictability and client wins.

However, in contrast to ongoing innovation, investors should be aware that significant parts of Genpact’s revenue pipeline are still exposed to future booking uncertainties and...

Read the full narrative on Genpact (it's free!)

Genpact's outlook anticipates $5.9 billion in revenue and $688.3 million in earnings by 2028. This scenario presumes a 7.5% annual revenue growth rate and a $174.6 million earnings increase from the current $513.7 million.

Uncover how Genpact's forecasts yield a $56.90 fair value, a 24% upside to its current price.

Exploring Other Perspectives

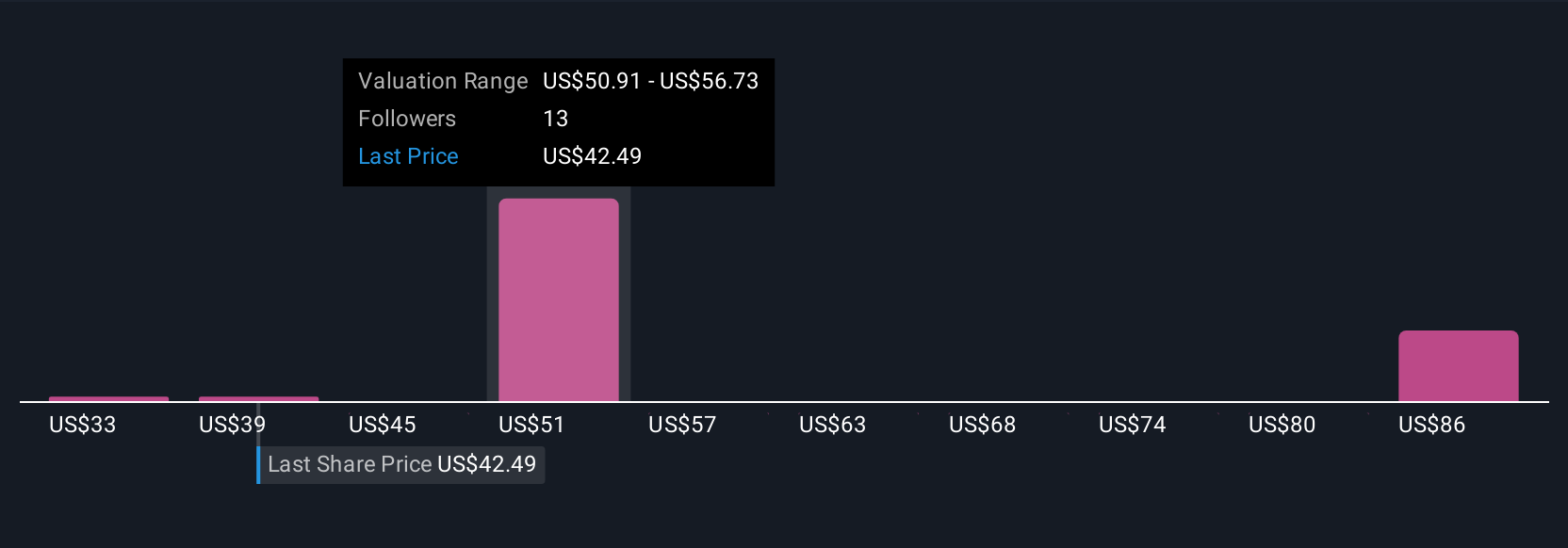

Simply Wall St Community members have submitted four fair value estimates for Genpact, spanning from US$33.47 to US$79.23 per share. While opinions vary, the focus on scaling GenAI-powered solutions could influence the company's ability to address revenue predictability issues going forward.

Build Your Own Genpact Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genpact research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Genpact research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genpact's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:G

Genpact

Provides business process outsourcing and information technology services in India, rest of Asia, North and Latin America, and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives