- United States

- /

- Professional Services

- /

- NYSE:FVRR

Will Analyst Optimism on Fiverr (FVRR) Earnings Reshape Its Long-Term Investment Story?

Reviewed by Sasha Jovanovic

- Fiverr International recently attracted increased market attention as investors focused on its upcoming earnings report, with analysts expecting EPS of $0.70, an increase from the same quarter last year, and the company receiving a top ranking from Zacks.

- The heightened analyst optimism signals that Fiverr’s progress and outlook are being closely scrutinized by the investment community ahead of its earnings release.

- We'll explore how strong analyst sentiment and guidance for higher earnings may influence Fiverr International’s investment narrative and longer-term outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Fiverr International Investment Narrative Recap

To be a shareholder in Fiverr International, you need to believe in the company’s ability to expand its platform beyond simple, lower-cost freelance tasks and capture more value from complex, upmarket services. The upcoming earnings report, with analyst expectations of $0.70 EPS and a top Zacks ranking, has put short-term growth in the spotlight, but the most important near-term catalyst remains Fiverr’s progress attracting larger business clients, while the biggest risk centers on AI-driven automation disrupting entry-level gig categories. Based on current news, these factors remain the most material drivers for the stock’s performance.

Of the recent company actions, the August 2025 launch of Fiverr’s new brand campaign, featuring an AI-generated ad made by freelancers for small businesses, stands out. This move not only highlights Fiverr's focus on AI-powered offerings but also supports the catalyst of expanding into higher-value, more complex projects, which is critical as the platform seeks to offset the automation-driven decline in lower-tier freelance demand.

Yet, against this optimism, investors should not overlook the risk that if growth in complex project bookings cannot fully offset losses in basic gigs...

Read the full narrative on Fiverr International (it's free!)

Fiverr International's outlook suggests revenue of $533.3 million and earnings of $60.0 million by 2028. This scenario implies an annual revenue growth rate of 8.4% and a $41.8 million increase in earnings from the current level of $18.2 million.

Uncover how Fiverr International's forecasts yield a $32.56 fair value, a 39% upside to its current price.

Exploring Other Perspectives

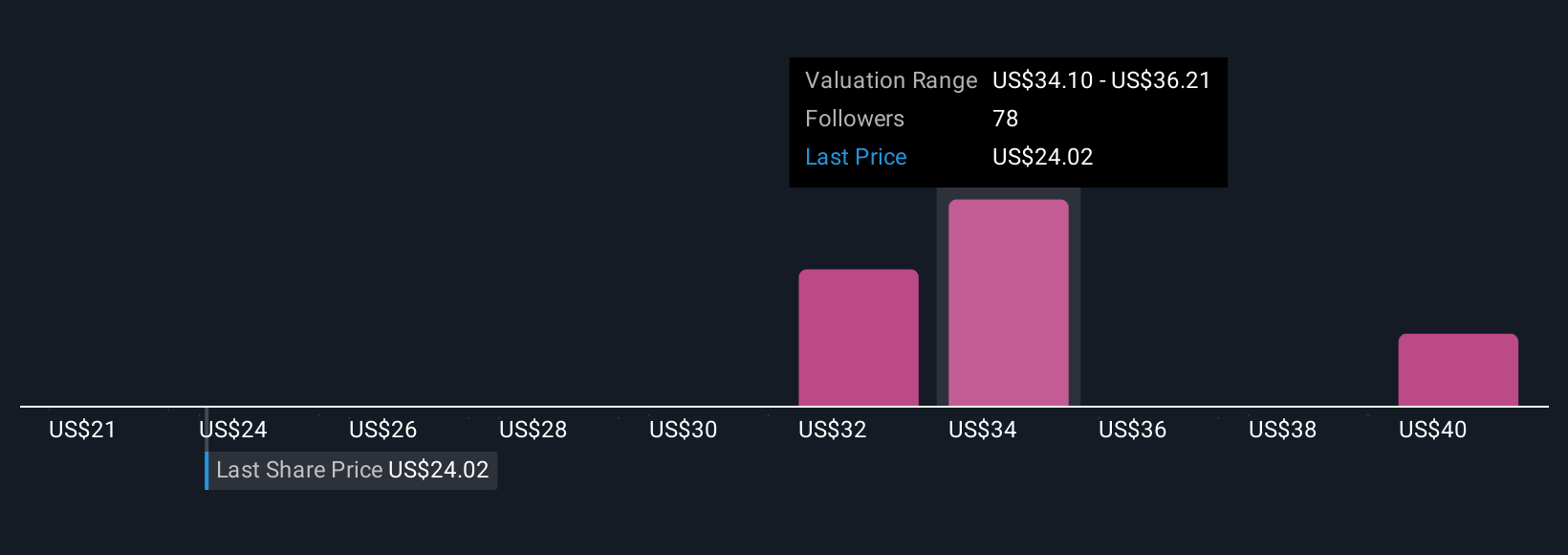

Simply Wall St Community members submitted 10 distinct fair value estimates for Fiverr International, ranging from US$21.45 to US$42.54 per share. While market participants weigh these varied valuations, the competitive pressure from both established and niche platforms remains a key theme to monitor for long-term company performance.

Explore 10 other fair value estimates on Fiverr International - why the stock might be worth 9% less than the current price!

Build Your Own Fiverr International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fiverr International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fiverr International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fiverr International's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FVRR

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives