- United States

- /

- Professional Services

- /

- NYSE:FCN

FTI Consulting (FCN): Rethinking Valuation After a Year of Negative Returns and Softer Share Price Momentum

Reviewed by Simply Wall St

FTI Consulting (FCN) has been drifting slightly lower this year, and that softer share price is catching investors attention. With steady revenue and earnings growth, the stock now raises a straightforward value question.

See our latest analysis for FTI Consulting.

At around $164.43 per share, FTI Consulting’s year to date share price return of minus 13.38 percent and one year total shareholder return of minus 19.66 percent suggest momentum has cooled, even though the five year total shareholder return of 52.39 percent still points to a solid long term compounding story.

If this shift in sentiment has you rethinking your opportunity set, it could be a good moment to explore fast growing stocks with high insider ownership as potential fresh ideas beyond the consulting space.

With earnings still rising and the share price under pressure, investors now face a key question: does the current valuation underestimate FTI Consulting’s long term prospects, or is the market already pricing in the growth ahead?

Most Popular Narrative Narrative: 1% Undervalued

With FTI Consulting last closing at $164.43 against a narrative fair value of $166, the valuation gap is narrow but grounded in detailed forecasts.

Analysts expect earnings to reach $358.3 million (and earnings per share of $11.05) by about September 2028, up from $249.7 million today. In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.9x on those 2028 earnings, down from 21.3x today.

Curious how mid single digit growth, fatter margins, and a lower future earnings multiple can still argue for upside from here? Unlock the full narrative math.

Result: Fair Value of $166 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in regulation and rapid advances in automation could temper demand in key practices and pressure the profitability assumptions underpinning this narrative.

Find out about the key risks to this FTI Consulting narrative.

Another Angle on Valuation

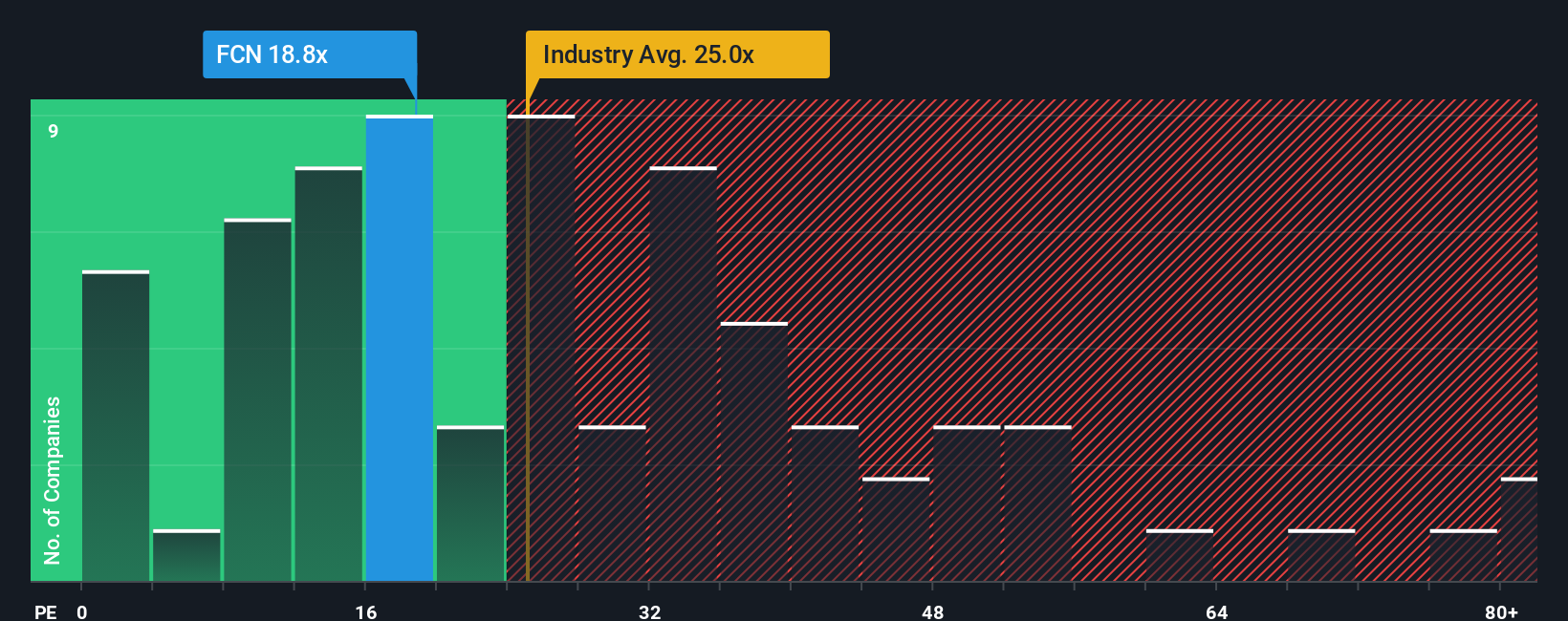

On simple earnings metrics, FTI Consulting looks inexpensive, trading on a 18.7 times price earnings ratio versus 24.2 times for the US Professional Services industry and 41.1 times for peers. Our fair ratio of 23.7 times suggests room for re rating if sentiment turns, or a value trap if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FTI Consulting for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 932 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own FTI Consulting Narrative

If you see things differently or want to stress test the assumptions yourself, you can quickly build a custom narrative from scratch in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding FTI Consulting.

Ready for more smart investment ideas?

Before you move on, give yourself an edge by scanning a few curated stock sets that could reveal opportunities you will not want to overlook.

- Explore opportunities at the smaller end of the market by reviewing these 3570 penny stocks with strong financials that pair low share prices with robust fundamentals.

- Consider ways to align your portfolio with tech shifts by targeting these 24 AI penny stocks connected to trends in automation and data driven innovation.

- Review potential income ideas by assessing these 14 dividend stocks with yields > 3% that aim to balance consistent payouts with underlying financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCN

FTI Consulting

Provides business advisory services to manage change, mitigate risk, and resolve disputes worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026