- United States

- /

- Professional Services

- /

- NYSE:EFX

Will Price Cuts and AI Offerings Shift Equifax’s (EFX) Mortgage Market Narrative?

Reviewed by Sasha Jovanovic

- In response to increased competition in mortgage credit scoring, Equifax recently reduced VantageScore 4.0 prices and began offering free reports to mortgage lenders purchasing FICO scores, following regulatory approval for VantageScore 4.0 use.

- This shift highlights Equifax's efforts to offset pricing pressure by expanding higher-margin services amid regulatory changes.

- We'll assess how Equifax's AI-powered product investments may help balance intensified price competition and regulatory shifts in its investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs . Discover why before your portfolio feels the trade war pinch.

Equifax Investment Narrative Recap

To own Equifax, you need confidence in its ability to grow higher-margin data and verification services while withstanding pricing pressure and regulatory shifts in credit scoring. The recent price cuts for VantageScore 4.0 and introduction of free reports are intended to address heightened competition, but these changes may weigh on short-term mortgage segment profitability, which is a key near-term catalyst; at the same time, intensified competition looks like the biggest continuing risk for shareholders, and this event heightens that concern materially.

Among recent launches, the Identity Proofing feature within the Kount 360 platform stands out for its relevance to this competitive shift; strengthening Equifax's AI-driven fraud and identity verification offerings may be critical to building resilience against margin pressure and supporting its growth narrative.

In contrast, investors should also be aware that ongoing litigation costs and heavier legal expenses remain stubbornly high, and ...

Read the full narrative on Equifax (it's free!)

Equifax's narrative projects $7.8 billion revenue and $1.3 billion earnings by 2028. This requires 9.9% yearly revenue growth and an earnings increase of around $660 million from the current $639.7 million.

Uncover how Equifax's forecasts yield a $277.70 fair value , a 22% upside to its current price.

Exploring Other Perspectives

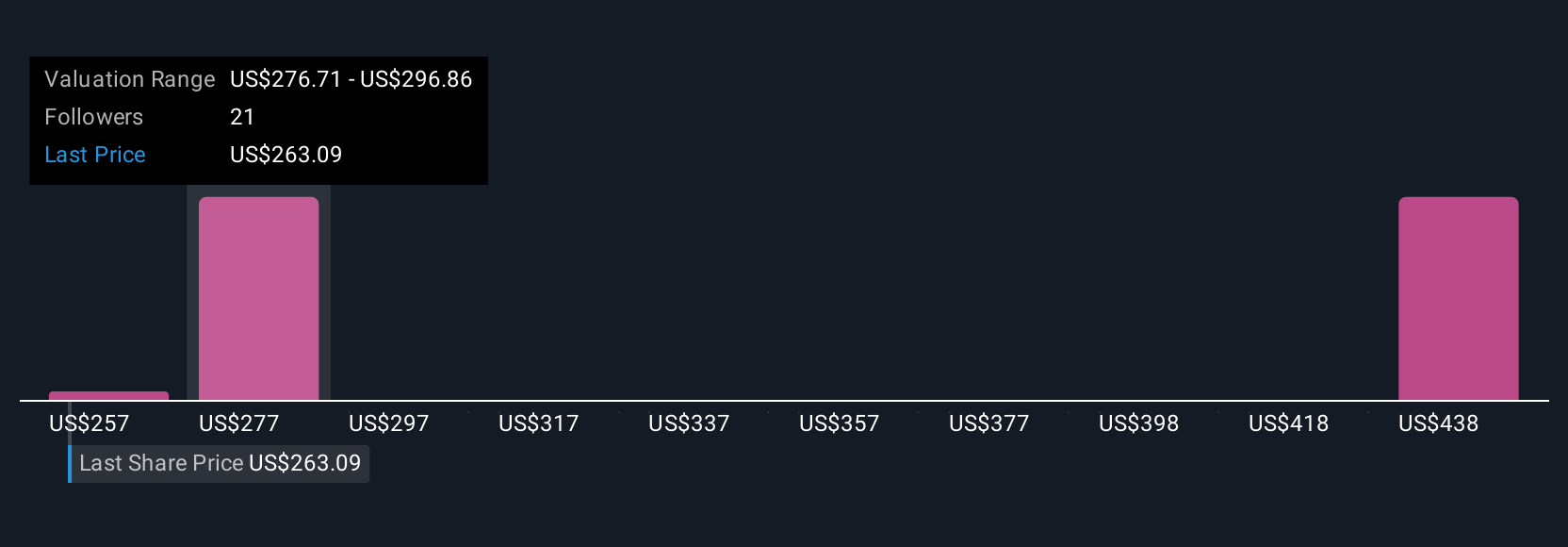

Five members of the Simply Wall St Community placed fair values in a wide US$256.57 to US$368.80 range. With regulatory changes fueling competition in credit scoring, you will see a variety of opinions across the market on where Equifax could head next.

Explore 5 other fair value estimates on Equifax - why the stock might be worth just $256.57!

Build Your Own Equifax Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Equifax research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Equifax research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Equifax's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery . The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equifax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EFX

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives