- United States

- /

- Professional Services

- /

- NYSE:EFX

Equifax (EFX): Exploring Valuation Opportunities After Recent 11% Share Price Slide

Reviewed by Simply Wall St

Equifax (EFX) shares have drifted lower over the past month, falling 11%. Investors are keeping an eye on valuation in light of recent price moves and looking for signs of sustained growth or a possible turnaround ahead.

See our latest analysis for Equifax.

Equifax’s recent 11% slide is the latest dip in what has been a challenging run for the stock, with the year-to-date share price return at -15.9% and total shareholder return over the past year down nearly 20%. While there has been some momentum behind the company’s long-term prospects, with three- and five-year total shareholder returns remaining positive, the short-term pressure reflects shifting risk perceptions and investor caution around valuation after the stock’s latest peak.

If you’re interested in broadening your search beyond Equifax, now is a great time to discover fast growing stocks with high insider ownership

With the share price under pressure and analyst targets suggesting upside, the question for investors is whether Equifax offers compelling value at current levels or if the market is already factoring in any future rebound.

Most Popular Narrative: 22.4% Undervalued

Equifax’s most popular narrative places the company’s fair value well above the recent close, drawing attention from value-driven investors and skeptics alike. The analysis points to a blend of structural growth and strategic investments that could support a higher valuation, even as near-term risks intensify.

Accelerating customer adoption of new multi-data product solutions (e.g., TWN indicator, Single Data Fabric, EFX.AI) and continued high NPI (New Product Introduction) rates are expanding Equifax's value proposition, positioning the company to capture incremental market share and drive sustained organic revenue growth above historical levels.

What’s fueling the bullish outlook? The most recent narrative is betting on a combination of rapid product rollouts, an expanding moat, and bold profit assumptions beyond what the current market seems to believe. Find out which forward-looking forecasts and growth expectations are making analysts double down on their targets. Step inside the narrative to see the details powering this undervaluation call.

Result: Fair Value of $272.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing legal costs and rising competition from alternative credit providers could challenge Equifax’s growth narrative. These factors may also put future earnings at risk.

Find out about the key risks to this Equifax narrative.

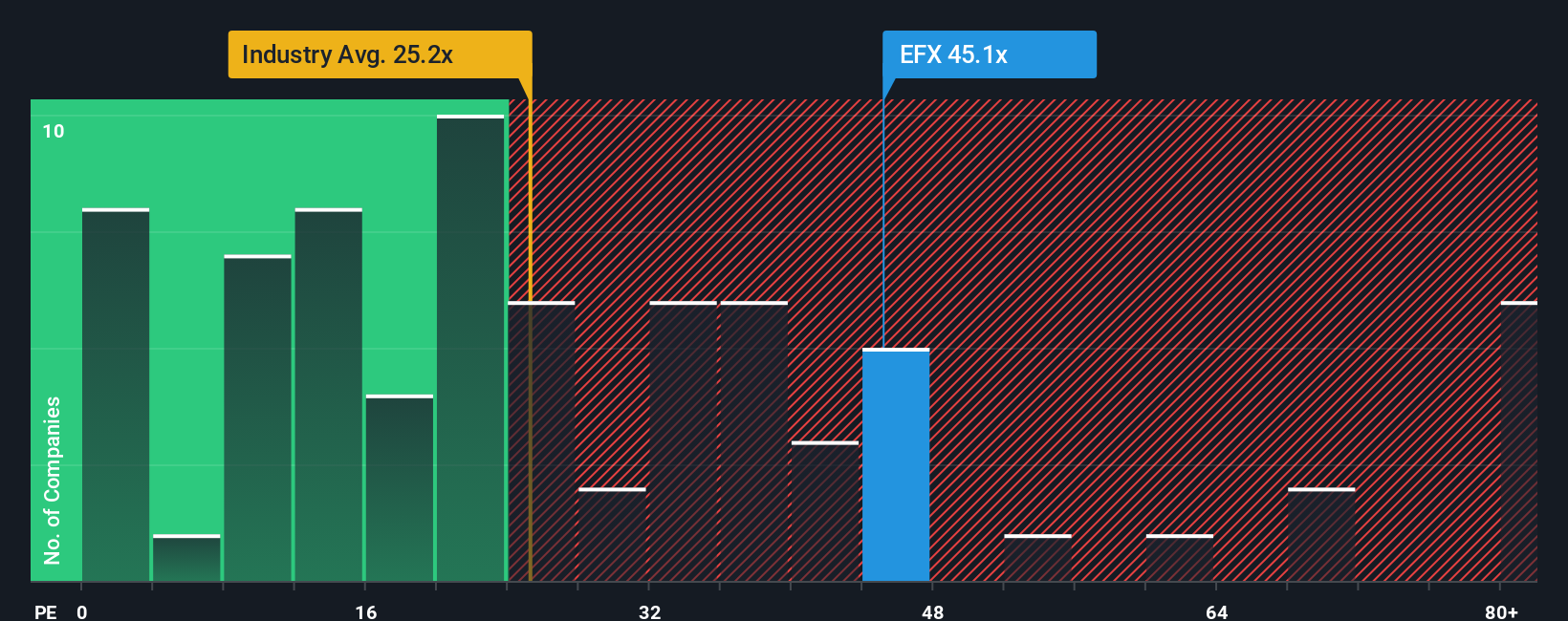

Another View: What Do Earnings Ratios Show?

Looking through the lens of earnings ratios, Equifax trades at 39.2 times earnings, which is higher than its peer average of 34x and the US Professional Services average of 25.4x. The fair ratio stands at 32.4x, suggesting the stock is priced at a premium. Does this higher valuation leave little room for error if growth stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Equifax Narrative

If you want to challenge the current findings, take a closer look at the numbers yourself and easily craft your own story in just a few minutes. Do it your way

A great starting point for your Equifax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your options to just one stock when the market is packed with standout opportunities? Tap into game-changing trends backed by data-driven insights and sharpen your edge for the next move.

- Capture impressive yields by hunting for top performers among these 20 dividend stocks with yields > 3% with strong payouts and reliable income potential.

- Uncover trailblazers breaking new ground in medical technology by scanning these 33 healthcare AI stocks with transformative healthcare applications.

- Get ahead of powerful market shifts by securing a front-row seat to these 81 cryptocurrency and blockchain stocks pioneering digital assets and blockchain revolutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equifax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EFX

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives