- United States

- /

- Professional Services

- /

- NYSE:CLVT

What Clarivate (CLVT)'s Potential Asset Sales and Refocus on Analytics Means for Shareholders

Reviewed by Sasha Jovanovic

- Earlier this week, Clarivate Plc announced it has begun a review of strategic alternatives, considering possible divestitures of non-core academic and IP management units to potentially refocus its business in 2025.

- This process could lead to a sharper concentration on high-margin analytics, with asset sales and organizational adjustments aimed at deleveraging and expanding profitability capturing the attention of market participants.

- To assess the implications of this strategic review, we'll explore how a renewed focus on high-margin analytics could shape Clarivate's investment narrative moving forward.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Clarivate Investment Narrative Recap

For investors to remain confident in Clarivate, they must believe in the company's ability to transform itself into a higher-margin, analytics-focused platform while managing the risks of transition. The recent announcement of a strategic review and potential divestitures directly addresses the most important near-term catalyst, Clarivate’s path toward margin expansion and deleveraging, while also heightening the risk of execution missteps that could affect revenue predictability during restructuring.

Among Clarivate’s latest product-related announcements, the launch of its AI-powered Regulatory Assistant within Cortellis Regulatory Intelligence stands out. This initiative is highly relevant, as it aligns with Clarivate’s increasing focus on AI-driven analytics and supports the view that a streamlined portfolio could foster new subscription-based revenue streams and strengthen customer retention.

However, in contrast, investors should be aware that asset sales and a stricter strategic focus can also heighten customer attrition risk and revenue volatility if underlying demand shifts...

Read the full narrative on Clarivate (it's free!)

Clarivate is expected to deliver $2.5 billion in revenue and $3.4 million in earnings by 2028. This outlook is based on a slight annual revenue decline of 0.1% and a $436.7 million increase in earnings from the current loss of $-433.3 million.

Uncover how Clarivate's forecasts yield a $5.14 fair value, a 39% upside to its current price.

Exploring Other Perspectives

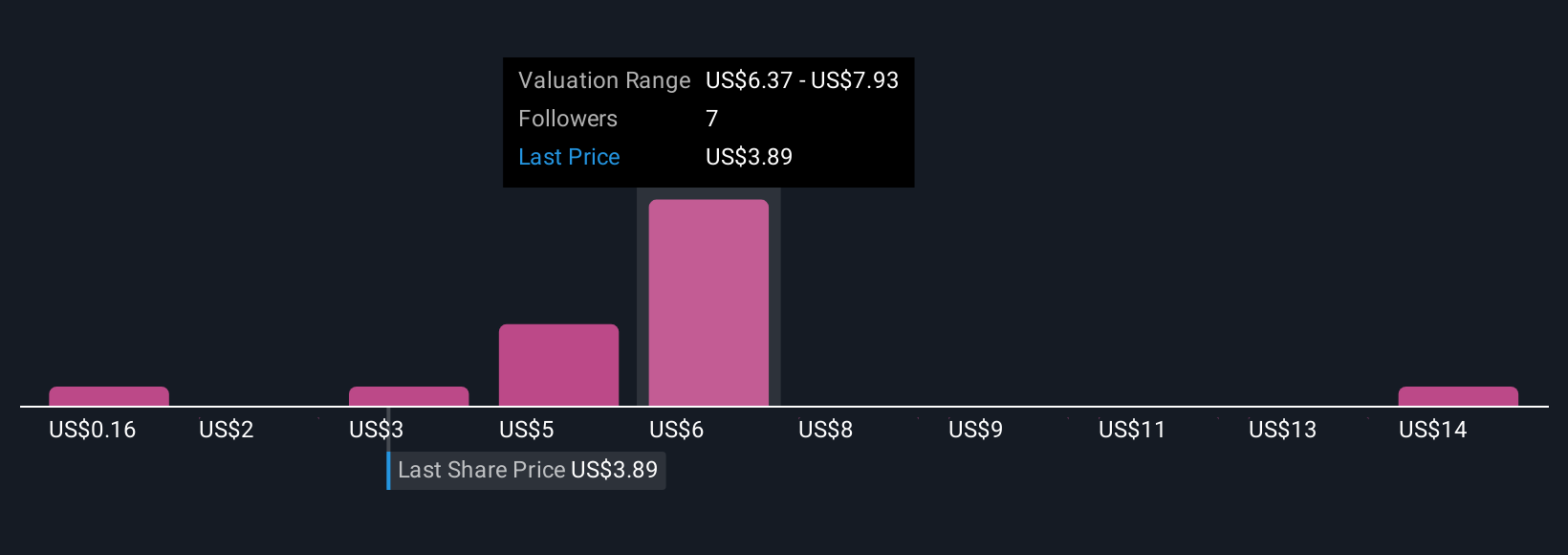

Fair value estimates from the Simply Wall St Community span from just US$0.16 up to US$15.69, with five unique viewpoints represented. While some foresee margin expansion from portfolio optimization, the broad spread of fair values underscores how opinions on Clarivate’s future performance continue to diverge.

Explore 5 other fair value estimates on Clarivate - why the stock might be worth over 4x more than the current price!

Build Your Own Clarivate Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clarivate research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Clarivate research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clarivate's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLVT

Clarivate

Operates as an information services provider in the Americas, the Middle East, Africa, Europe, and the Asia Pacific.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives