- United States

- /

- Professional Services

- /

- NYSE:CACI

Is CACI International Still a Bargain After 47.5% Stock Surge in 2025?

Reviewed by Bailey Pemberton

- Curious if CACI International is fairly priced in today’s market? You’re not alone, and the stock’s valuation is a hot topic among both new and experienced investors.

- After a strong run this year, with the stock up 47.5% year-to-date and 33.6% over the past 12 months, CACI’s share price recently cooled off with a 1.9% slide this week. Despite this, it remains up 7.8% for the past month.

- Recent headlines around government contract wins and evolving cybersecurity demands have kept CACI International in the spotlight, fueling investor interest and debate. As defense and technology spending ramps up, the company’s strategic wins and positioning are providing plenty of context behind the recent price movements.

- On our valuation checks, CACI International scores a 2 out of 6, hinting at only limited undervaluation based on traditional measures. Next, we’ll dig into these valuation approaches in detail. If you want to really understand what makes a stock undervalued, make sure to check out the bigger picture at the end of this article.

CACI International scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

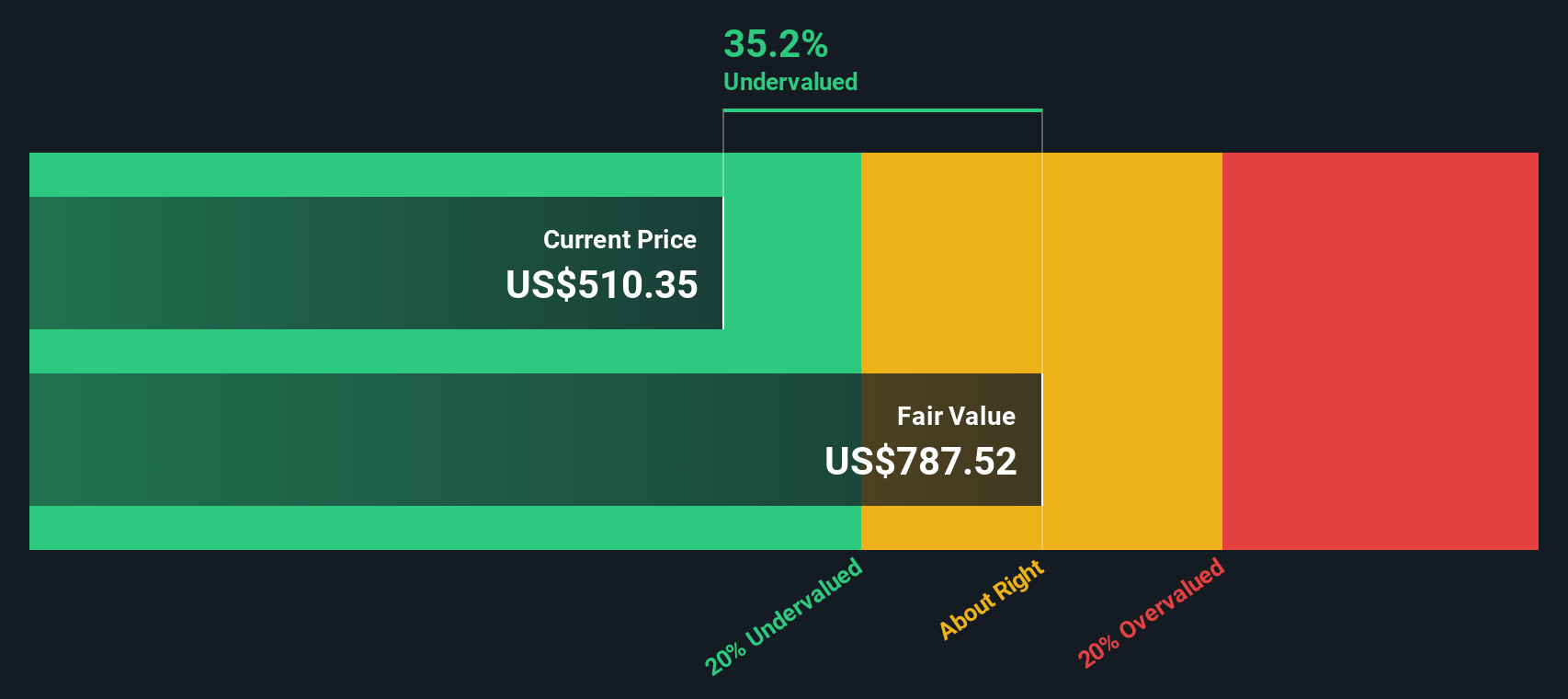

Approach 1: CACI International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future free cash flows and discounting them to their present value. This approach gives investors an idea of what a business might be worth based solely on its ability to generate cash over time.

For CACI International, the DCF model uses its most recent Free Cash Flow of $609.6 million as a starting point. Analysts’ projections cover the next five years, with Free Cash Flow expected to reach $790.1 million by 2028. Beyond these analyst forecasts, further cash flow projections out to 2035 are extrapolated, reflecting continued business growth and operational momentum.

Applying these projections, the model calculates an intrinsic value for the stock of $736.86 per share. This is about 17.7% above the current market price, which suggests the stock is undervalued based on cash flow assumptions and conservative discounting.

In summary, this analysis indicates CACI International is trading below its fair value, giving investors a potential margin of safety.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CACI International is undervalued by 17.7%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

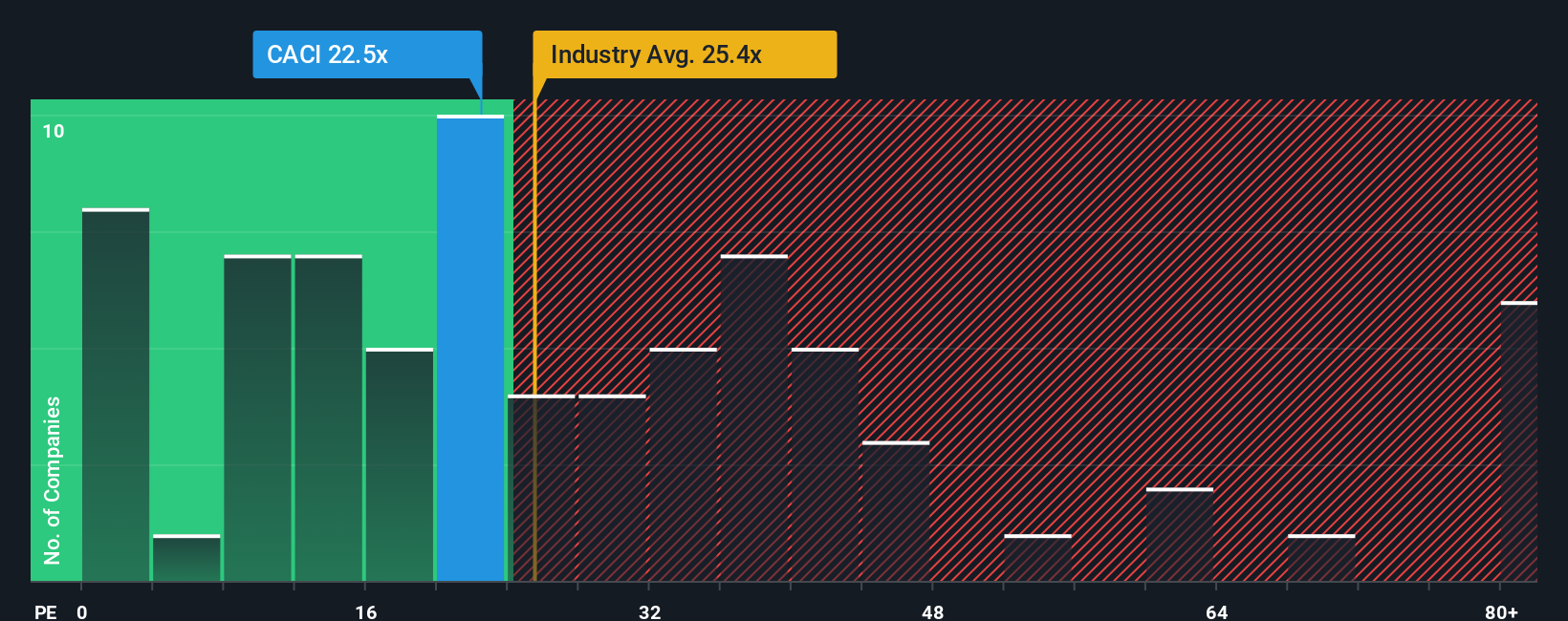

Approach 2: CACI International Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely accepted valuation metric for established, profitable companies like CACI International. This ratio provides a snapshot of how much investors are willing to pay for each dollar of the company's earnings, making it especially relevant for firms with steady and predictable profits.

Growth expectations and risk play a pivotal role in determining a normal or fair PE ratio. Companies with promising growth outlooks or lower perceived risks usually attract higher PE multiples. Slower-growing or riskier firms tend to trade at lower valuations. This dynamic means that a truly meaningful comparison must go beyond a single number.

CACI International currently trades at a PE ratio of 26.5x. For context, this sits above the professional services industry average of 24.2x, but below its peers, who average 35.3x. While these baseline comparisons are useful, they do not tell the full story because they overlook company-specific strengths and risks.

Simply Wall St's Fair Ratio addresses this issue by adjusting for factors such as CACI's historical and expected earnings growth, profit margin, market cap, industry sector, and risk profile. With this approach, the Fair Ratio for CACI International is calculated at 26.4x, which is nearly identical to the current market multiple.

Because CACI’s actual PE almost perfectly matches the Fair Ratio, it suggests the stock is trading close to its precise fair value when all relevant fundamentals are considered by this methodology.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CACI International Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. This is a smarter, more dynamic approach that links your view of a company’s story to a financial forecast and ultimately its Fair Value.

A Narrative is your perspective on what drives CACI International’s future. It combines the big picture, such as government funding, tech adoption, and risks, with your own numbers for revenue, earnings, and margins. Narratives connect these stories to concrete financial outcomes, making it much easier to see how new information or changing forecasts could affect whether CACI seems undervalued, fairly priced, or overvalued today.

This tool is available for everyone on Simply Wall St's Community page, where millions of investors create, share, and update their Narratives. This helps you judge when to buy or sell by comparing your Fair Value to the current market price. Narratives also update automatically whenever significant new information, like earnings reports or major news, comes in so your valuation always stays current.

Consider CACI International. One investor with a bullish outlook sees strong tech investment and rising margins, and estimates a Fair Value near $670. Another, focused on contract risks and government spending uncertainty, sets a lower Fair Value closer to $563. This is a perfect example of how Narratives reflect different stories behind the same stock.

Do you think there's more to the story for CACI International? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CACI

CACI International

Through its subsidiaries, provides expertise and technology solutions in the United States, the United Kingdom, rest of Europe, and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026