- United States

- /

- Commercial Services

- /

- NYSE:BV

Possible Bearish Signals With BrightView Holdings Insiders Disposing Stock

Over the past year, many BrightView Holdings, Inc. (NYSE:BV) insiders sold a significant stake in the company which may have piqued investors' interest. Knowing whether insiders are buying is usually more helpful when evaluating insider transactions, as insider selling can have various explanations. However, when multiple insiders sell stock over a specific duration, shareholders should take notice as that could possibly be a red flag.

While insider transactions are not the most important thing when it comes to long-term investing, we do think it is perfectly logical to keep tabs on what insiders are doing.

The Last 12 Months Of Insider Transactions At BrightView Holdings

Notably, that recent sale by Brett Urban is the biggest insider sale of BrightView Holdings shares that we've seen in the last year. So we know that an insider sold shares at around the present share price of US$14.29. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

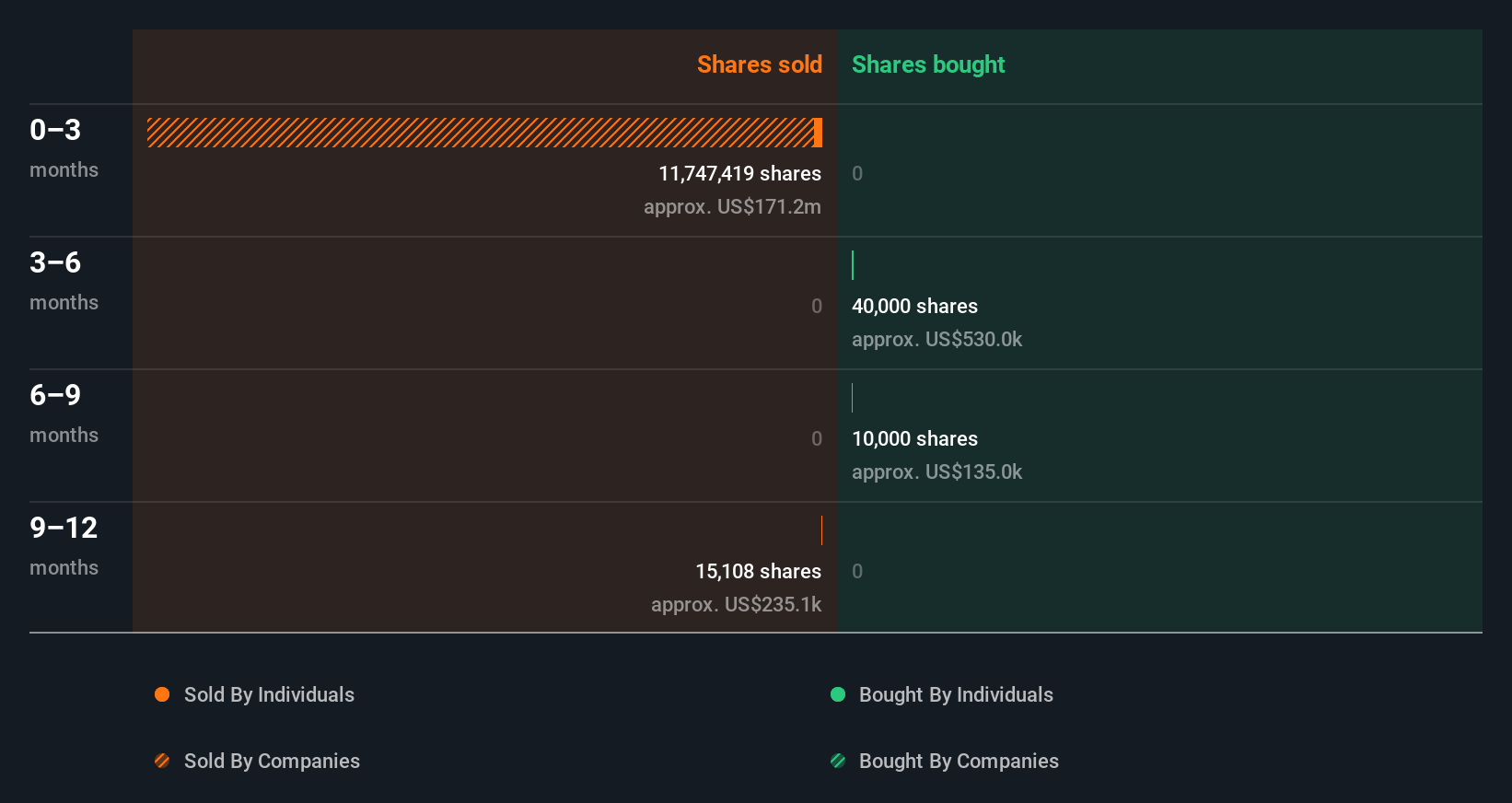

Over the last year, we can see that insiders have bought 50.00k shares worth US$665k. On the other hand they divested 162.53k shares, for US$2.4m. All up, insiders sold more shares in BrightView Holdings than they bought, over the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

See our latest analysis for BrightView Holdings

I will like BrightView Holdings better if I see some big insider buys. While we wait, check out this free list of undervalued and small cap stocks with considerable, recent, insider buying.

Insiders At BrightView Holdings Have Sold Stock Recently

The last three months saw significant insider selling at BrightView Holdings. Specifically, insiders ditched US$2.2m worth of shares in that time, and we didn't record any purchases whatsoever. In light of this it's hard to argue that all the insiders think that the shares are a bargain.

Insider Ownership

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. We usually like to see fairly high levels of insider ownership. BrightView Holdings insiders own about US$40m worth of shares. That equates to 2.9% of the company. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

So What Do The BrightView Holdings Insider Transactions Indicate?

Insiders sold stock recently, but they haven't been buying. Zooming out, the longer term picture doesn't give us much comfort. While insiders do own shares, they don't own a heap, and they have been selling. We'd practice some caution before buying! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing BrightView Holdings. You'd be interested to know, that we found 3 warning signs for BrightView Holdings and we suggest you have a look.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if BrightView Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BV

BrightView Holdings

Through its subsidiaries, provides commercial landscaping services in the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)