- United States

- /

- Medical Equipment

- /

- NasdaqGS:EMBC

3 Undervalued Small Caps With Insider Activity Across Global Markets

Reviewed by Simply Wall St

The United States market has shown positive momentum, rising 1.3% over the last week and 8.2% over the past year, with earnings projected to grow by 14% annually. In this context, identifying stocks that are potentially undervalued can offer intriguing opportunities, especially when there is notable insider activity that may suggest confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 10.3x | 2.9x | 47.96% | ★★★★★☆ |

| Flowco Holdings | 6.9x | 1.0x | 37.93% | ★★★★★☆ |

| West Bancorporation | 12.7x | 4.0x | 37.69% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.8x | 36.45% | ★★★★☆☆ |

| Columbus McKinnon | 50.5x | 0.5x | 34.15% | ★★★☆☆☆ |

| MVB Financial | 12.1x | 1.6x | 28.06% | ★★★☆☆☆ |

| Franklin Financial Services | 14.8x | 2.4x | 29.84% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -21.25% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.5x | -2991.71% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -387.85% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Embecta (NasdaqGS:EMBC)

Simply Wall St Value Rating: ★★★★★☆

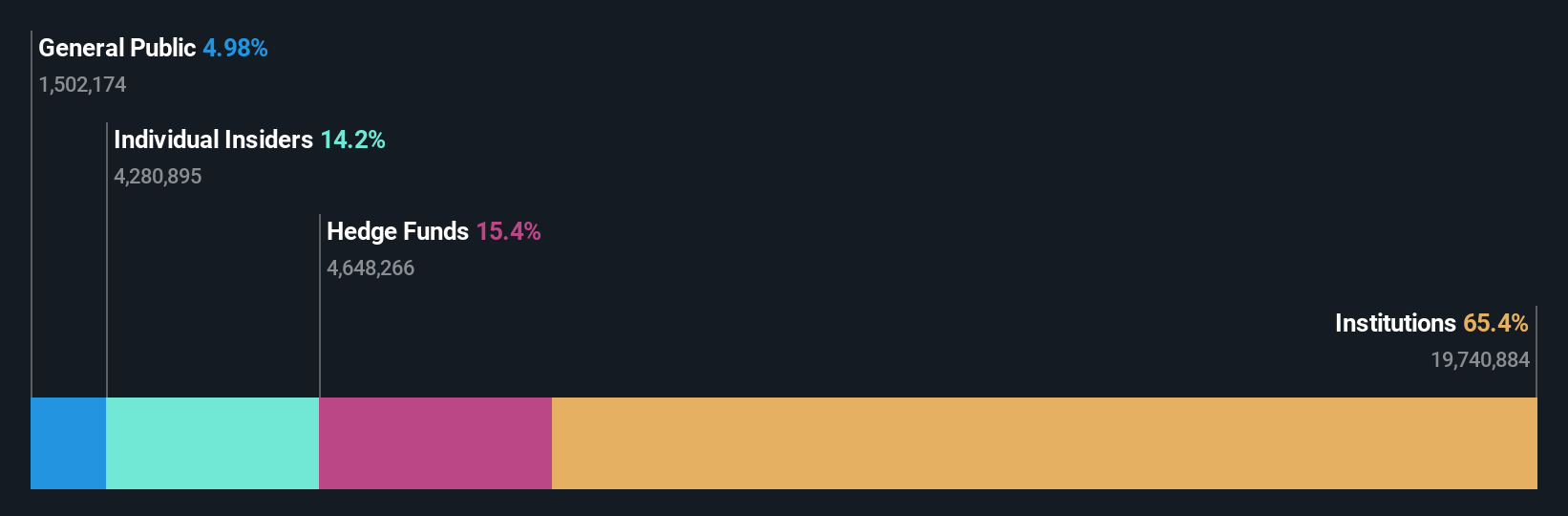

Overview: Embecta operates in the healthcare sector, focusing on the production and distribution of disposable medical products, with a market capitalization of approximately $1.25 billion.

Operations: The company's revenue primarily comes from disposable medical products, amounting to $1.11 billion. Over recent periods, the gross profit margin has shown a downward trend, reaching 64.33% by the latest period. Operating expenses have been significant, with general and administrative expenses consistently being a major component.

PE: 13.3x

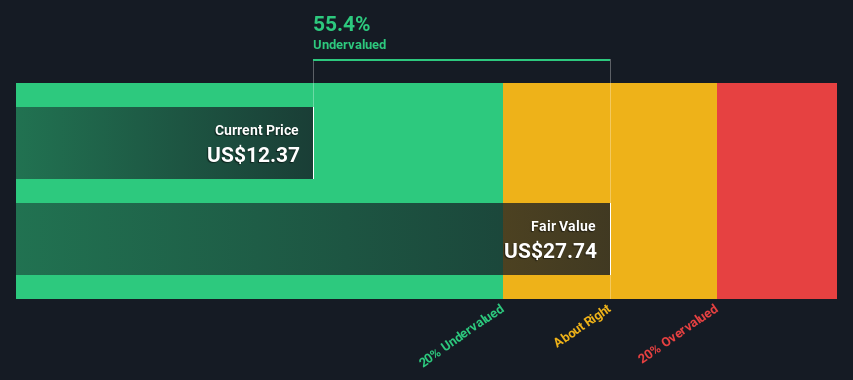

Embecta, a small cap stock, shows insider confidence with David Melcher purchasing 13,000 shares for US$177,646 in February 2025. Despite earnings not covering interest payments well and reliance on higher-risk external funding, the company is poised for growth with a forecasted annual earnings increase of 37%. Upcoming Q2 results on May 9 may provide further insights into financial health. Potential investors should weigh these factors when considering Embecta's future prospects.

- Dive into the specifics of Embecta here with our thorough valuation report.

Gain insights into Embecta's historical performance by reviewing our past performance report.

Potbelly (NasdaqGS:PBPB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Potbelly operates a chain of sandwich shops offering a variety of sandwiches, salads, and other food items, with a market cap of approximately $0.08 billion.

Operations: Potbelly's revenue model primarily involves generating income from its operations, with a significant portion of costs attributed to the cost of goods sold (COGS). The company has experienced fluctuations in net income margins, with recent figures showing a positive trend reaching 9.24% as of March 2025. Operating expenses have consistently been a major component of the company's cost structure, including general and administrative expenses which were $48.07 million in the latest period reported. Gross profit margin has shown an upward trajectory, reaching 35.98% by March 2025, indicating improved efficiency in managing production costs relative to sales revenue.

PE: 7.1x

Potbelly, a known player in the fast-casual dining sector, is making strides with its expansion plans across various U.S. markets. Despite forecasting an 80.3% annual earnings decline over three years, they reported a Q1 2025 revenue increase to US$113.68 million and narrowed net losses significantly from last year. Insider confidence is evident as insiders have been purchasing shares recently, reflecting belief in the company's strategic direction and potential growth through new shop openings and franchise partnerships nationwide.

- Navigate through the intricacies of Potbelly with our comprehensive valuation report here.

Examine Potbelly's past performance report to understand how it has performed in the past.

BrightView Holdings (NYSE:BV)

Simply Wall St Value Rating: ★★★★★☆

Overview: BrightView Holdings operates as a provider of commercial landscaping services in the United States, with a market capitalization of approximately $1.12 billion.

Operations: BrightView Holdings generates revenue primarily through its services, with a significant portion of costs attributed to COGS. The company's gross profit margin has shown variability, reaching 23.23% in recent periods. Operating expenses are consistently significant, with general and administrative expenses being a major component. Non-operating expenses have also impacted net income margins over time.

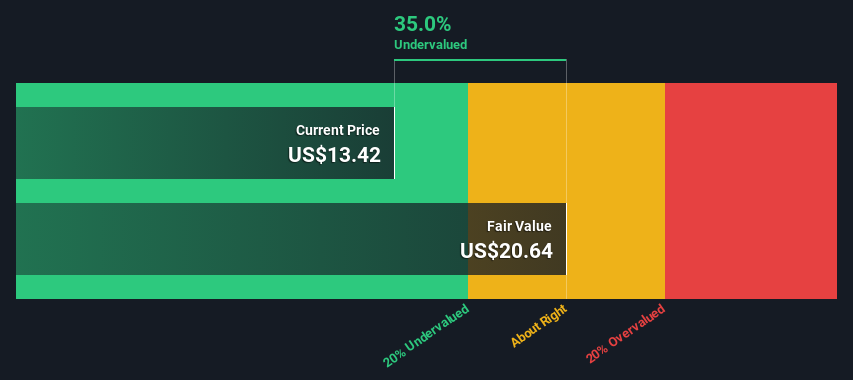

PE: 208.7x

BrightView Holdings, operating in the landscaping services sector, recently reported a dip in net income to US$6.4 million for Q2 2025 from US$33.7 million the previous year. Despite this, insider confidence is evident as Independent Director Kurtis Barker purchased 40,000 shares for approximately US$530,044. The company anticipates annual revenue between US$2.75 billion and US$2.84 billion and has initiated a share repurchase program worth up to US$100 million, indicating potential growth opportunities amidst current challenges.

Key Takeaways

- Unlock our comprehensive list of 93 Undervalued US Small Caps With Insider Buying by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Embecta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EMBC

Embecta

A medical device company, focuses on the provision of various solutions to enhance the health and wellbeing of people living with diabetes in the United States and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives