- United States

- /

- Professional Services

- /

- NYSE:BR

Broadridge Financial Solutions (BR): Assessing Valuation After $750 Million JPMorgan Credit Agreement

Reviewed by Simply Wall St

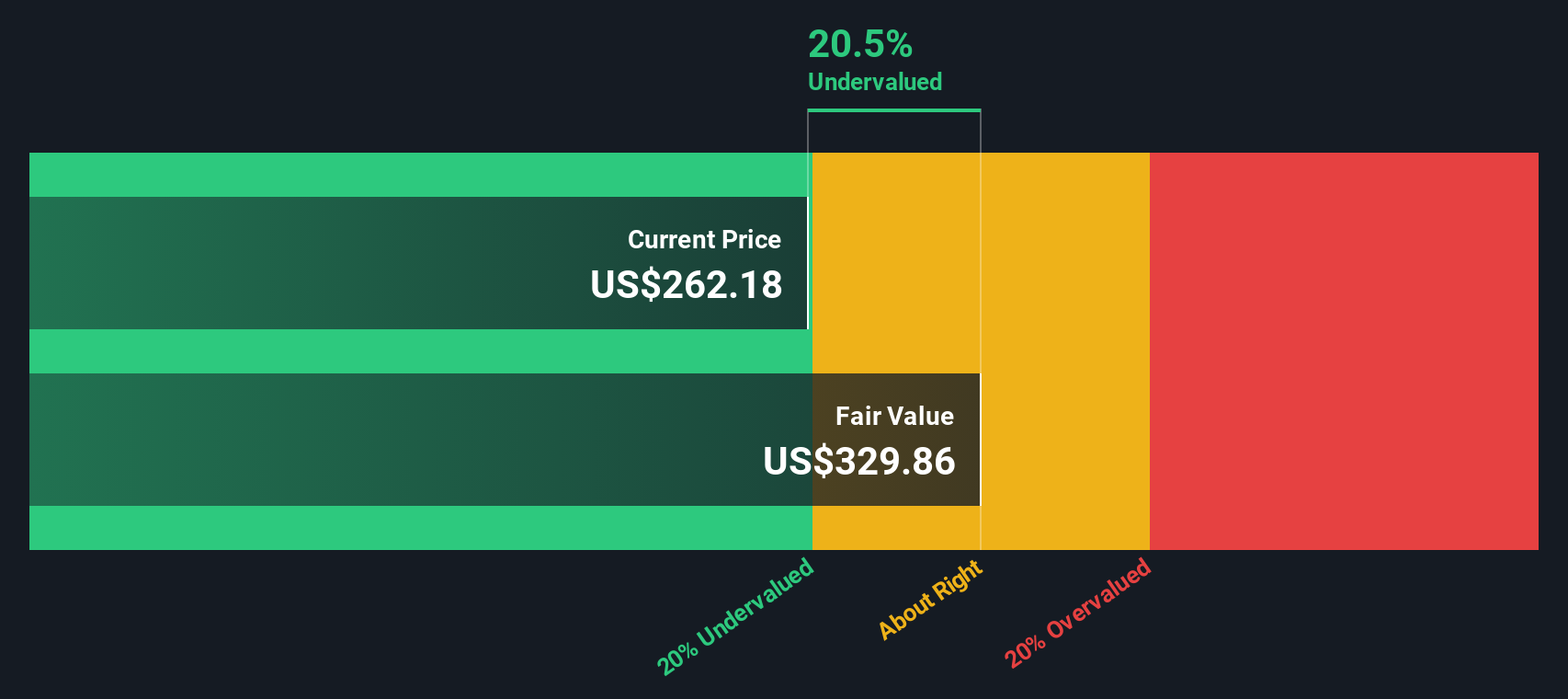

Most Popular Narrative: 6% Undervalued

According to community narrative, Broadridge Financial Solutions is currently seen as undervalued, with a fair value estimate notably higher than its current share price. Analysts believe that ongoing digital adoption and international growth prospects form the foundation of this upward re-rating.

The continued shift toward digitization of financial services, evidenced by Broadridge's growing double-digit digital revenue and rapid increases in digitization rates for regulatory communications (now over 90% for equity proxies), positions the company to benefit from rising demand for digital investor communications and lower-cost delivery. This is expected to support long-term recurring revenue growth and future margin expansion.

Curious about what is really fueling this premium valuation? The underlying factors include robust forecasts for top-line growth and profit margins, but the boldest assumptions are yet to be revealed. Which financial leaps, already backed by consensus, could be positioning Broadridge for a pricing power play? Explore the full story behind these rare numbers and discover why so many see further upside.

Result: Fair Value of $279.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, declining event-driven revenues and macro uncertainty could limit Broadridge’s growth trajectory sooner than analysts expect. This introduces new risks to the outlook.

Find out about the key risks to this Broadridge Financial Solutions narrative.Another View: The SWS DCF Model

While the market seems to be pricing in growth through earnings multiples, our DCF model offers a different perspective. This approach currently suggests shares might still be trading below intrinsic value. Could this point to hidden opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Broadridge Financial Solutions for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Broadridge Financial Solutions Narrative

If you see the data differently or want to dig deeper on your own, you can easily craft a personalized perspective in under three minutes. do it your way.

A great starting point for your Broadridge Financial Solutions research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Power up your portfolio by taking a smart look at sectors buzzing with potential. Don’t let these opportunities pass you by. See firsthand which types of winners are catching investor attention right now.

- Uncover the income advantage and add stable, high-yield contenders to your watchlist by checking out stocks offering dividend stocks with yields > 3%.

- Hunt for tomorrow’s tech leaders and tap into new growth by scanning the smartest bets in AI penny stocks.

- Stay ahead of the curve by tracking companies fueling breakthroughs in the next computing frontier through the latest picks in quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadridge Financial Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BR

Broadridge Financial Solutions

Provides investor communications and technology-driven solutions for the financial services industry in the United States and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives