- United States

- /

- Professional Services

- /

- NYSE:BKSY

BlackSky Technology (BKSY) Is Up 23.0% After Major International Contracts Boost Geospatial Intelligence Profile

Reviewed by Sasha Jovanovic

- In recent days, BlackSky Technology reached a new 52-week high after securing major government and international contracts, including a seven-figure agreement with HEO and a two-year Gen-3 early access deal with an international client.

- This milestone spotlights BlackSky's growing presence in geospatial intelligence and the rising global demand for its advanced Earth observation analytics.

- We'll explore how winning significant international contracts could reshape BlackSky's investment narrative and its future growth potential.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

BlackSky Technology Investment Narrative Recap

For shareholders, belief in BlackSky Technology centers on the accelerating global need for real-time geospatial intelligence and analytics, an area where BlackSky aims to lead with its Gen-3 satellite constellation and AI-driven Spectra platform. The surge to a 52-week high, following major international deals, is a positive signal for the near-term catalyst of recurring imagery and analytics revenues as Gen-3 demand rises. However, this does not fully erase risks linked to customer conversions from early access agreements or revenue volatility tied to government contract timing.

Among recent announcements, the two-year Gen-3 early access agreement with a new international customer directly highlights the company’s progress in converting technical capability into tangible recurring contracts, a key step as general availability launches for Gen-3 are seen as the most immediate revenue driver. This aligns with improving revenue visibility, but leaves open questions about the pace and consistency of multi-year commitments, especially as international contracts become a larger share of the backlog.

In contrast, investors should closely watch how the heavy upfront investments in satellite infrastructure could...

Read the full narrative on BlackSky Technology (it's free!)

BlackSky Technology's outlook anticipates $230.4 million in revenue and $16.4 million in earnings by 2028. This projection relies on an annual revenue growth rate of 30.1% and an $102.5 million increase in earnings from the current level of -$86.1 million.

Uncover how BlackSky Technology's forecasts yield a $25.29 fair value, a 16% downside to its current price.

Exploring Other Perspectives

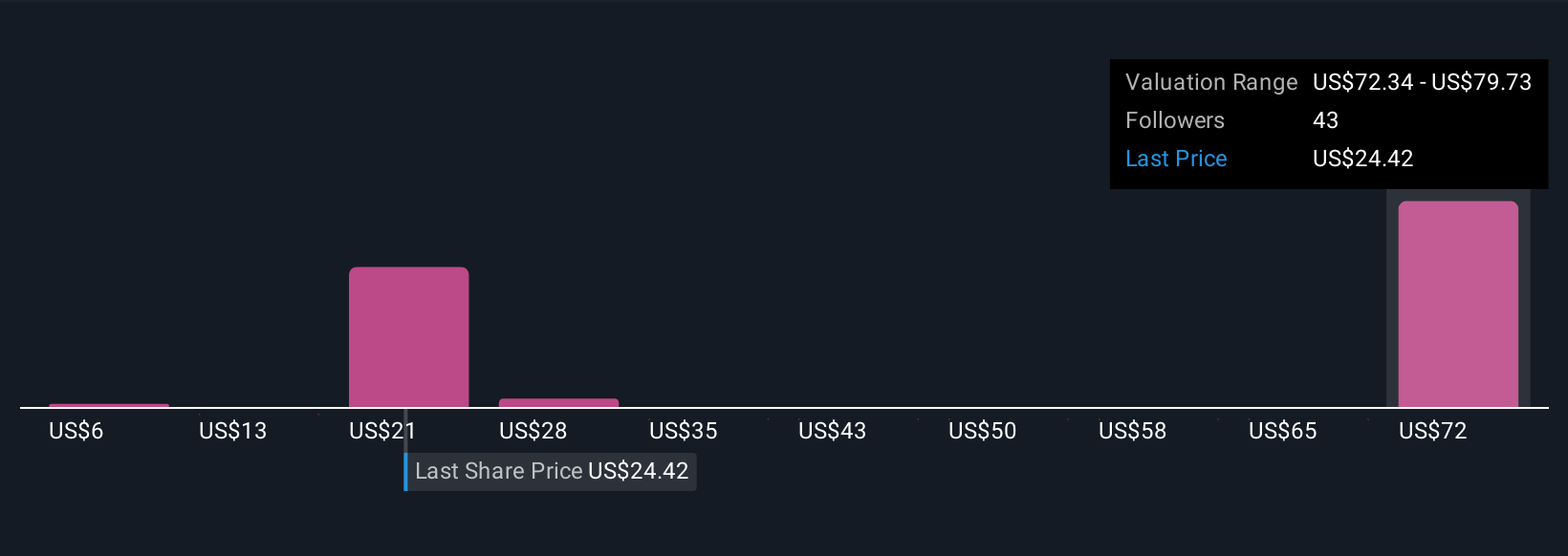

Fair value opinions from nine Simply Wall St Community members range widely, from US$5.84 to US$79.93 per share. With upcoming recurring revenue catalysts still in the spotlight, consider how your interpretation of risk or opportunity could differ from prevailing views.

Explore 9 other fair value estimates on BlackSky Technology - why the stock might be worth over 2x more than the current price!

Build Your Own BlackSky Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BlackSky Technology research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free BlackSky Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BlackSky Technology's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackSky Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKSY

BlackSky Technology

Operates as a space-based intelligence company in North America, the Middle East, the Asia Pacific, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives