- United States

- /

- Professional Services

- /

- NYSE:BAH

Booz Allen Hamilton (BAH): Valuation Insights After New Quantum Computing Partnership With SEEQC

Reviewed by Kshitija Bhandaru

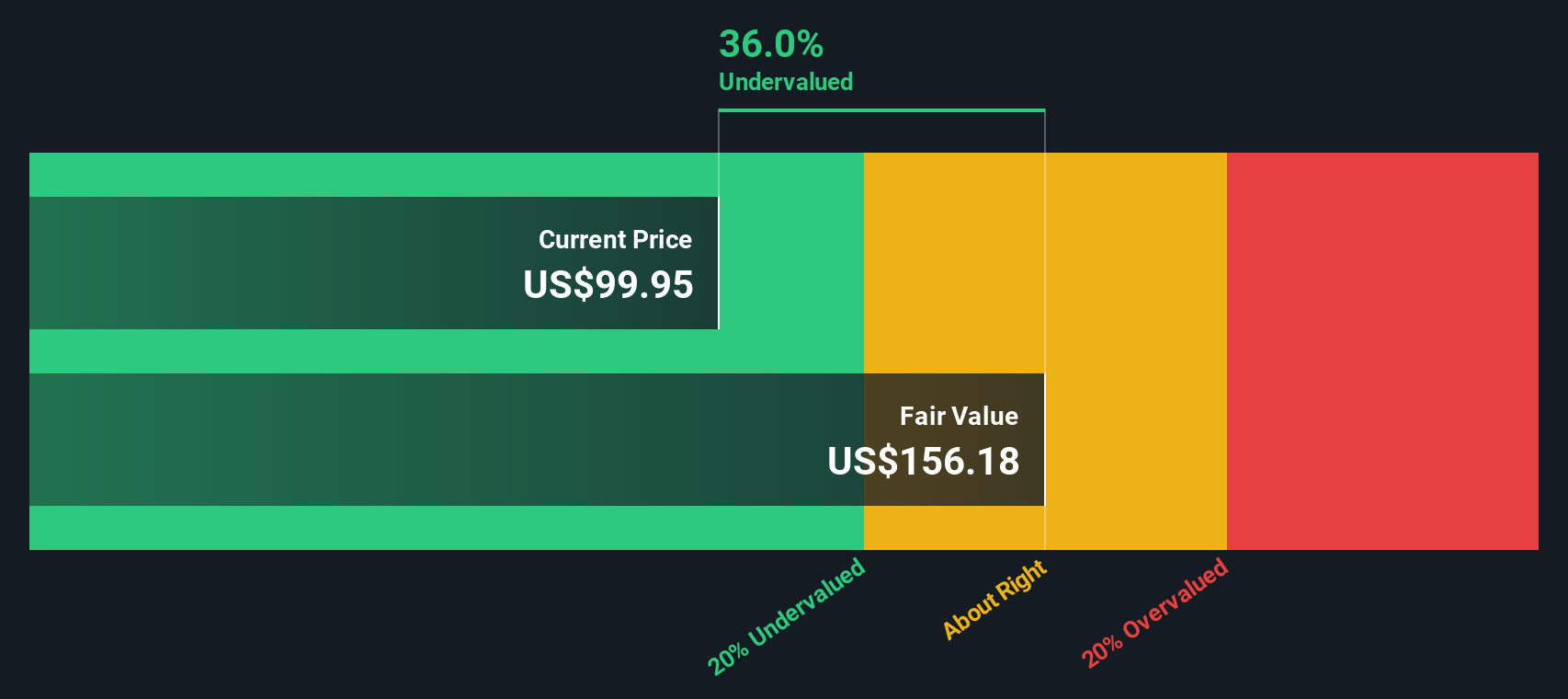

Booz Allen Hamilton Holding (BAH) is making headlines this month, thanks to an expanded partnership with SEEQC to speed up quantum computing development for clients across government, civil, and commercial sectors. The ambition is clear: build the bridge between quantum hardware and software so clients can access large-scale quantum computing sooner. For investors, it is a move that reinforces Booz Allen’s long-term commitment to advanced technology and positions it at the cutting edge of an industry shift that is already drawing attention from across the market.

This announcement comes at a time when Booz Allen’s share price has struggled to build momentum. Shares have slipped around 38% over the past year, and year-to-date performance is also down, despite revenue growing 4% annually. While the company continues to invest in future-facing technology, recent quarterly results and guidance have weighed on near-term sentiment. The company’s upcoming earnings report and expectations of softer profits suggest the market remains cautious, but forward valuation still looks more attractive than many industry peers.

After this year’s pullback and with quantum on the horizon, is Booz Allen Hamilton Holding trading at a bargain, or is the market simply being realistic about future growth?

Most Popular Narrative: 21% Undervalued

Booz Allen Hamilton Holding is viewed as notably undervalued based on the prevailing narrative, with its fair value estimate standing well above the current trading price. This perspective emphasizes the company's long-term upside potential despite some short-term challenges.

“Booz Allen is positioned to benefit from increased federal investment in digital transformation, AI, and cybersecurity, as evidenced by record backlog, major new awards (e.g., TOC-L for the Air Force, CBP cloud migration), and expanded tech partnerships. As procurement normalizes, this is likely to accelerate revenue growth.”

Wondering what’s fueling this above-average valuation? One critical assumption behind the narrative involves a path to future earnings that only a select group of companies could hope to achieve. See how these projections paint a bold picture for Booz Allen's future, and decide if you agree with this fair value estimate or have a different view.

Result: Fair Value of $126.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent government spending delays or heightened competition could dampen Booz Allen’s growth outlook. These factors could serve as substantial catalysts for a shift in sentiment.

Find out about the key risks to this Booz Allen Hamilton Holding narrative.Another View: SWS DCF Model Weighs In

While analysts place Booz Allen Hamilton well below their fair value target, our DCF model also suggests the stock remains undervalued. However, what if both approaches are leaning too optimistic or overlooking a potential risk? Which side do you trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Booz Allen Hamilton Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Booz Allen Hamilton Holding Narrative

If you see things differently, or want to dig deeper on your own, you can quickly build your own view of Booz Allen in just a few minutes. Do it your way.

A great starting point for your Booz Allen Hamilton Holding research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't let opportunity slip by. Expand your investing horizons now with these hand-picked strategies. The market never waits, so seize your next edge before everyone else does.

- Tap into market momentum by uncovering undervalued stocks based on cash flows packed with potential and trading well below their intrinsic worth.

- Unlock tomorrow’s breakthroughs by following AI penny stocks at the cutting edge of automation, intelligent technology, and innovation-driven growth.

- Capture income and stability by pursuing dividend stocks with yields > 3% offering reliable yields above 3% for stronger portfolio resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Booz Allen Hamilton Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAH

Booz Allen Hamilton Holding

A technology company, provides technology solutions using artificial intelligence, cyber, and other technologies for government’s cabinet-level departments and commercial customers in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives