- United States

- /

- Professional Services

- /

- NYSE:ALIT

Does Alight Offer Opportunity After Falling 51% in 2025?

Reviewed by Bailey Pemberton

If you are weighing what to do with Alight stock right now, you are not alone. After all, this is a name that has seen its share of dizzying swings. The stock most recently closed at $3.25, and although there was a mild dip of -2.7% over the past week, the broader picture reveals deeper declines, including a sharp -16.2% drop in the last month and a year-to-date slide of -51.9%. Looking further back, Alight is down -53.9% over the past year and -54.4% across the last three years, painting a picture of sustained pressure. For the patient, this could also suggest untapped opportunity.

Some of these moves have unfolded alongside broader market volatility, with investors adjusting their outlooks as economic conditions shift. While there has not been a direct jolt from major news lately, changing perceptions of risk and future growth potential have clearly influenced Alight’s price trajectory.

The big question now is whether Alight has fallen too far. On a valuation basis, the company earns a score of 4 out of 6 checks for being undervalued. That means it passes two-thirds of key tests analysts often use to spot bargains, though it is not a unanimous call just yet.

So how do we dig deeper and decide if Alight deserves a spot in your portfolio, a spot on your watchlist, or a pass for now? Let’s break down the valuation approaches one by one. At the end, I will share the single most important thing to focus on before making your decision.

Why Alight is lagging behind its peersApproach 1: Alight Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular approach that estimates a company’s value by projecting its future cash flows and discounting them to today’s dollars. This method helps investors gauge what the business could be worth based on its ability to generate cash in the years ahead.

For Alight, the most recent reported Free Cash Flow is $133.5 million. Analyst forecasts anticipate steady growth, with projections showing Free Cash Flow rising to $376 million by 2027 and continuing to increase over the next decade through a combination of analyst estimates and extrapolations. By 2035, the model suggests cash flows could reach around $608 million, representing a consistent trend of expansion.

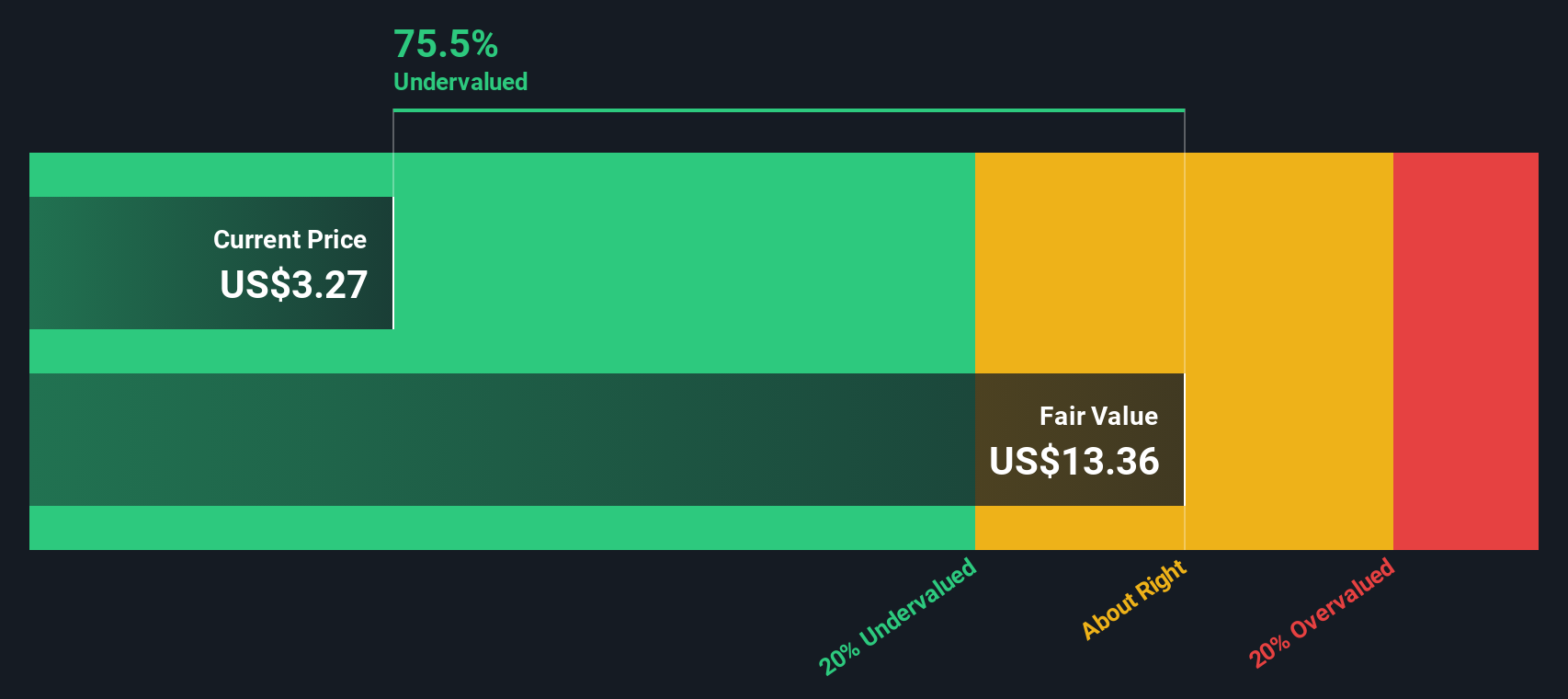

Based on these projections and the application of the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value comes out to $13.23 per share. Compared to the current share price of $3.25, this implies Alight is trading at a substantial discount, specifically about 75.4% below the DCF fair value. This indicates there may be significant long-term value that the market is currently not recognizing.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Alight.

Approach 2: Alight Price vs Sales (P/S)

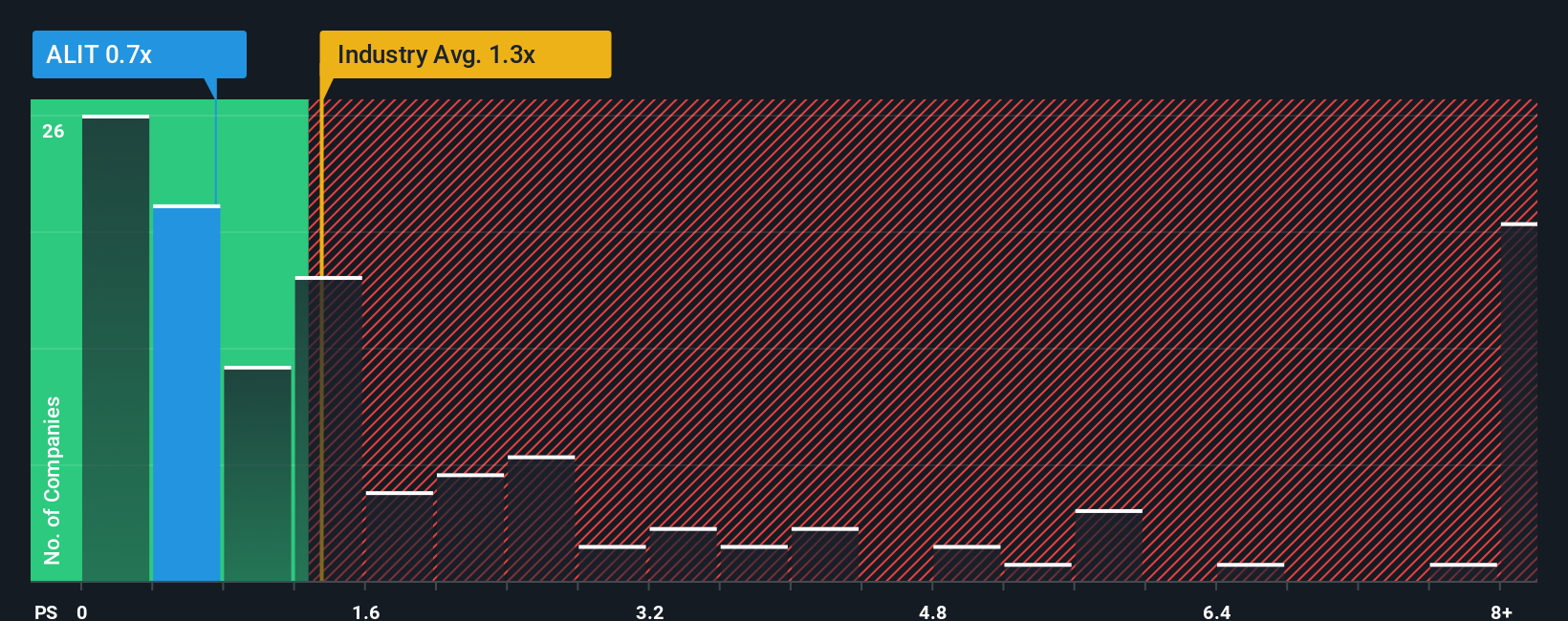

The Price-to-Sales (P/S) ratio is a valuable tool for evaluating companies like Alight, especially when profitability is not consistent or earnings fluctuate. It compares the company’s stock price to its revenues, making it a preferred metric for businesses in growth or turnaround phases where revenue trends are more stable and informative than unpredictable profits.

In general, investors expect higher valuation multiples for companies showing strong growth prospects and lower perceived risks, while slower growth or higher risk pushes the "normal" or "fair" ratio down. Put simply, a low P/S could signal undervaluation if future growth looks solid, but it is crucial to factor in the bigger picture.

Alight’s current P/S ratio stands at 0.74x. For context, this is slightly above the peer group average of 0.56x, but well below the industry average of 1.32x for Professional Services. More importantly, the proprietary Simply Wall St Fair Ratio for Alight is calculated at 1.16x. This is based on a tailored approach that incorporates not only revenue growth, but also the company’s margins, industry, market cap, and risk profile. Unlike simple peer or industry benchmarks, this Fair Ratio reflects a more complete view of company-specific conditions.

When matched against its Fair Ratio, Alight’s actual P/S is considerably lower. This suggests the stock could be undervalued on this basis.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Alight Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful concept: it is your story and perspective on a company, built by connecting what you know about a business with realistic expectations for its revenue, earnings, and margins, which together lead to your estimate of fair value.

Instead of only relying on ratios or analyst opinions, Narratives let you clearly link why you believe a company will prosper (or struggle) to the numbers in your forecast, making the driver behind every investment decision completely transparent. Narratives are at the heart of the Simply Wall St Community page, so you can create and compare your own view instantly, just like millions of other investors do.

What makes Narratives especially useful is how they help you decide when to buy or sell, by showing if your view of fair value is above or below the current market price. Plus, Narratives update dynamically, so every time relevant news or earnings are announced, the numbers and your story evolve together without you needing to manually recalculate.

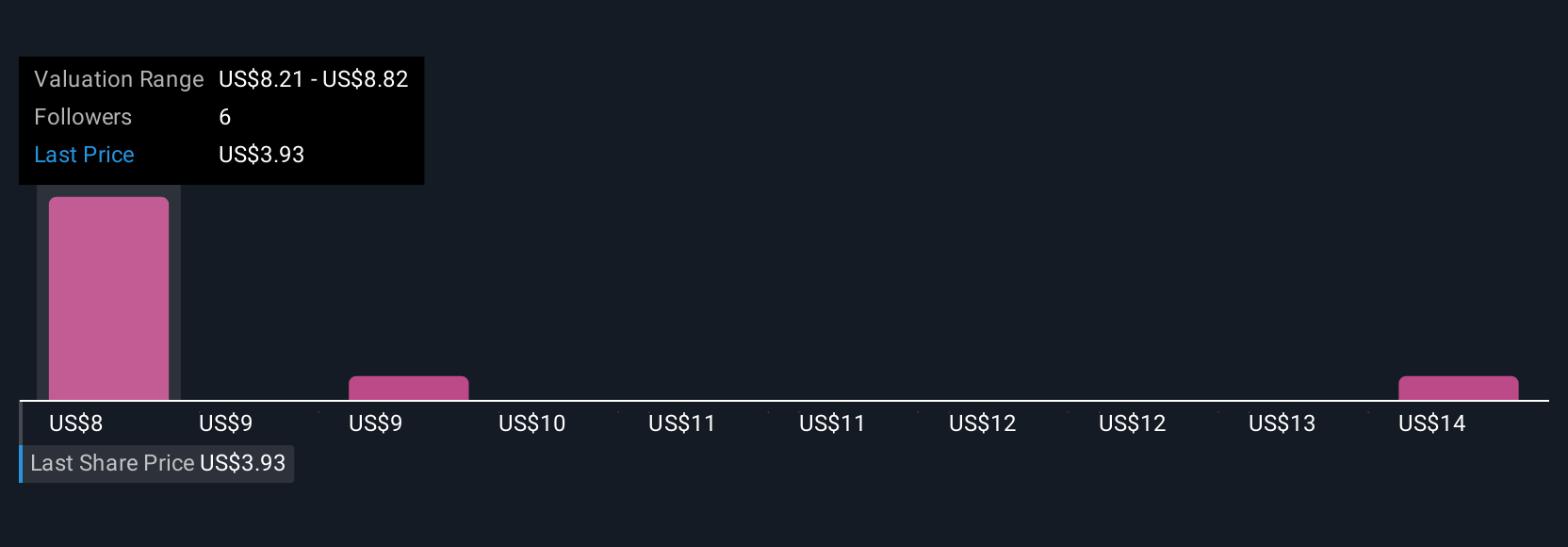

For Alight, some investors are bullish with price targets as high as $11.00, seeing AI adoption and big partnerships, while others are cautious with targets near $6.00, citing growth risks and client dependence. This highlights how Narratives help you both see the range of possibilities and make your call.

Do you think there's more to the story for Alight? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALIT

Good value with adequate balance sheet.

Market Insights

Community Narratives