- United States

- /

- Commercial Services

- /

- NYSE:ABM

Should Insider Stock Sales and Restructuring Shape ABM Industries' (ABM) Margin Improvement Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, Dean Chin, Senior Vice President and Chief Accounting Officer at ABM Industries, sold 3,567 shares of company stock, coinciding with the release of financial results showing revenues above analyst expectations but earnings per share below guidance.

- This activity comes as ABM Industries implements restructuring measures to address margin pressures, with optimism around its Technical Solutions segment and planned AI investments for future savings.

- We’ll explore how ongoing restructuring and insider stock sales could influence ABM Industries’ outlook and investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ABM Industries Investment Narrative Recap

To invest in ABM Industries today, you need to believe that its restructuring efforts and investments, particularly in AI and technical solutions, will offset ongoing margin pressures and drive future earnings growth, even as current challenges persist. The recent insider sale by a senior executive, paired with a short-term share price drop after mixed quarterly results, does not materially alter the most important short-term catalyst (cost-saving execution through restructuring), nor does it heighten the biggest risk (recurring margin pressures from pricing concessions in key markets).

The announcement that stands out most is ABM’s recent buyback update: between May and early September 2025, the company repurchased 1.1 million shares for US$50.1 million. This move, occurring despite margin headwinds and financial restructuring, reinforces the company’s commitment to returning value to shareholders, which could bolster confidence as management works to navigate cost pressures and stabilize margins.

But on the risk side, investors should be aware that, in contrast to these steady buybacks, ABM continues to face ongoing margin pressure from pricing concessions in competitive markets…

Read the full narrative on ABM Industries (it's free!)

ABM Industries' projections indicate revenues of $9.5 billion and earnings of $370.4 million by 2028. This outlook assumes 3.2% annual revenue growth and a $254.5 million increase in earnings from the current $115.9 million level.

Uncover how ABM Industries' forecasts yield a $58.00 fair value, a 25% upside to its current price.

Exploring Other Perspectives

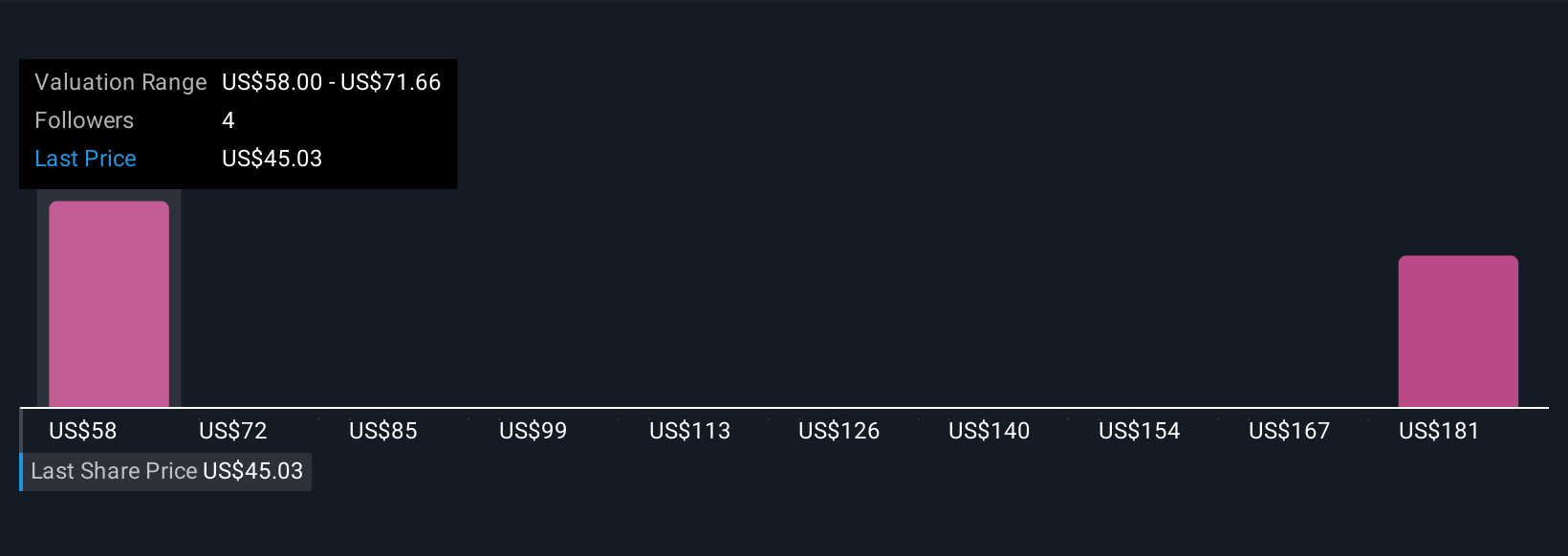

Simply Wall St Community members peg ABM’s fair value from US$58 to US$191.51 across two submissions. With cost-saving measures underway but recurring margin risk, opinions on ABM’s prospects remain split, see the full range of views here.

Explore 2 other fair value estimates on ABM Industries - why the stock might be worth over 4x more than the current price!

Build Your Own ABM Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ABM Industries research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free ABM Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ABM Industries' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABM

ABM Industries

Through its subsidiaries, engages in the provision of integrated facility, infrastructure, and mobility solutions in the United States and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion