- United States

- /

- Commercial Services

- /

- NYSE:ABM

ABM Industries Full Year 2024 Earnings: Revenues Beat Expectations, EPS Lags

ABM Industries (NYSE:ABM) Full Year 2024 Results

Key Financial Results

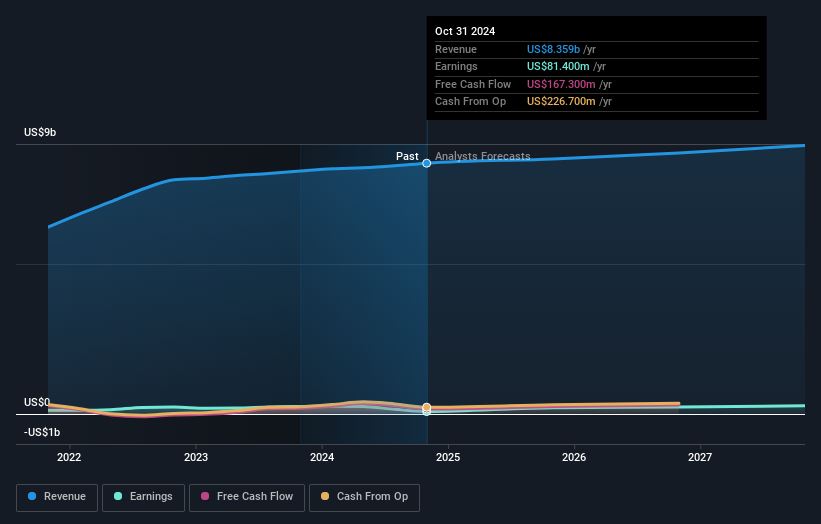

- Revenue: US$8.36b (up 3.2% from FY 2023).

- Net income: US$81.4m (down 68% from FY 2023).

- Profit margin: 1.0% (down from 3.1% in FY 2023). The decrease in margin was driven by higher expenses.

- EPS: US$1.29 (down from US$3.81 in FY 2023).

All figures shown in the chart above are for the trailing 12 month (TTM) period

ABM Industries Revenues Beat Expectations, EPS Falls Short

Revenue exceeded analyst estimates by 1.2%. Earnings per share (EPS) missed analyst estimates by 42%.

Looking ahead, revenue is forecast to grow 2.1% p.a. on average during the next 3 years, compared to a 7.3% growth forecast for the Commercial Services industry in the US.

Performance of the American Commercial Services industry.

The company's shares are down 9.4% from a week ago.

Risk Analysis

You should always think about risks. Case in point, we've spotted 2 warning signs for ABM Industries you should be aware of, and 1 of them is a bit concerning.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ABM

ABM Industries

Through its subsidiaries, engages in the provision of integrated facility, infrastructure, and mobility solutions in the United States and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives