- United States

- /

- Professional Services

- /

- NasdaqGS:VRSK

Verisk Analytics (VRSK): Exploring Valuation After Strong Earnings and Updated Guidance

Reviewed by Simply Wall St

Verisk Analytics (VRSK) just reported its third quarter results, revealing an increase in both revenue and net income compared to last year. The company also updated its outlook for the full year.

See our latest analysis for Verisk Analytics.

Even with revenue and profits ticking up, Verisk Analytics has seen its momentum stumble in recent weeks. The share price has dropped sharply, down more than 16% over the last month and off nearly 24% for the year so far. This reflects a shift in sentiment after the company revised its full-year guidance and wrapped up further share buybacks. Despite the recent volatility, the stock’s three-year total shareholder return is still a healthy 25%.

If this kind of swing in fortune has you watching the market more closely, now could be the perfect time to explore fast growing stocks with high insider ownership.

With shares now trading at a sizable discount to analyst price targets and new guidance on the table, investors are left weighing whether Verisk Analytics is undervalued or if the current price already reflects its growth prospects.

Most Popular Narrative: 28.4% Undervalued

With the fair value calculated at $290.53 versus the last close of $208.00, the latest narrative presents a significant potential upside. This stark difference has caught the attention of both optimistic and cautious analysts alike.

The company is responding to customer demand for better insights and data connections, supporting revenue growth by leveraging its Core Lines Reimagine project, which provides timely loss insights and improved data analytics. These enhancements are likely to contribute to higher revenue and client retention.

Want a glimpse into the real engine powering this bold price target? The narrative centers on a strategy that assumes elevated growth rates, higher profit margins, and a future valuation multiple above the industry standard. Ready to unravel the precise financial bets and aggressive assumptions analysts are using? Read on to discover what is driving such an ambitious fair value for Verisk Analytics.

Result: Fair Value of $290.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as ongoing regulatory changes and severe weather-related losses could quickly upset analysts' projections and challenge Verisk's bullish outlook.

Find out about the key risks to this Verisk Analytics narrative.

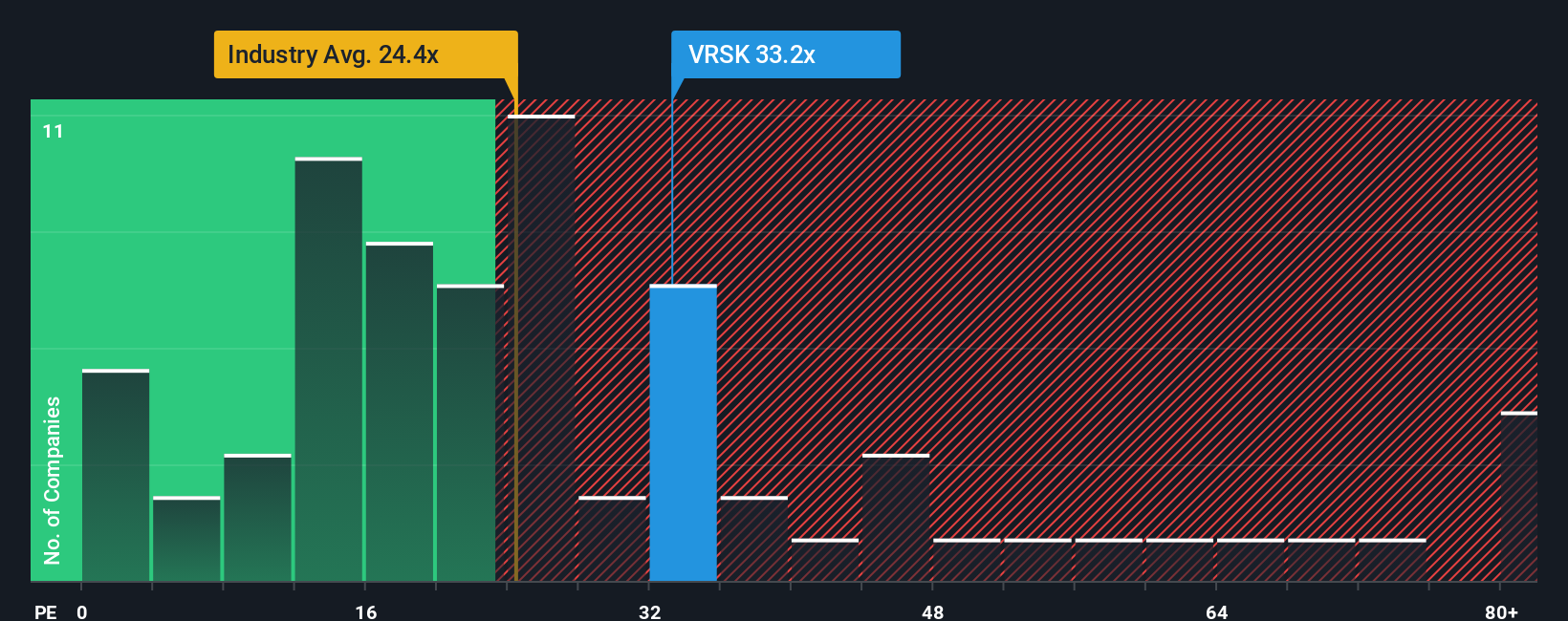

Another View: Market Multiples Tell a Different Story

While fair value models see upside, market-based multiples suggest caution. Verisk trades at a price-to-earnings ratio of 32x, which is higher than the US Professional Services industry average of 27.2x and above its own fair ratio of 29.8x. This signals the market expects more, increasing valuation risk if growth slows. Could the optimism be overdone?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Verisk Analytics Narrative

If you want to dig into the numbers your own way or challenge the assumptions made here, you can craft a complete view in just minutes. Do it your way

A great starting point for your Verisk Analytics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Ideas?

Smart investors keep their options open. Don’t risk missing out. Supercharge your portfolio potential with these standout stock ideas using the Simply Wall Street Screener:

- Supercharge your returns by targeting these 854 undervalued stocks based on cash flows that could break out thanks to strong fundamentals and attractive pricing.

- Seize the edge in tomorrow’s technologies and get ahead of the crowd with these 26 AI penny stocks powering rapid innovation and relentless growth.

- Boost your income strategy by picking these 21 dividend stocks with yields > 3% offering reliable yields, making your money work harder in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRSK

Verisk Analytics

Engages in the provision of data analytics and technology solutions to the insurance industry in the United States and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives