- United States

- /

- Professional Services

- /

- NasdaqGS:UPWK

Upwork (UPWK) Valuation in Focus as Analysts Highlight Growth Potential After New Platform Launch and Turnaround Signals

Reviewed by Kshitija Bhandaru

If you’re wondering what to do next with Upwork (UPWK), this week’s news probably made you pause. Shares caught a bid after both Citizens JMP and UBS analysts highlighted Upwork’s ongoing turnaround efforts, with upbeat commentary focusing on a new enterprise platform called Lifted. Even though a recent CEO stock sale added a small speed bump, it has not dimmed attention on potential longer-term growth drivers and a shift in the company narrative.

Skeptics and fans both have reasons for a second look. The stock is up more than 80% over the past year, with its rebound accelerating in the past month. After grappling with declines in its core Gross Services Volume, Upwork is now signaling a potential inflection point, spurred by stabilizing sales and key new initiatives such as improved infrastructure for global payouts. The market is clearly warming to the gig economy theme again, but memories of past volatility remain close.

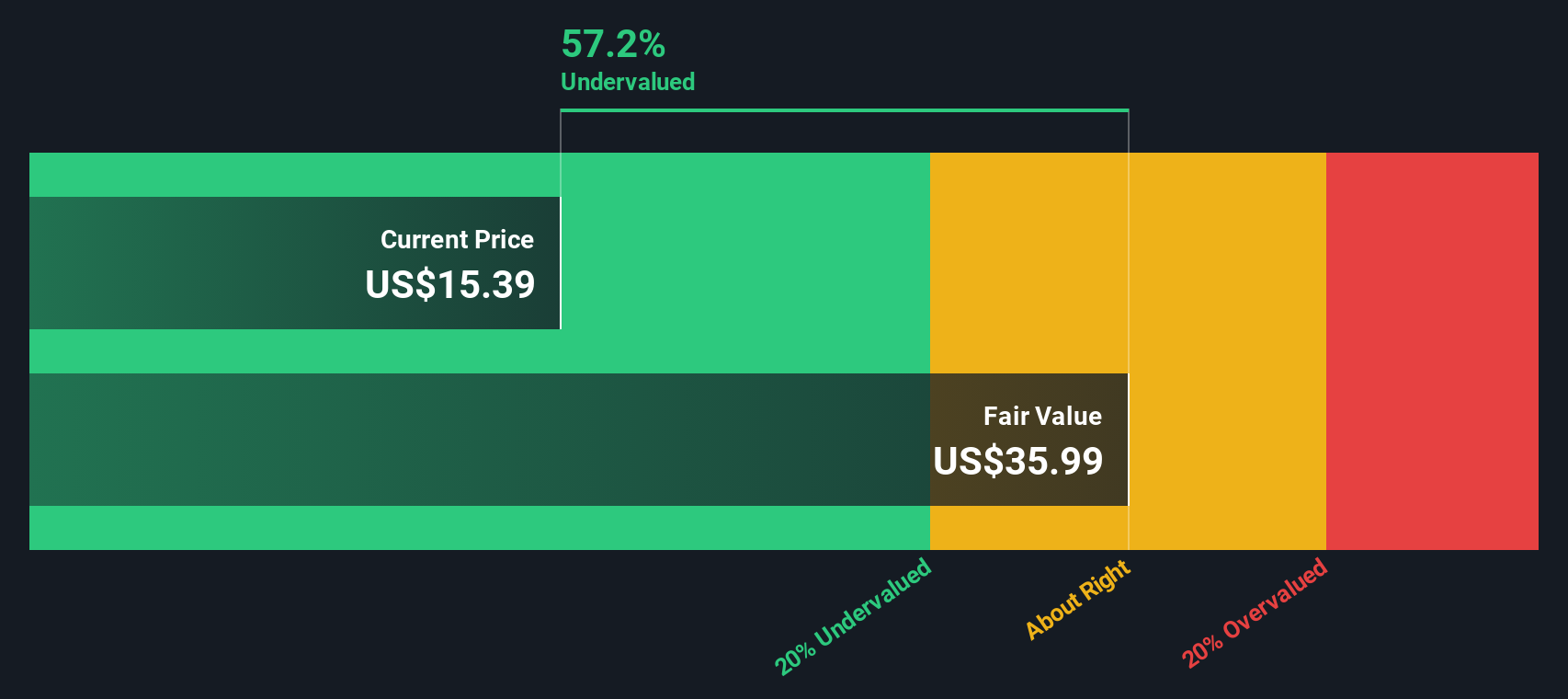

This bounce raises the big question: is Upwork trading at a bargain ahead of real growth, or is the latest optimism already reflected in the price?

Most Popular Narrative: 3.8% Undervalued

Consensus among analysts suggests Upwork is undervalued, with improving enterprise traction and new product rollouts shaping the latest fair value estimate.

"Upwork's launch of integrated enterprise solutions through recent acquisitions (Bubty and Ascen) positions the company to capture a larger share of the $650 billion contingent workforce market. Expectations include meaningful GSV, revenue, and adjusted EBITDA contributions beginning in late 2026 and accelerating into 2027, supporting long-term earnings expansion."

Want insight on the drivers behind this bullish forecast? The core of this narrative is a big bet on Upwork's breakthrough in enterprise, future earnings power, and a premium rating usually reserved for industry leaders. What do analysts see that the market is missing? Find out how specific growth levers could reshape the company's value story in the years ahead.

Result: Fair Value of $19.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent macro uncertainty and slower client acquisition could easily undermine Upwork's progress. This makes continued growth far from guaranteed.

Find out about the key risks to this Upwork narrative.Another View: Discounted Cash Flow Perspective

Taking a fresh angle, our DCF model looks past near-term sentiment and focuses on long-term cash flows. This method still suggests Upwork is undervalued. However, does it capture the whole story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Upwork for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Upwork Narrative

If you see things differently or think there’s more beneath the surface, our platform lets you dig in and shape your own viewpoint in just a few minutes. Do it your way.

A great starting point for your Upwork research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t watch from the sidelines while others act. Use these powerful ideas to keep your portfolio ahead of the curve and find tomorrow’s winners today.

- Spot opportunities among penny stocks with strong financials, which boast resilient balance sheets and promising growth that is overlooked by most investors.

- Tap into the surge of innovation with access to quantum computing stocks as companies make breakthrough advances in quantum technology and pursue commercial dominance.

- Secure steady returns by choosing from dividend stocks with yields > 3%, featuring robust yields and income strength for your long-term goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPWK

Upwork

Operates a work marketplace that connects businesses with various independent professionals and agencies in the United States, India, the Philippines, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives