- United States

- /

- Commercial Services

- /

- NasdaqGS:TTEK

Tetra Tech (TTEK): Valuation Check After Major U.S. Army Corps and EirGrid Contract Wins

Reviewed by Simply Wall St

Tetra Tech (TTEK) just landed a five year, $500 million environmental services contract with the U.S. Army Corps of Engineers, a win that reinforces its niche in hazardous waste cleanup and technology-enabled engineering.

See our latest analysis for Tetra Tech.

Despite the new Army Corps and EirGrid wins highlighting solid long term demand, Tetra Tech’s 1 year total shareholder return of negative 16 percent and year to date share price return of negative 13 percent suggest momentum has cooled for now.

If this kind of contract driven growth story interests you, it is worth scanning other aerospace and defense stocks that might be quietly lining up multi year government work of their own.

With shares down double digits this year yet trading at a sizable discount to analyst targets, is Tetra Tech an underappreciated compounder following its latest contract wins, or is the market already factoring in years of growth?

Most Popular Narrative Narrative: 18% Undervalued

With Tetra Tech last closing at $34.56 against a narrative fair value near $42, the gap reflects confidence in margin expansion and disciplined capital deployment.

Execution of a strategic shift away from lower margin USAID and legacy work toward complex, higher value projects has already resulted in record high company margins. Management is targeting ongoing annual margin expansion of 50+ basis points, which suggests further earnings leverage ahead.

Curious how shrinking top line assumptions can still support a higher value? The narrative leans on richer margins, rising EPS and a re rated earnings multiple. Want the full blueprint behind that math?

Result: Fair Value of $42.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, revenue concentration after USAID losses and fading disaster response work could pressure growth assumptions and undermine the margin-driven upside case.

Find out about the key risks to this Tetra Tech narrative.

Another Take on Valuation

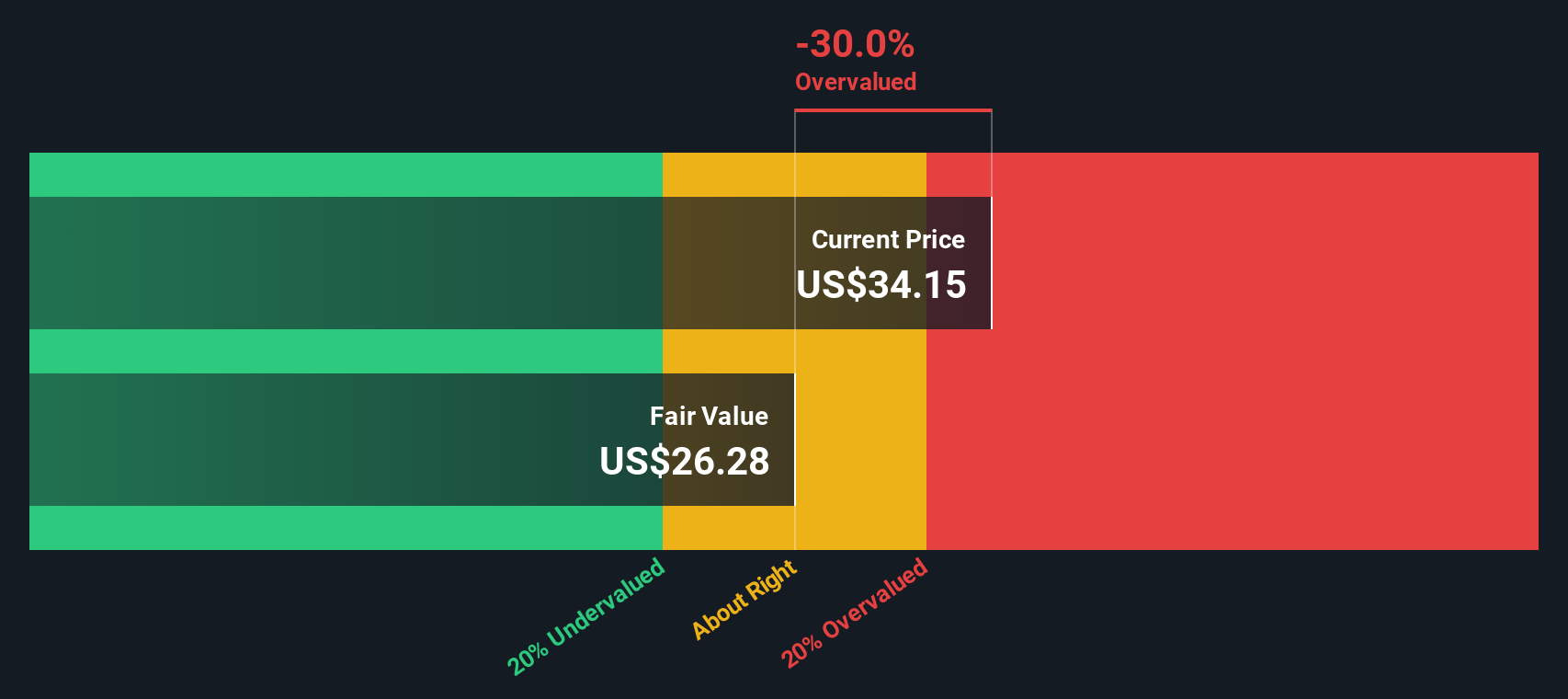

Our DCF model paints a cooler picture, putting Tetra Tech’s fair value near $26.28, which implies the shares are trading above intrinsic value rather than at a discount. If cash flows fall short of analyst hopes, could this premium leave little margin for error?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tetra Tech for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 911 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tetra Tech Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a tailored view in just a few minutes: Do it your way.

A great starting point for your Tetra Tech research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Put your Tetra Tech research to work by lining up your next ideas today. The right screen could surface an opportunity the market is still overlooking.

- Capture turnaround potential with these 911 undervalued stocks based on cash flows that the market has temporarily marked down despite solid cash flow prospects and resilient fundamentals.

- Ride innovation at the edge of computing by scanning these 27 quantum computing stocks pushing boundaries in security, processing power, and future proof infrastructure.

- Lock in potential income streams through these 14 dividend stocks with yields > 3% offering attractive yields that can strengthen your portfolio’s long term total return.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tetra Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTEK

Tetra Tech

Provides consulting and engineering services focusing on water, environment, and sustainable infrastructure in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)