- United States

- /

- Commercial Services

- /

- NasdaqGS:TTEK

Tetra Tech (TTEK) Lands Major Irish Grid Project: A Fresh Look at the Stock’s Valuation

Reviewed by Simply Wall St

Tetra Tech (TTEK) just landed a meaningful role in Ireland’s long term power buildout, after grid operator EirGrid tapped the firm to support expansion of the country’s transmission and distribution network.

See our latest analysis for Tetra Tech.

Even with this Irish grid win underscoring its role in critical infrastructure, Tetra Tech’s 1 year total shareholder return is down 18.7 percent. At the same time, a solid 5 year total shareholder return of 52.03 percent points to longer term momentum still intact.

If this kind of infrastructure story has you thinking bigger, it might be a good moment to explore other aerospace and defense stocks that are reshaping how governments and industries manage complex systems.

With the share price lagging recent fundamentals but still trading only slightly below intrinsic estimates and well under analyst targets, is Tetra Tech quietly setting up a buying opportunity, or is the market already baking in future growth?

Most Popular Narrative Narrative: 19.0% Undervalued

With Tetra Tech last closing at $34.14 against a narrative fair value of $42.17, the valuation case leans firmly toward upside from here.

Ongoing expansion of advanced digital automation and analytics offerings, catalyzed by rising adoption of AI and recent strategic acquisitions, positions Tetra Tech for higher margin, tech driven consulting services and recurring revenue streams, supporting long term net margin and earnings growth.

Curious how flat top line expectations still support a higher valuation? The narrative leans on expanding margins, richer mix, and a profit multiple usually reserved for faster growing sectors. Want to see the exact assumptions behind that confidence?

Result: Fair Value of $42.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on replacing lapsed government contracts and avoiding a prolonged slowdown in commercial and international work, which could pressure margins and growth.

Find out about the key risks to this Tetra Tech narrative.

Another View: Market Multiples Look Stretched

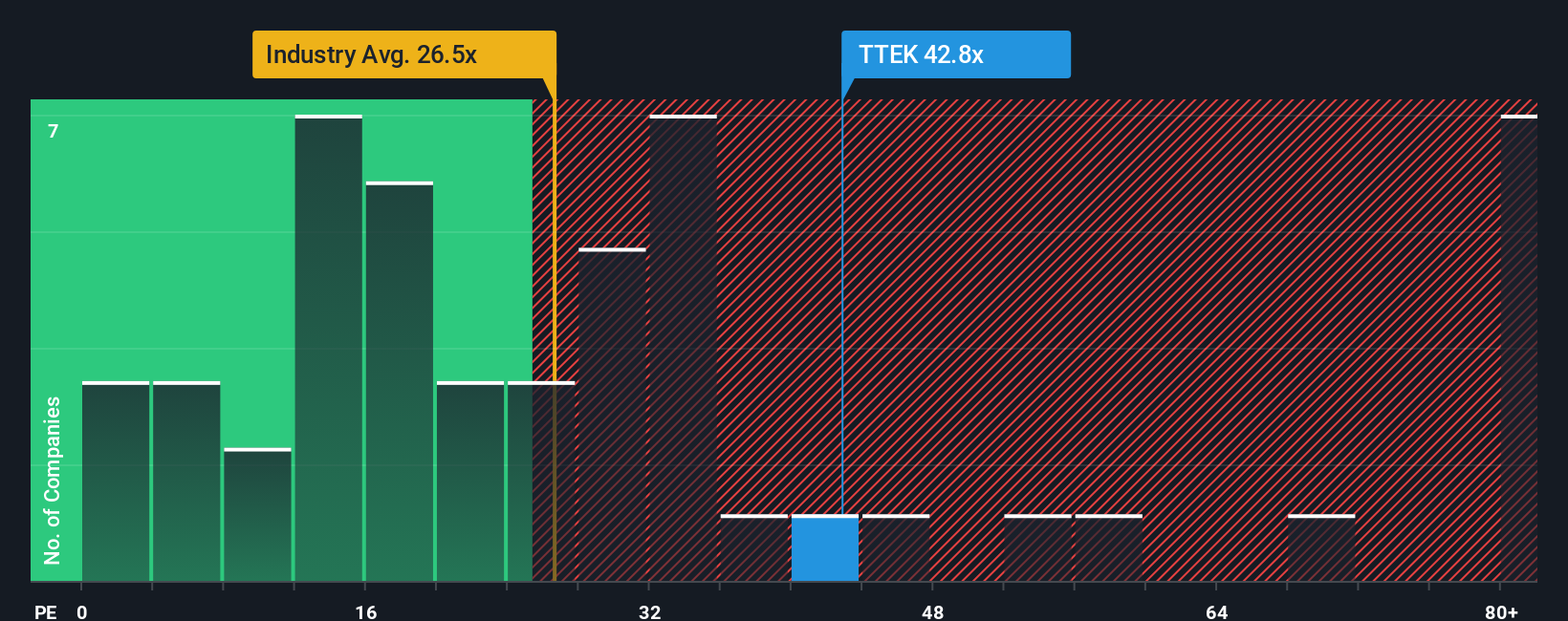

While the narrative fair value suggests upside, the market’s own yardstick tells a tougher story. Tetra Tech trades on a price to earnings ratio of 35.9 times, richer than the US Commercial Services industry at 23.1 times and slightly above peers at 35.3 times, and even higher than its fair ratio of 31.9 times. That premium hints the market may already be pricing in a lot of good news, raising the question of how much safety margin is really left for new buyers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tetra Tech Narrative

If you see the story differently, or simply want to test your own assumptions against the numbers, you can build a fresh view in minutes: Do it your way.

A great starting point for your Tetra Tech research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before the market’s next move leaves you watching from the sidelines, use the Simply Wall St Screener to pinpoint fresh opportunities that match your strategy and risk appetite.

- Capture potential mispricings by targeting quality companies trading on attractive cash flow valuations with these 904 undervalued stocks based on cash flows that highlight where sentiment may have overshot reality.

- Ride structural growth trends in automation and intelligent software by scanning these 26 AI penny stocks that are embedding machine learning into real world products and services.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that pair robust balance sheets with reliable cash payouts above savings account yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tetra Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTEK

Tetra Tech

Provides consulting and engineering services focusing on water, environment, and sustainable infrastructure in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)