- United States

- /

- Professional Services

- /

- NasdaqGS:TTEC

TTEC Holdings, Inc.'s (NASDAQ:TTEC) 47% Dip In Price Shows Sentiment Is Matching Revenues

TTEC Holdings, Inc. (NASDAQ:TTEC) shareholders that were waiting for something to happen have been dealt a blow with a 47% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 74% share price decline.

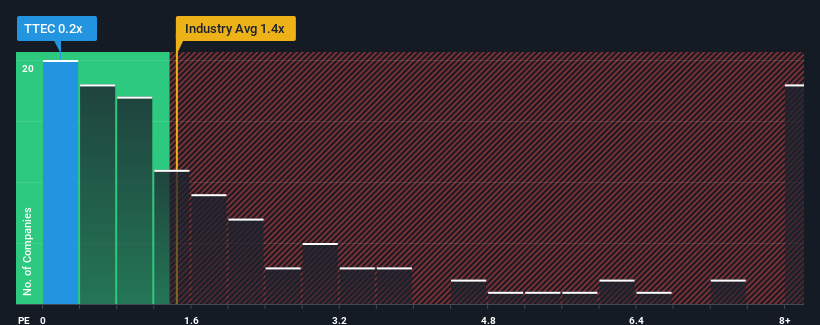

Although its price has dipped substantially, TTEC Holdings may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Professional Services industry in the United States have P/S ratios greater than 1.4x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for TTEC Holdings

How TTEC Holdings Has Been Performing

Recent times haven't been great for TTEC Holdings as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think TTEC Holdings' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

TTEC Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period was better as it's delivered a decent 26% overall rise in revenue. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 0.07% per annum during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 7.2% per year, which is noticeably more attractive.

With this information, we can see why TTEC Holdings is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From TTEC Holdings' P/S?

The southerly movements of TTEC Holdings' shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that TTEC Holdings maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for TTEC Holdings (1 makes us a bit uncomfortable) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if TTEC Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TTEC

TTEC Holdings

Operates as a customer experience (CX) company that designs, builds, and operates technology-enabled customer experiences across digital and live interaction channels.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives