- United States

- /

- Commercial Services

- /

- NasdaqGS:TILE

Will Recent Quarterly Momentum Change Interface's (TILE) Slow-Growth Narrative?

Reviewed by Sasha Jovanovic

- In the past six months, Interface reported strong quarterly results that captured investor interest and drew attention to the company.

- This recent momentum stands in contrast to Interface’s longer-term record of slow revenue expansion and limited improvement in earnings per share.

- We'll explore how this strong quarterly performance shapes Interface's investment story amid earlier questions about sustained growth and efficiency.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Interface Investment Narrative Recap

To be a shareholder of Interface right now, you need to believe that recent operational progress and demand for sustainable products can catalyze a meaningful and lasting business turnaround, despite prior sluggish growth. The company’s stock price surge on a strong quarter could signal improved near-term momentum, yet the biggest catalyst, a shift to profitable volume growth outside its core US market, remains untested, while a key risk is persistent competition and pricing pressure from low-cost rivals. The latest quarterly earnings announcement stands out, with Interface reporting a notable year-on-year jump in both sales and profitability, and raising full-year guidance, offering real evidence of short-term progress. However, investors should watch closely, because despite the recent surge, a potential pitfall remains if Interface cannot maintain pricing power when...

Read the full narrative on Interface (it's free!)

Interface's outlook projects $1.6 billion in revenue and $133.7 million in earnings by 2028. This scenario assumes annual revenue growth of 5.3% and a $37.7 million increase in earnings from the current $96.0 million.

Uncover how Interface's forecasts yield a $32.67 fair value, a 23% upside to its current price.

Exploring Other Perspectives

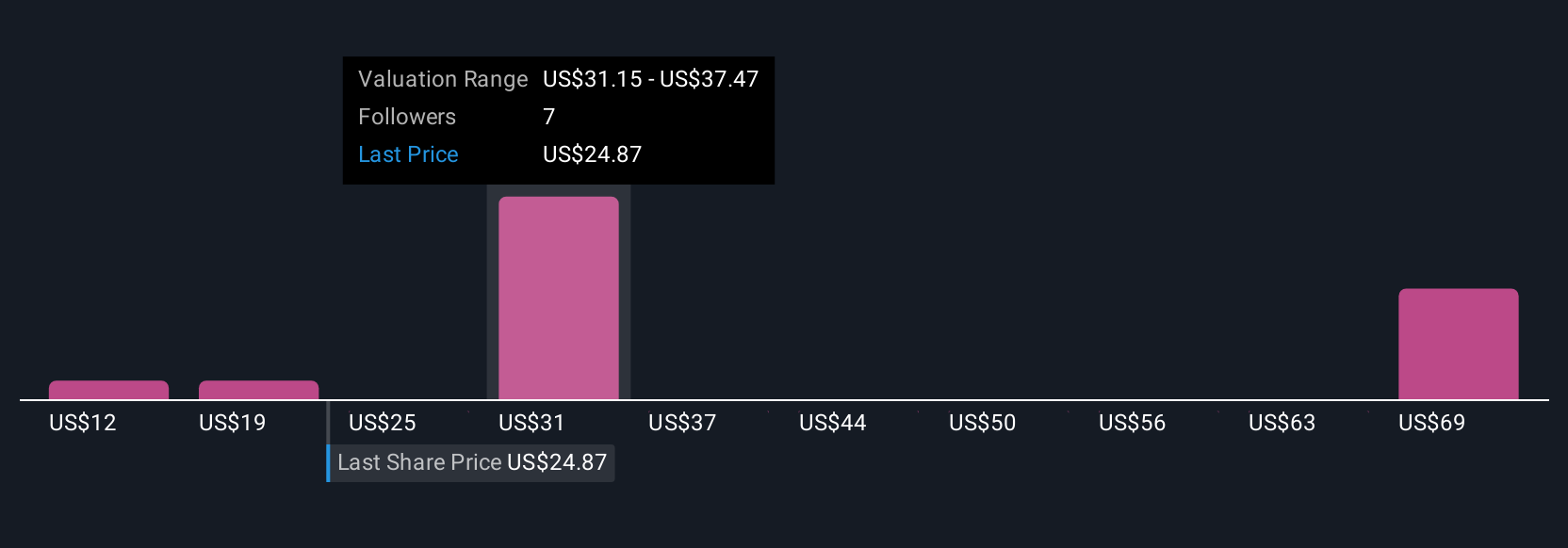

Five fair value estimates from the Simply Wall St Community range widely from US$12.21 to US$75.22 per share. While some see major upside, ongoing competitive threats could still hinder sustained margin expansion, so review multiple viewpoints.

Explore 5 other fair value estimates on Interface - why the stock might be worth less than half the current price!

Build Your Own Interface Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interface research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Interface research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interface's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TILE

Interface

Designs, produces, and sells modular carpet products in the United States, Canada, Latin America, Europe, Africa, Asia, and Australia.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives