- United States

- /

- Insurance

- /

- NYSE:HRTG

US Market's Hidden Gems: 3 Undiscovered Stocks With Potential

Reviewed by Simply Wall St

As the U.S. stock market experiences a notable upswing, with major indexes on track for their best week since June, investors are increasingly turning their attention to potential opportunities within the small-cap sector. Amidst this backdrop of rising indices and economic shifts, identifying stocks with strong fundamentals and growth potential can be key to uncovering hidden gems in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Daily Journal (DJCO)

Simply Wall St Value Rating: ★★★★★★

Overview: Daily Journal Corporation operates by publishing newspapers and websites in California, Arizona, Utah, and Australia, with a market cap of $632.94 million.

Operations: Daily Journal Corporation generates revenue primarily from its Journal Technologies segment, contributing $61.41 million, and its Traditional Business segment, adding $17.75 million. The company has a market cap of approximately $632.94 million.

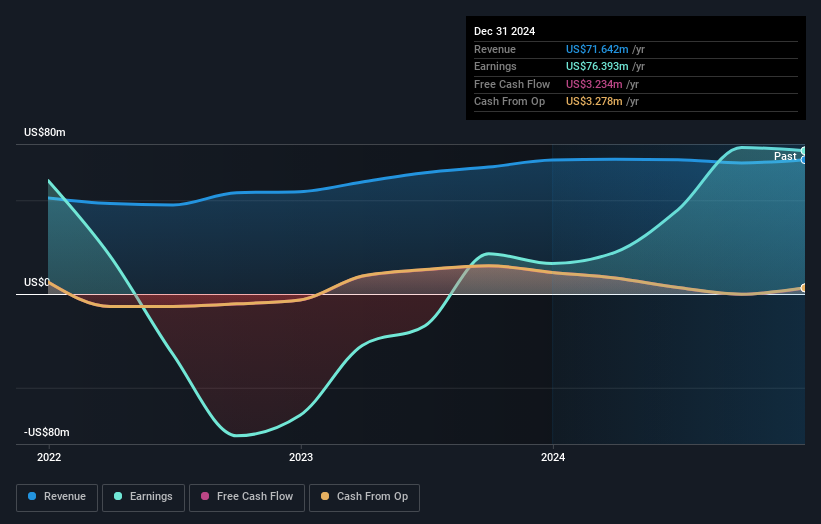

Daily Journal, a smaller player in the software industry, has showcased impressive financial health with earnings growth of 115% over the past year, far outpacing the industry's 19%. The company's debt-to-equity ratio has improved significantly from 29.3 to 7.5 over five years, indicating prudent financial management. Despite a substantial one-off gain of US$118 million impacting recent results, its price-to-earnings ratio at 6.5x suggests it remains undervalued compared to the broader market's 18.7x. With Ms. Tu To set to retire as CFO in early 2026 after decades of service, leadership transitions are on the horizon for Daily Journal.

Interface (TILE)

Simply Wall St Value Rating: ★★★★★★

Overview: Interface, Inc. is a company that designs, produces, and sells modular carpet products across various global regions including the United States, Canada, Latin America, Europe, Africa, Asia, and Australia with a market capitalization of approximately $1.63 billion.

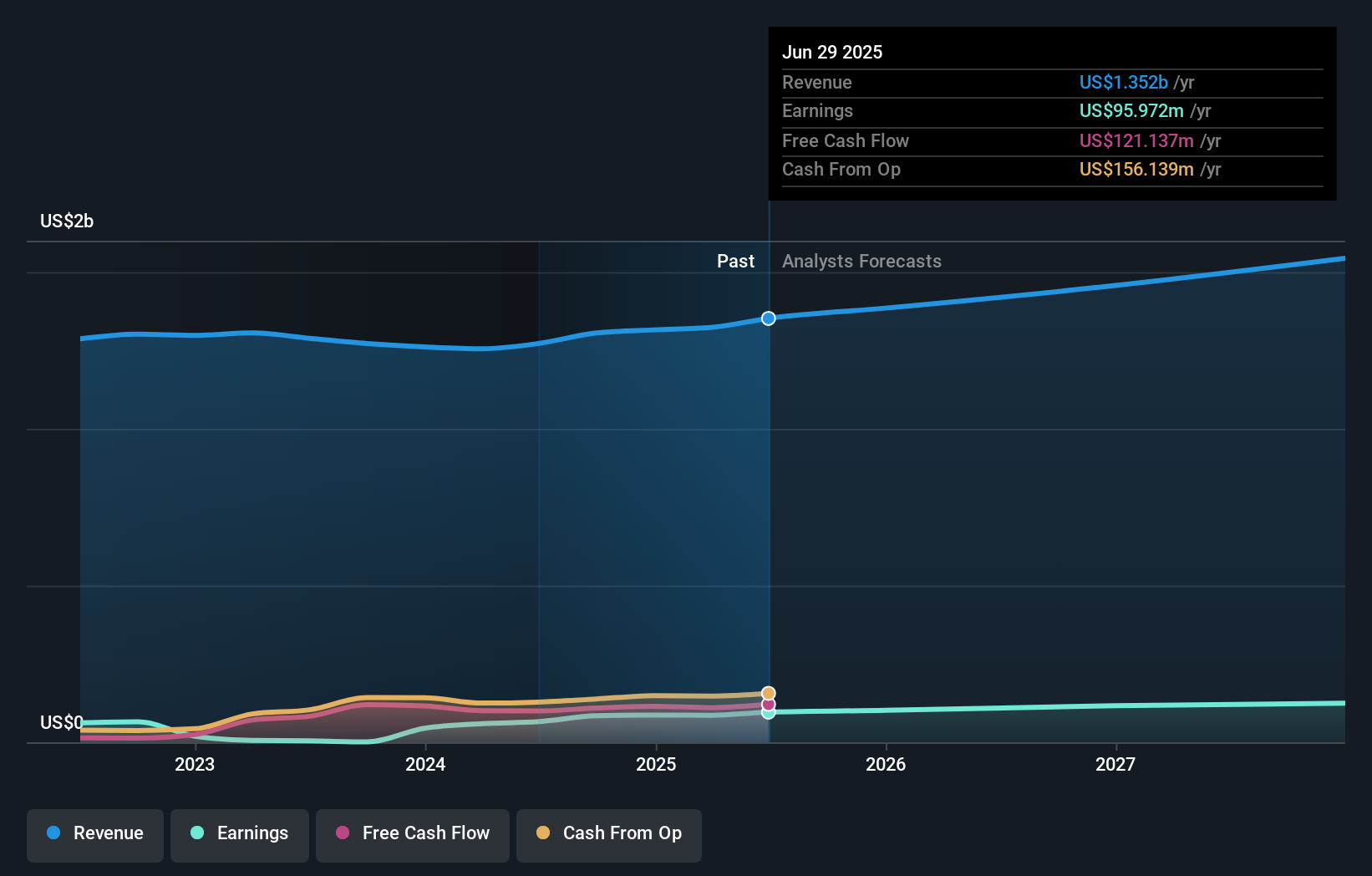

Operations: Interface generates revenue primarily from two segments: Americas, contributing $843.72 million, and Europe, Africa, Asia, and Australia (EAAA), adding $528.75 million.

Interface, a company with strong footing in the commercial flooring industry, is making strides with its eco-friendly product lines and operational efficiencies. Its recent earnings report showed sales of US$364 million for Q3 2025, up from US$344 million the previous year, while net income jumped to US$46 million from US$28 million. Interface's debt management appears robust, as evidenced by its net debt to equity ratio dropping significantly over five years to 49.6%. Despite facing competition and market reliance challenges, Interface's strategic focus on sustainability and innovation positions it well for continued growth in the evolving market landscape.

Heritage Insurance Holdings (HRTG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Heritage Insurance Holdings, Inc. operates through its subsidiaries to offer personal and commercial residential insurance products, with a market cap of $836.29 million.

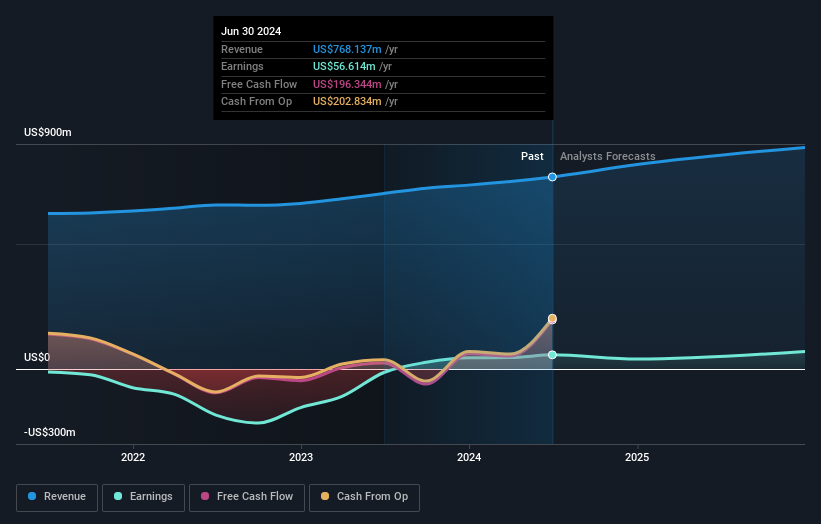

Operations: Heritage generates revenue primarily from residential property insurance, totaling $842.28 million. The company's financial performance is influenced by its cost structure and operational efficiency, with a focus on optimizing profitability metrics such as net profit margin.

Heritage Insurance Holdings, a smaller player in the insurance sector, has demonstrated robust earnings growth of 106.7% over the past year, outpacing the industry's 10.3%. The company is trading at an attractive valuation, sitting 64.7% below its estimated fair value and showing good relative value compared to peers. Heritage's debt-to-equity ratio has improved from 27.7% to 18.1% over five years, indicating prudent financial management. Additionally, with interest payments well-covered by EBIT at a multiple of 24x and positive free cash flow reported recently, Heritage seems financially sound despite potential challenges ahead like regulatory scrutiny and climate-related risks impacting profitability.

Make It Happen

- Delve into our full catalog of 296 US Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heritage Insurance Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HRTG

Heritage Insurance Holdings

Through its subsidiaries, provides personal and commercial residential insurance products.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.