- United States

- /

- Professional Services

- /

- NasdaqGS:TASK

Top Growth Companies With Insider Stake In May 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 2.7%, yet it has risen by 9.1% over the past year, with earnings forecasted to grow annually by 14%. In this context, growth companies with high insider ownership can be particularly appealing as they often indicate confidence from those closest to the business in its potential for future success.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 22.7% | 24.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.2% | 39.1% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| FTC Solar (NasdaqCM:FTCI) | 27.9% | 61.8% |

| AST SpaceMobile (NasdaqGS:ASTS) | 13.4% | 67.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.2% | 44.3% |

| Enovix (NasdaqGS:ENVX) | 12.1% | 58.4% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 102.6% |

| BBB Foods (NYSE:TBBB) | 16.2% | 30.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

Community West Bancshares (NasdaqCM:CWBC)

Simply Wall St Growth Rating: ★★★★☆☆

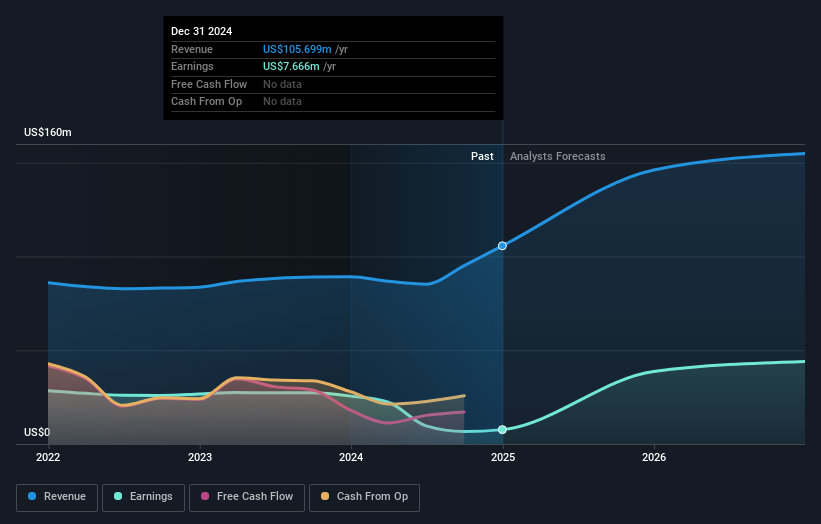

Overview: Community West Bancshares is the bank holding company for Central Valley Community Bank, offering commercial banking services to small and middle-market businesses and individuals in California, with a market cap of $337.00 million.

Operations: The company generates revenue of $120.40 million through its banking operations, providing commercial banking services to small and middle-market businesses and individuals in California.

Insider Ownership: 12.2%

Earnings Growth Forecast: 54% p.a.

Community West Bancshares demonstrates strong growth potential with earnings forecasted to grow significantly at 54% annually, outpacing the US market. Despite a decline in profit margins from last year, revenue is expected to increase by 12.9% per year, surpassing the broader market's growth rate. Insider activity has been positive with substantial buying and no significant selling in recent months. The company recently filed a shelf registration for $8.93 million related to an ESOP offering, indicating strategic financial maneuvers.

- Dive into the specifics of Community West Bancshares here with our thorough growth forecast report.

- The analysis detailed in our Community West Bancshares valuation report hints at an inflated share price compared to its estimated value.

TaskUs (NasdaqGS:TASK)

Simply Wall St Growth Rating: ★★★★☆☆

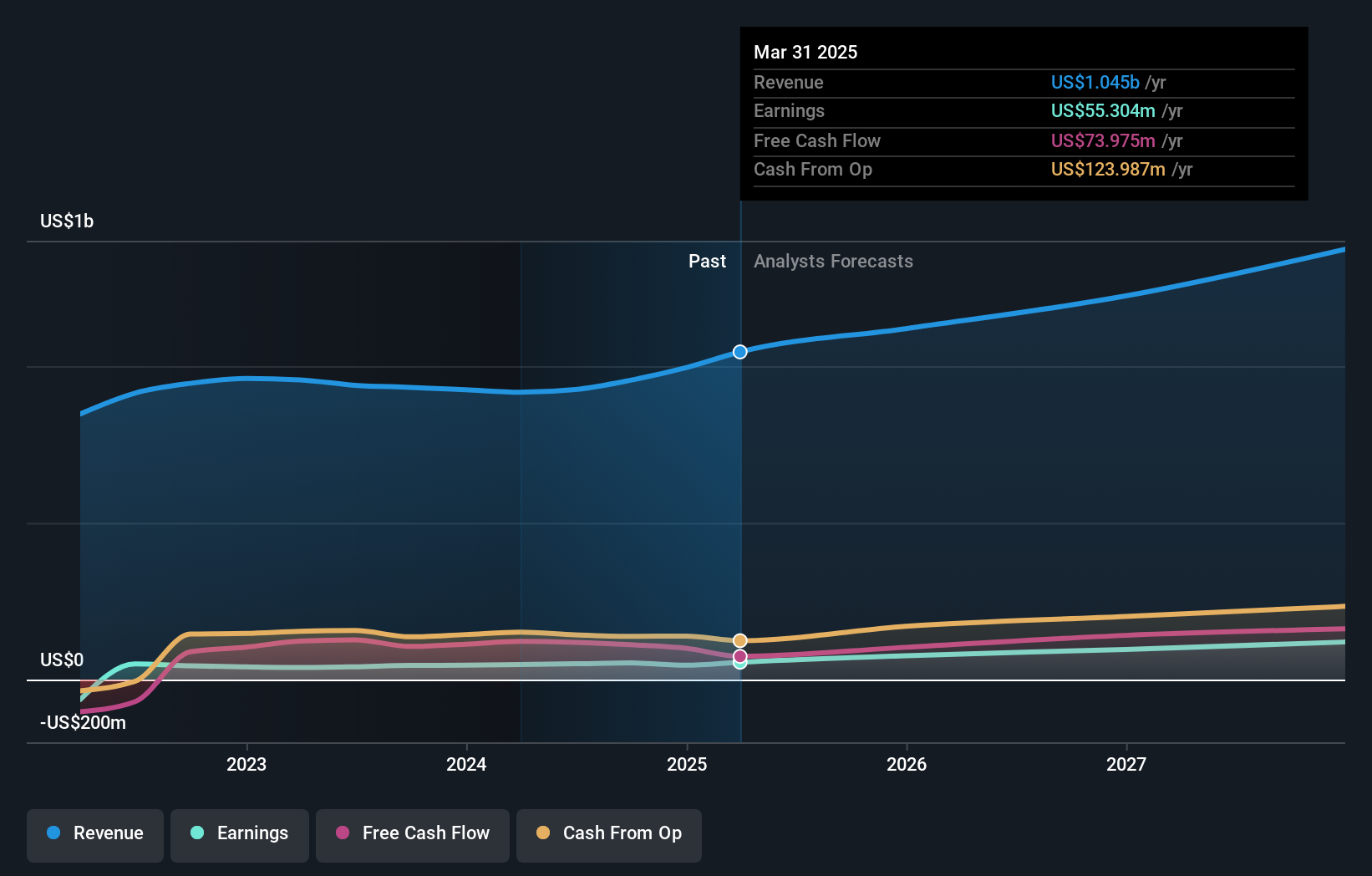

Overview: TaskUs, Inc. offers outsourced digital services to companies across the Philippines, the United States, India, and internationally with a market cap of approximately $1.49 billion.

Operations: The company generates revenue primarily through its Direct Marketing segment, which accounted for $1.05 billion.

Insider Ownership: 28.6%

Earnings Growth Forecast: 26.2% p.a.

TaskUs is experiencing substantial earnings growth, projected at 26.2% annually, outpacing the US market. Recent strategic alliances with Decagon and Regal enhance its AI-driven customer support capabilities. The company is undergoing a buyout by insiders and Blackstone affiliates, consolidating ownership to 100%. Despite trading below fair value estimates, TaskUs's revenue growth of 9.7% lags behind its earnings trajectory but exceeds market averages, reflecting a mixed growth outlook amidst strategic advancements.

- Click to explore a detailed breakdown of our findings in TaskUs' earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of TaskUs shares in the market.

SES AI (NYSE:SES)

Simply Wall St Growth Rating: ★★★★★☆

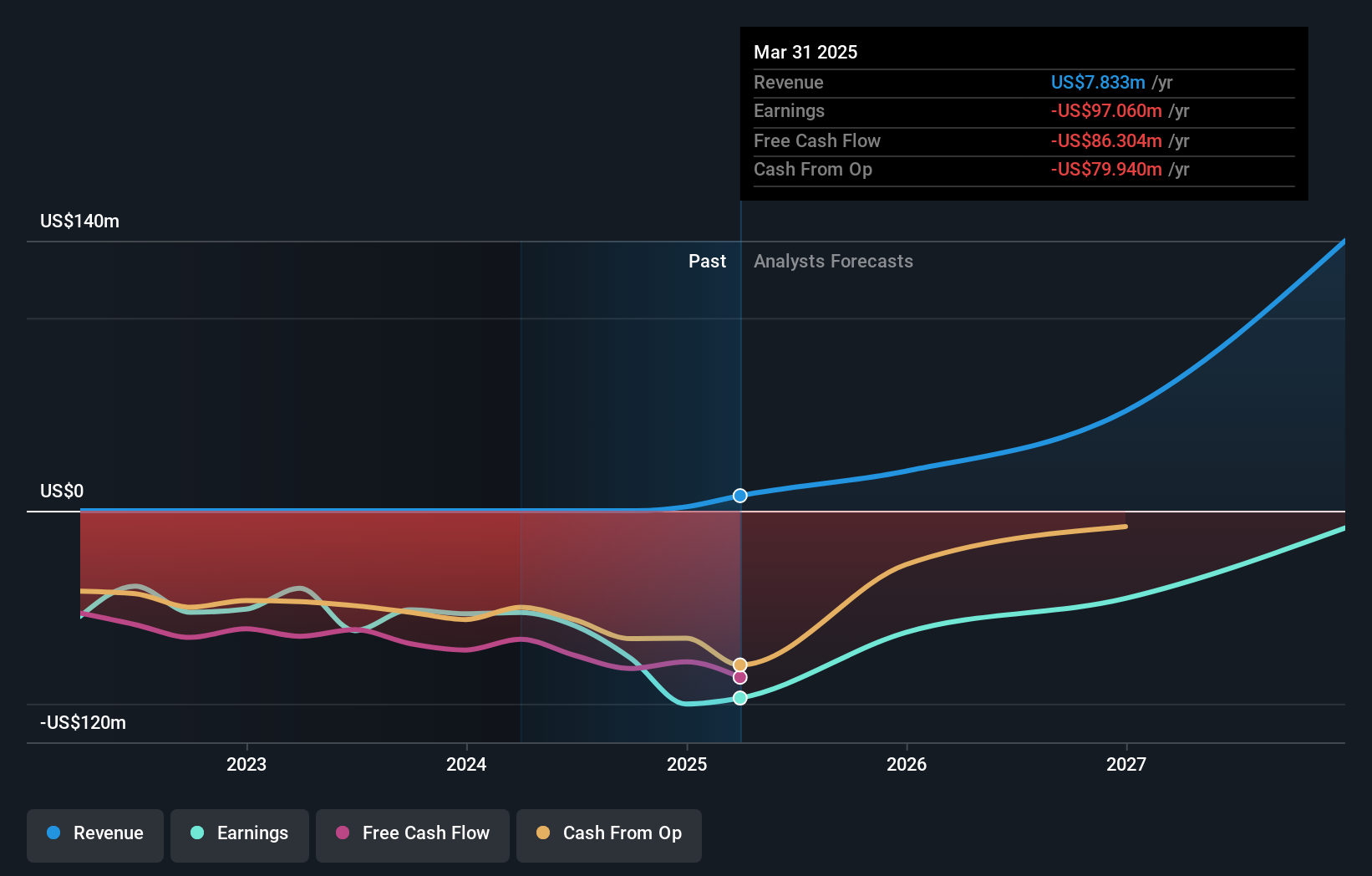

Overview: SES AI Corporation develops and produces AI-enhanced lithium metal and lithium-ion rechargeable battery technologies for various applications, including electric vehicles and drones, with a market cap of approximately $349.06 million.

Operations: SES AI Corporation's revenue segments are currently not specified in the provided text.

Insider Ownership: 12.3%

Earnings Growth Forecast: 64.1% p.a.

SES AI is poised for significant growth, with revenue expected to rise 51% annually, surpassing US market averages. Despite a current net loss of US$12.43 million, the company aims for profitability within three years. Recent developments include the launch of Molecular Universe MU-0, an innovative battery material discovery platform. Additionally, SES announced a US$30 million share repurchase plan to bolster shareholder value amidst compliance challenges with NYSE listing standards due to stock price fluctuations.

- Get an in-depth perspective on SES AI's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility SES AI's shares may be trading at a premium.

Summing It All Up

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 190 more companies for you to explore.Click here to unveil our expertly curated list of 193 Fast Growing US Companies With High Insider Ownership.

- Want To Explore Some Alternatives? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if TaskUs might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TASK

TaskUs

Provides outsourced digital services for companies in Philippines, the United States, India, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives