- United States

- /

- Professional Services

- /

- NasdaqGS:SSNC

Will New Retirement Services Wins and IT Partnerships Shift SS&C Technologies' (SSNC) Growth Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, The Trust Company of Tennessee announced the rollout of over US$18 billion in corporate retirement services on SS&C Technologies' upgraded recordkeeping platform, while Axcelus Financial selected SS&C to modernize its IT operations and migrate infrastructure to SS&C's private cloud.

- These client wins underscore SS&C Technologies' ability to secure partnerships aimed at modernizing core financial services and enhancing digital experiences for institutional clients.

- We'll explore how this expansion of SS&C’s platform services with financial clients influences the company’s investment outlook and growth narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

SS&C Technologies Holdings Investment Narrative Recap

To be a shareholder in SS&C Technologies Holdings, it’s important to believe in the company’s capacity to leverage technology and operational resilience to deepen its reach among institutional financial clients. The recent wins with The Trust Company of Tennessee and Axcelus Financial reinforce SS&C’s execution on client growth, but do not appear to materially alter the biggest short-term catalyst: broadening platform adoption and client integration among wealth management firms. The principal risk remains volatile foreign exchange rates and potential revenue growth constraints tied to macroeconomic factors.

Among the latest announcements, The Trust Company of Tennessee’s rollout of US$18 billion in retirement services on SS&C’s upgraded recordkeeping platform stands out. This event directly aligns with efforts to boost platform scale and digital capabilities, supporting the key catalyst of deepening institutional partnerships and enhancing stickiness through comprehensive digital services.

However, investors should be mindful that while client wins can add resilience, limited visibility on future revenue due to currency risk could still impact...

Read the full narrative on SS&C Technologies Holdings (it's free!)

SS&C Technologies Holdings is projected to reach $7.0 billion in revenue and $1.2 billion in earnings by 2028. This outlook assumes a 4.8% annual revenue growth rate and a $393.6 million increase in earnings from the current $806.4 million.

Uncover how SS&C Technologies Holdings' forecasts yield a $97.89 fair value, a 18% upside to its current price.

Exploring Other Perspectives

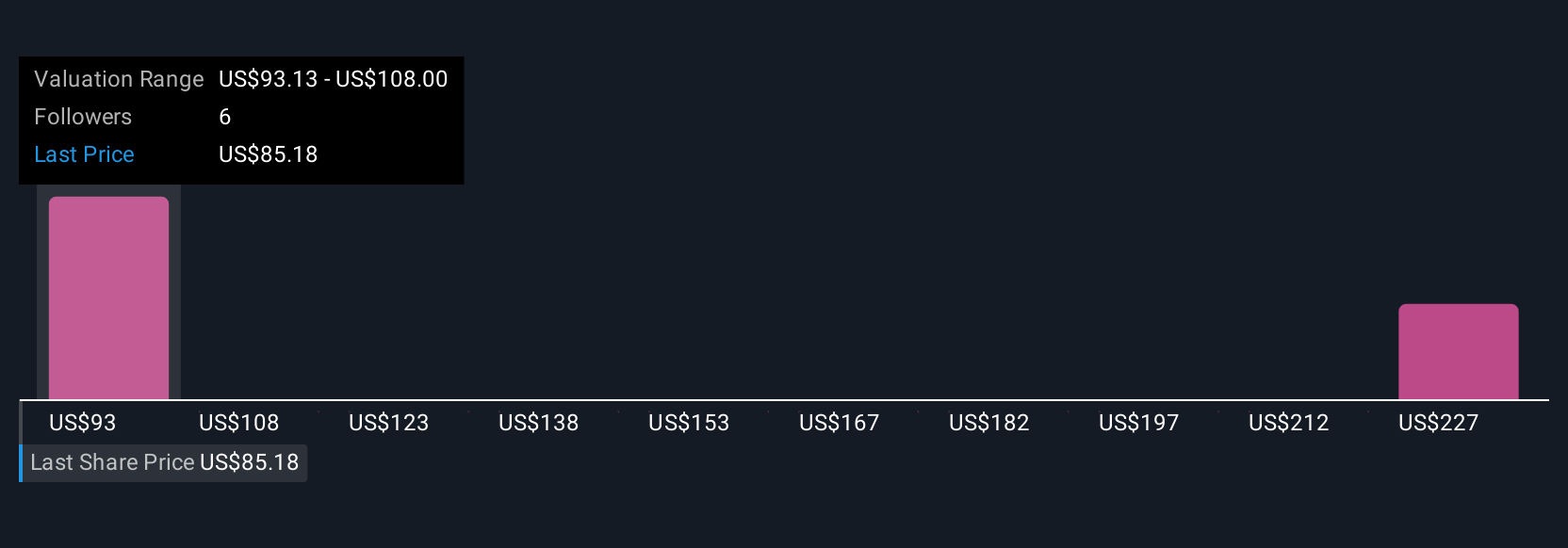

Three members of the Simply Wall St Community valued SS&C Technologies between US$97.04 and US$223.84 per share. As you weigh these wide-ranging views, remember that ongoing currency fluctuations continue to present a meaningful risk to expected revenue growth.

Explore 3 other fair value estimates on SS&C Technologies Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own SS&C Technologies Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SS&C Technologies Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SS&C Technologies Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SS&C Technologies Holdings' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SSNC

SS&C Technologies Holdings

Provides software products and software-enabled services to financial services and healthcare industries.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026