- United States

- /

- Professional Services

- /

- NasdaqGS:SSNC

SS&C Technologies Holdings (NasdaqGS:SSNC) Extends GBP 9 Billion Agreement With Dimensional Fund Advisors

Reviewed by Simply Wall St

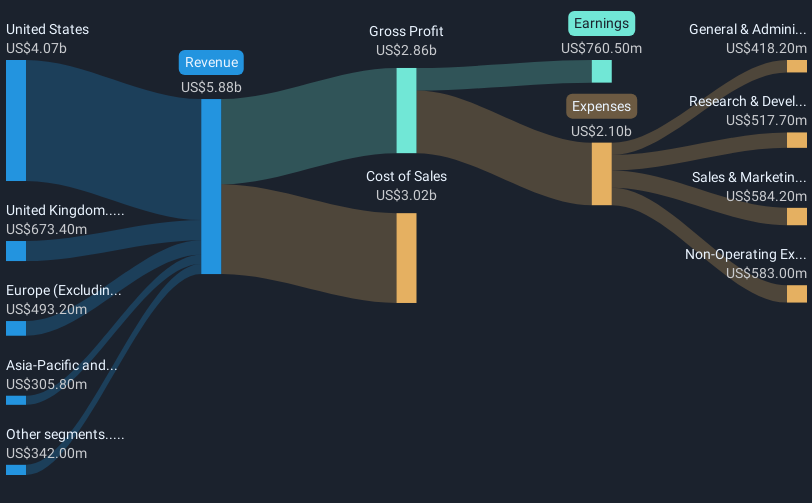

SS&C Technologies Holdings (NasdaqGS:SSNC) has recently extended its transfer agency agreement with Dimensional Fund Advisors, enhancing its market presence in the U.K. This announcement, amidst the backdrop of broader market Jitters due to tariff concerns and a tech sell-off, was accompanied by a 14% increase in SS&C's share price over the last quarter. While the tech-heavy Nasdaq Composite suffered, SS&C navigated through these headwinds by affirming its dividend policy and reporting solid year-over-year growth in revenue and net income. The consistent quarterly dividend and robust earnings report reinforced investor confidence in the company. Additionally, the company's client base expanded with partnerships with LPL Financial and PensionBee, showcasing its resilience in a challenging market landscape. While most technology stocks faced pressure, SS&C's strategic partnerships and stable earnings likely provided stability, helping the company outpace market declines despite the overall sector's volatility.

Unlock comprehensive insights into our analysis of SS&C Technologies Holdings stock here.

Over the past five years, SS&C Technologies Holdings has achieved a total return of 100.75%. This outperformance highlights the company's strong foothold in the market despite broader challenges. Recent collaborations with industry players like LPL Financial and Constellation Insurance underscore SS&C's adaptability and expanded service offerings, contributing to its growth trajectory. Additionally, the launch of AI-enabled SS&C Accord for wealth managers in October 2024 has positioned the company at the forefront of technological innovation.

The company's earnings have consistently improved, reflected in a notable year-over-year increase as reported in February 2025. SS&C's share buyback initiated in mid-2023, where 8.6 million shares were repurchased, likely further supported its share value. These financial maneuvers, alongside quarterly dividend enhancements, have helped SS&C navigate financial headwinds effectively and maintain investor confidence over the longer term. Furthermore, SS&C's client-focused expansion strategies have reinforced its competitive positioning relative to both the broader market and its sector.

- See whether SS&C Technologies Holdings' current market price aligns with its intrinsic value in our detailed report

- Explore the potential challenges for SS&C Technologies Holdings in our thorough risk analysis report.

- Is SS&C Technologies Holdings part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SSNC

SS&C Technologies Holdings

Provides software products and software-enabled services to financial services and healthcare industries.

Solid track record average dividend payer.