- United States

- /

- Professional Services

- /

- NasdaqGS:SAIC

How Investors Are Reacting To SAIC's $7.9 Million Army Drone Contract with Skydio

Reviewed by Sasha Jovanovic

- On September 30, 2025, Skydio, in partnership with Science Applications International Corp. (SAIC), announced the award of a US$7.9 million contract to deliver X10D small unmanned aircraft systems under the U.S. Army's Short Range Reconnaissance Tranche 2 Low-Rate Initial Production contract.

- This latest contract highlights SAIC's involvement in advanced defense technology projects supporting Army modernization and signals continued federal demand for tactical reconnaissance capabilities.

- We'll examine how SAIC’s expanded work in drone technology reinforces its positioning in government defense modernization initiatives.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Science Applications International Investment Narrative Recap

To own shares in Science Applications International (SAIC), investors generally need to believe that federal demand for advanced defense technologies and digital transformation, in areas like Army modernization and secure unmanned systems, can offset budget headwinds and industry competition. The recent US$7.9 million Army drone contract highlights progress on these catalysts, but current developments around credit facilities and recent earnings guidance reduction do not material materially affect the major short-term catalyst: the normalization of government procurement and funding cycles. Meanwhile, execution risk tied to dependency on key government programs and contract timing remains the biggest risk for the business right now.

Among recent announcements, SAIC’s new $1.1 billion term loan and $1 billion revolving credit facilities, both maturing in 2030, stand out for their direct impact on financial flexibility. While these facilities offer balance sheet stability, supporting SAIC’s ability to weather delays in federal contract awards, they reinforce how ongoing revenue softness, driven by funding slowdowns and intense competition, remains an ongoing concern for investors focused on near-term catalysts.

However, investors should be aware that funding delays and procurement headwinds continue to...

Read the full narrative on Science Applications International (it's free!)

Science Applications International is projected to generate $7.7 billion in revenue and $344.8 million in earnings by 2028. This forecast is based on analysts assuming a 1.0% annual revenue growth rate and a decrease in earnings of $54.2 million from the current $399.0 million.

Uncover how Science Applications International's forecasts yield a $116.00 fair value, a 19% upside to its current price.

Exploring Other Perspectives

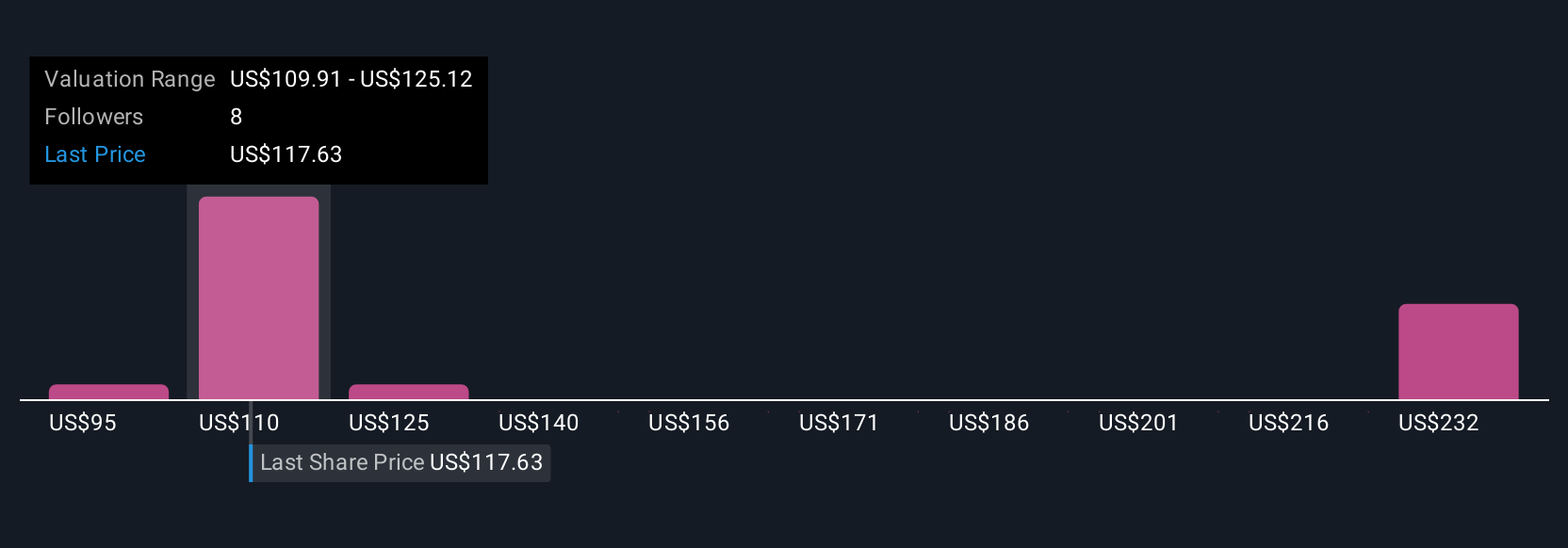

Four members of the Simply Wall St Community estimate SAIC’s fair value between US$94.71 and US$213.51 per share. These diverse views reflect the persistent challenge of budget uncertainty, which can affect future revenue and opportunity timing for the company.

Explore 4 other fair value estimates on Science Applications International - why the stock might be worth over 2x more than the current price!

Build Your Own Science Applications International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Science Applications International research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Science Applications International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Science Applications International's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SAIC

Science Applications International

Provides technical, engineering, and enterprise information technology (IT) services in the United States.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives