- United States

- /

- Professional Services

- /

- NasdaqGS:PCTY

Paylocity (PCTY): Assessing Valuation After a Modest Share Price Rebound

Reviewed by Simply Wall St

Paylocity Holding (PCTY) has quietly inched higher over the past week even as its longer term returns remain negative, a setup that invites a closer look at whether the recent strength is sustainable.

See our latest analysis for Paylocity Holding.

That recent 1 week share price return of 2.98 percent only slightly chips away at Paylocity Holding's year to date share price decline. The 1 year total shareholder return of negative 24.62 percent shows longer term momentum is still under pressure despite steady revenue and profit growth.

If you are weighing whether Paylocity's recent bounce fits your strategy, it can help to compare it with other fast moving opportunities via high growth tech and AI stocks.

With shares still down sharply over 12 months yet trading at a meaningful discount to analyst targets, the key question now is whether Paylocity is genuinely undervalued or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 22.3% Undervalued

With Paylocity Holding last closing at $150.89 versus a narrative fair value near $194, the current gap hinges on specific long term growth and margin assumptions.

Strong client retention (92%+) and accelerating cross sell of new modules (including Paylocity for Finance) are yielding steady margin expansion and improved operating leverage, evidenced by rising adjusted EBITDA margins and free cash flow, which could lead to higher net margins in the future.

Curious how steady, mid teens earnings growth, disciplined margin expansion, and a richer future earnings multiple can all coexist in one story? See what powers this valuation roadmap and where the narrative thinks Paylocity’s earnings base will land a few years from now.

Result: Fair Value of $194.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing revenue guidance and tougher competition from larger HCM peers could challenge Paylocity's growth narrative and compress the premium embedded in its valuation.

Find out about the key risks to this Paylocity Holding narrative.

Another Lens on Valuation

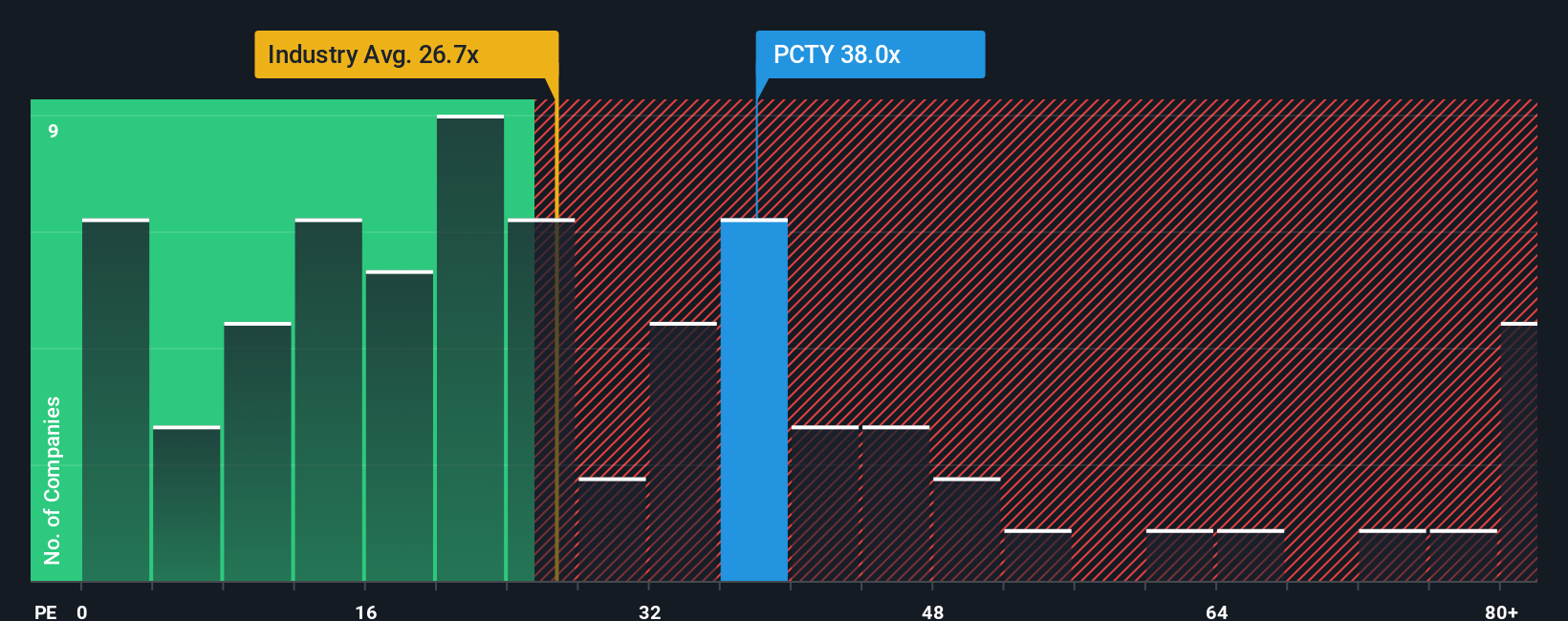

While the narrative suggests Paylocity is around 22 percent undervalued, its 36.4 times earnings multiple paints a tougher picture. That is rich versus both the US Professional Services industry at 25 times and peers at 18 times, and even sits well above a 27 times fair ratio, implying real downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Paylocity Holding Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can build a personalized view in just minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Paylocity Holding.

Ready for your next investment move?

Do not stop at a single stock when you can quickly scan smarter opportunities, compare strengths, and position your portfolio ahead of the next wave of market leaders.

- Capitalize on mispriced quality by reviewing these 908 undervalued stocks based on cash flows that may offer attractive upside relative to their long term cash flow potential.

- Harness the momentum of innovation by targeting these 26 AI penny stocks that are positioned to benefit from accelerating adoption of artificial intelligence across industries.

- Lock in potential income streams by focusing on these 13 dividend stocks with yields > 3% that can strengthen your returns through consistent cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCTY

Paylocity Holding

Provides cloud-based human capital management, payroll software, and spend management solutions for the workforce in the United States.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)