- United States

- /

- Commercial Services

- /

- NasdaqCM:LNZA

LanzaTech Global, Inc. (NASDAQ:LNZA) Stocks Pounded By 29% But Not Lagging Industry On Growth Or Pricing

The LanzaTech Global, Inc. (NASDAQ:LNZA) share price has fared very poorly over the last month, falling by a substantial 29%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 16% in that time.

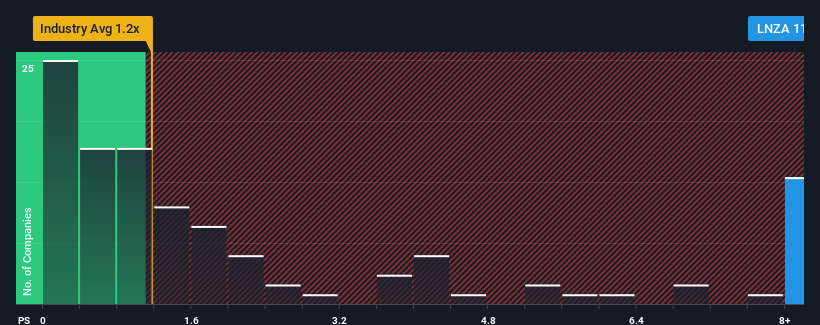

Even after such a large drop in price, given around half the companies in the United States' Commercial Services industry have price-to-sales ratios (or "P/S") below 1.2x, you may still consider LanzaTech Global as a stock to avoid entirely with its 11.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for LanzaTech Global

How Has LanzaTech Global Performed Recently?

With revenue growth that's superior to most other companies of late, LanzaTech Global has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on LanzaTech Global.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, LanzaTech Global would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 63% gain to the company's top line. The latest three year period has also seen an excellent 193% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 97% per year as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 17% each year growth forecast for the broader industry.

In light of this, it's understandable that LanzaTech Global's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From LanzaTech Global's P/S?

A significant share price dive has done very little to deflate LanzaTech Global's very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of LanzaTech Global's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for LanzaTech Global with six simple checks on some of these key factors.

If you're unsure about the strength of LanzaTech Global's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LNZA

LanzaTech Global

Operates as a nature-based carbon refining company in the United States and internationally.

Low with limited growth.