- United States

- /

- Professional Services

- /

- NasdaqGM:INOD

Innodata Inc. (NASDAQ:INOD) Looks Just Right With A 60% Price Jump

Innodata Inc. (NASDAQ:INOD) shares have had a really impressive month, gaining 60% after a shaky period beforehand. The annual gain comes to 100% following the latest surge, making investors sit up and take notice.

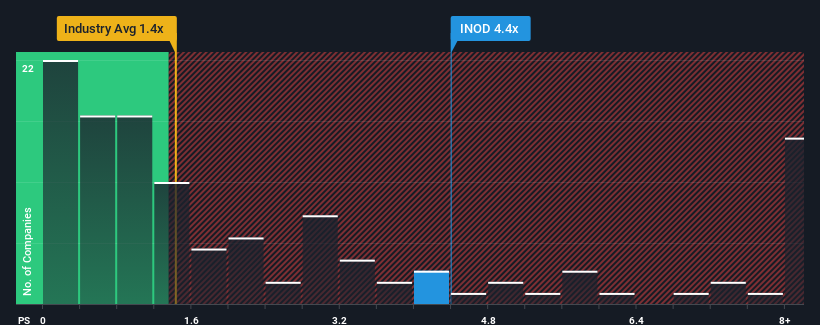

Since its price has surged higher, given around half the companies in the United States' Professional Services industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Innodata as a stock to avoid entirely with its 4.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Innodata

How Innodata Has Been Performing

It looks like revenue growth has deserted Innodata recently, which is not something to boast about. Perhaps the market believes that revenue growth will improve markedly over current levels, inflating the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Innodata's earnings, revenue and cash flow.How Is Innodata's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Innodata's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 39% overall rise in revenue, in spite of its uninspiring short-term performance. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

When compared to the industry's one-year growth forecast of 6.7%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why Innodata's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Innodata's P/S

Innodata's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Innodata maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Innodata (at least 1 which is a bit unpleasant), and understanding them should be part of your investment process.

If you're unsure about the strength of Innodata's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Innodata, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:INOD

Innodata

Operates as a data engineering company in the United States, the United Kingdom, the Netherlands, Canada, and internationally.

Flawless balance sheet with proven track record.