- United States

- /

- Professional Services

- /

- NasdaqGS:ICFI

Here's Why We Think ICF International (NASDAQ:ICFI) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like ICF International (NASDAQ:ICFI). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for ICF International

ICF International's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. ICF International managed to grow EPS by 15% per year, over three years. That's a good rate of growth, if it can be sustained.

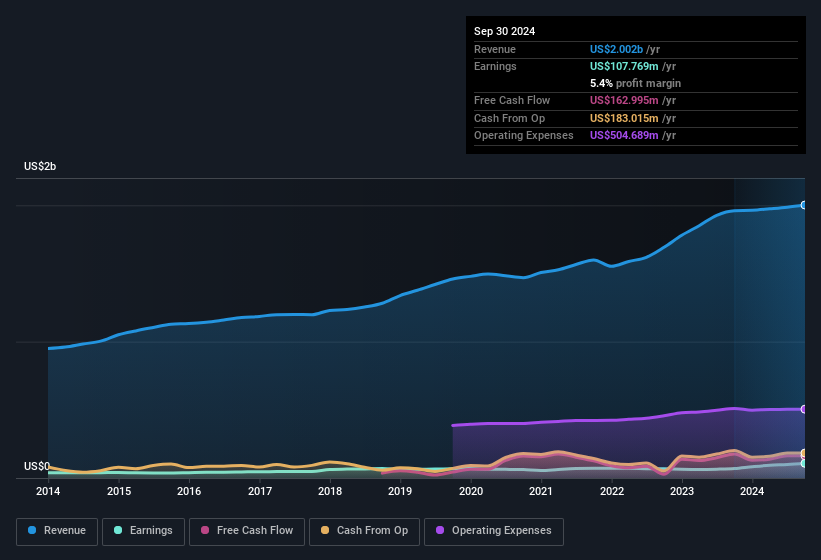

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that ICF International is growing revenues, and EBIT margins improved by 2.2 percentage points to 8.7%, over the last year. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for ICF International?

Are ICF International Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

ICF International top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the Independent Director, Scott Salmirs, paid US$55k to buy shares at an average price of US$138. It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

Along with the insider buying, another encouraging sign for ICF International is that insiders, as a group, have a considerable shareholding. As a matter of fact, their holding is valued at US$35m. That's a lot of money, and no small incentive to work hard. Despite being just 1.3% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because ICF International's CEO, John Wasson, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to ICF International, with market caps between US$2.0b and US$6.4b, is around US$6.6m.

The ICF International CEO received US$5.7m in compensation for the year ending December 2023. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add ICF International To Your Watchlist?

As previously touched on, ICF International is a growing business, which is encouraging. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for your watchlist - and arguably a research priority. It is worth noting though that we have found 1 warning sign for ICF International that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of ICF International, you'll probably love this curated collection of companies in the US that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ICFI

ICF International

Provides management, technology, and policy consulting and implementation services to government and commercial clients in the United States and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives