- United States

- /

- Professional Services

- /

- NasdaqGS:FA

Is Now The Time To Put First Advantage (NASDAQ:FA) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like First Advantage (NASDAQ:FA). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide First Advantage with the means to add long-term value to shareholders.

View our latest analysis for First Advantage

First Advantage's Improving Profits

In the last three years First Advantage's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. First Advantage has grown its trailing twelve month EPS from US$0.33 to US$0.37, in the last year. That's a modest gain of 10.0%.

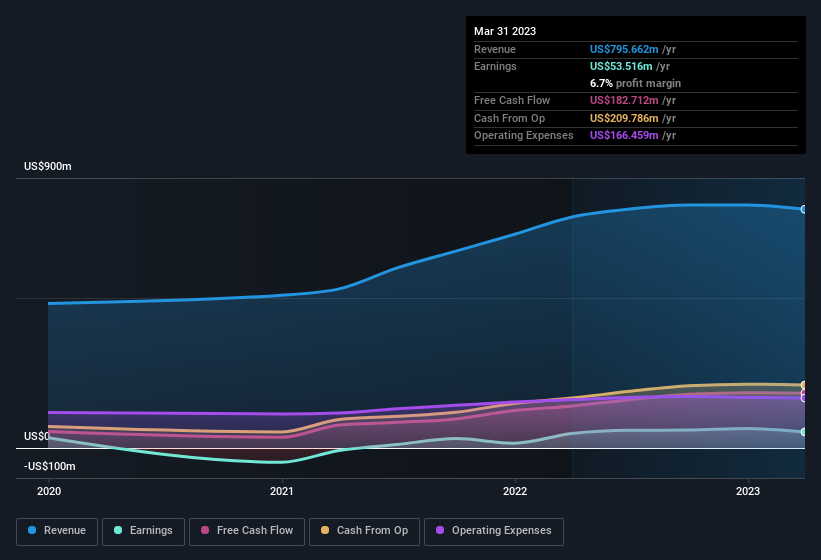

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for First Advantage remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 3.3% to US$796m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of First Advantage's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are First Advantage Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that First Advantage insiders have a significant amount of capital invested in the stock. Given insiders own a significant chunk of shares, currently valued at US$82m, they have plenty of motivation to push the business to succeed. This would indicate that the goals of shareholders and management are one and the same.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. For companies with market capitalisations between US$1.0b and US$3.2b, like First Advantage, the median CEO pay is around US$5.1m.

The First Advantage CEO received total compensation of just US$758k in the year to December 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does First Advantage Deserve A Spot On Your Watchlist?

One important encouraging feature of First Advantage is that it is growing profits. The fact that EPS is growing is a genuine positive for First Advantage, but the pleasant picture gets better than that. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. Now, you could try to make up your mind on First Advantage by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Although First Advantage certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FA

First Advantage

Provides employment background screening, identity, and verification solutions worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.