- United States

- /

- Professional Services

- /

- NasdaqGS:EXPO

Where Does Exponent Stand After a 41% Slide and Steady 2025 Declines?

Reviewed by Bailey Pemberton

Thinking about whether Exponent is a buy, sell, or hold right now? You’re not alone, especially with so much chatter in the market about where expert consulting firms like this one fit into the bigger investing picture. Let’s take a quick look at the numbers: over the past year, Exponent’s stock has dropped over 41%, and it has slid steadily this year as well. In the past week alone, shares moved down 2.7%, and for the past month, the decline was 6.8%. Even zooming out to three and five years, the performance has been lackluster, down 22.9% and 7.1%, respectively. There haven’t been any blockbuster headlines to blame, but the broader market has grown wary of legacy consulting names, seeing both old strengths and new risks in today’s environment.

With Exponent closing most recently at $65.27, investors may wonder if all of that pain has created any real value opportunities. According to our framework, Exponent is undervalued on exactly zero out of six valuation tests, which gives it a value score of 0. Not exactly the score bargain hunters hope to see. But how do we get to that number, and more importantly, is there something those methods might miss? Let’s walk through the ways Exponent’s worth is being measured, and I’ll share a smarter twist on valuation at the end.

Exponent scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Exponent Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and then discounting them back to their present value. This approach turns future expectations into a figure you can use right now when evaluating a stock.

For Exponent, the current Free Cash Flow stands at approximately $117.8 million. Over the next decade, projections indicate that Free Cash Flow is expected to decline initially from $105.0 million in 2026 to $98.0 million in 2027. It is then expected to gradually stabilize and grow slightly to around $101.0 million by 2035. Most estimates cover about five years into the future, and further numbers are extrapolated using Simply Wall St’s methodology, reflecting cautious optimism amid near-term headwinds.

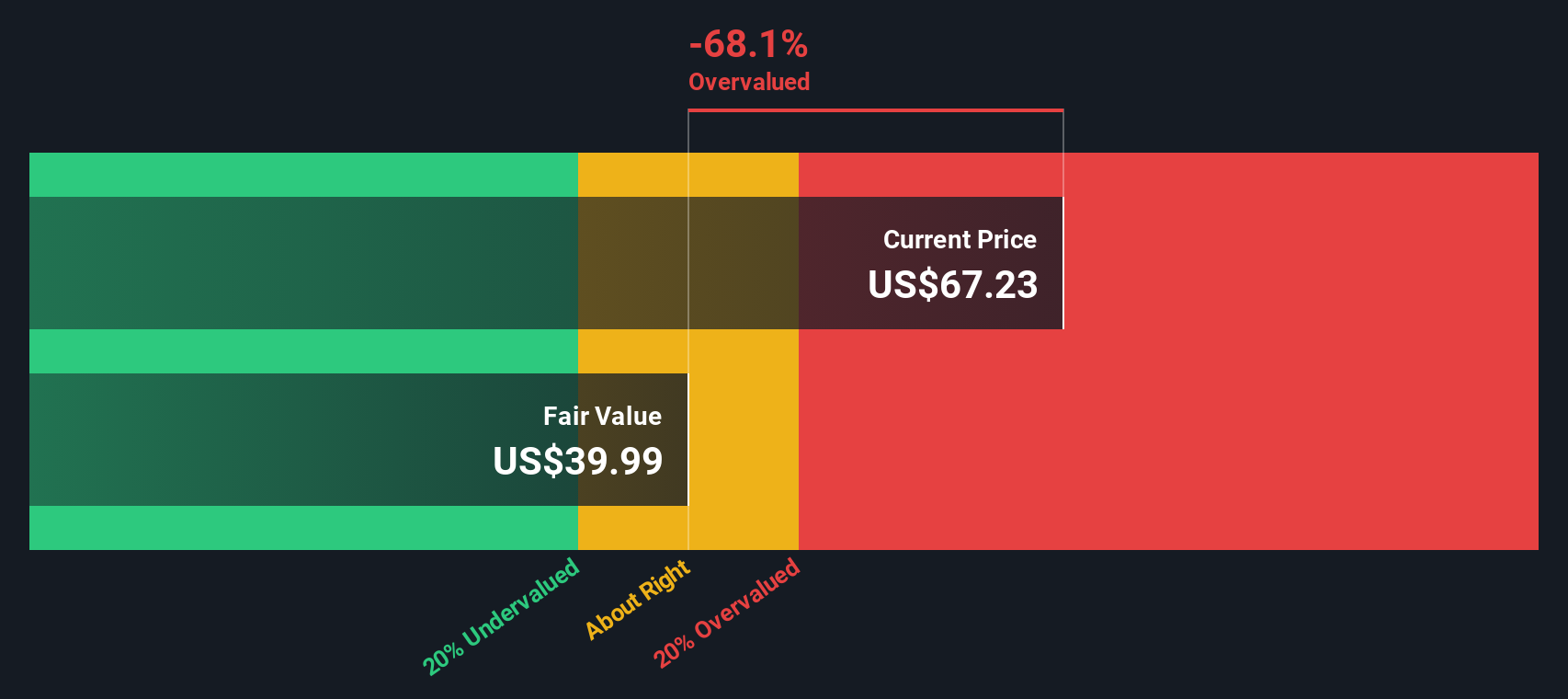

The result of this DCF analysis estimates Exponent’s fair value at $39.95 per share. With Exponent’s current share price at $65.27, this suggests the stock is about 63.4% overvalued based on these cash flow projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Exponent may be overvalued by 63.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Exponent Price vs Earnings

The price-to-earnings (PE) ratio is widely regarded as a reliable metric for valuing consistently profitable companies such as Exponent. It reflects how much investors are willing to pay for each dollar of earnings, making it particularly relevant for established businesses with steady cash flows.

However, no PE ratio exists in isolation. Companies expected to grow rapidly, or those with unique competitive advantages and lower risks, typically command higher "normal" PE ratios. On the other hand, riskier or slower-growing companies generally justify a lower PE.

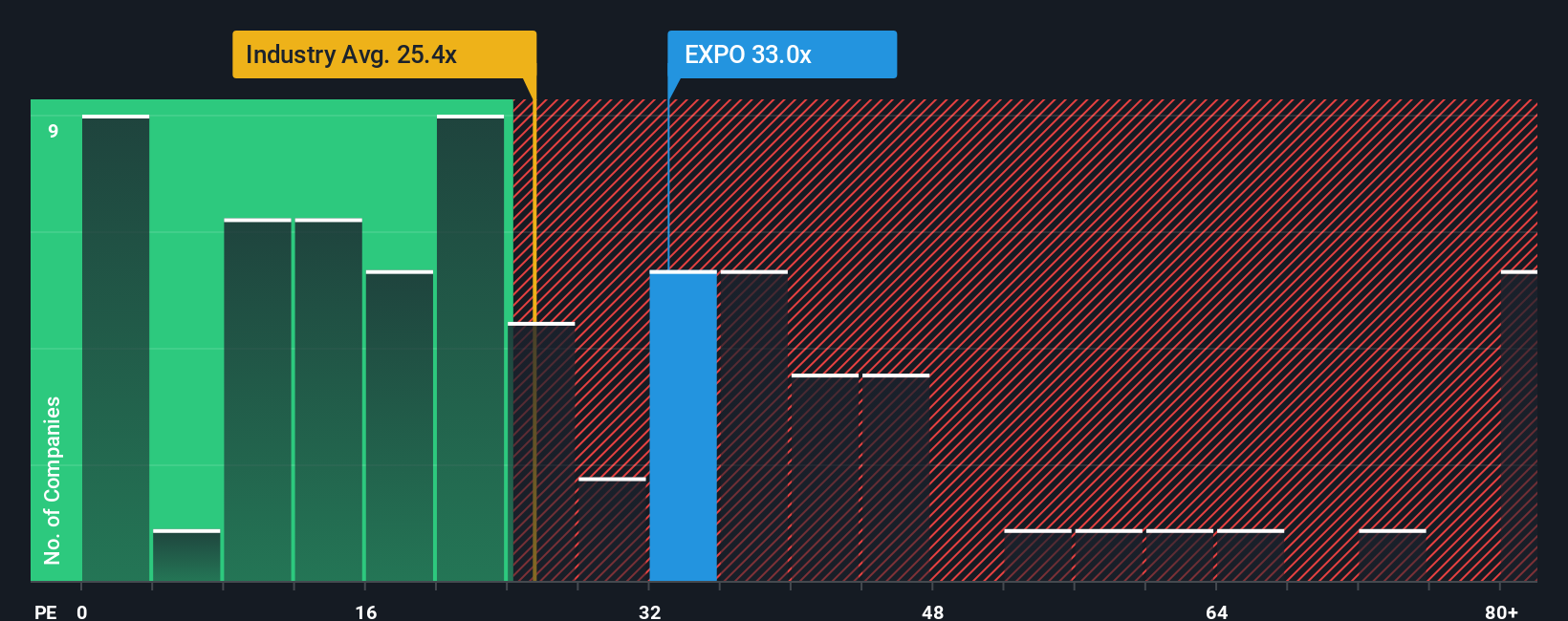

Exponent’s current PE ratio stands at 32x, which is noticeably above both the Professional Services industry average of 25.42x and the peer group average of 17.90x. At first glance, this premium might raise eyebrows, especially in a sector where profit margins and risk profiles can vary significantly.

This is where Simply Wall St's proprietary Fair Ratio becomes invaluable. The Fair Ratio for Exponent is calculated at 21.62x and is designed to account for factors such as earnings growth, industry dynamics, profit margins, market capitalization and company-specific risks. This approach gives a more comprehensive valuation assessment than simply benchmarking against peer or industry averages, as it tailors the "fair" multiple to Exponent’s unique profile.

With the stock trading at a 32x PE while its Fair Ratio sits at 21.62x, Exponent appears to be valued well above what would be expected based on its fundamentals and risk factors.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Exponent Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Instead of just sizing up numbers in isolation, Narratives let you express your investment perspective as a story grounded in your own assumptions about a company’s future, such as what you think is a fair value, how revenue, earnings, and margins will trend, and which risks or opportunities matter most.

Each Narrative links Exponent’s business story with your financial forecast, connecting what you believe about its future to a share price you think is fair. This tool is available right now in the Community page on Simply Wall St’s platform, used by millions of investors. By comparing your Fair Value to the current Price, Narratives help you decide whether Exponent looks like a Buy, Sell, or Hold based on your convictions, not just the consensus.

Best of all, Narratives are dynamic. Whenever new news or earnings data arrives, your forecasts and fair value will update automatically. For example, some investors see Exponent’s fair value as high as $100 if you believe rapid revenue growth will persist, while others argue it should be closer to $76 if you are more cautious about risks. With Narratives, you can decide which story and value makes the most sense for you.

Do you think there's more to the story for Exponent? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Exponent might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXPO

Exponent

Operates as a science and engineering consulting company in the United States and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)