- United States

- /

- Professional Services

- /

- NasdaqCM:DLHC

The Price Is Right For DLH Holdings Corp. (NASDAQ:DLHC)

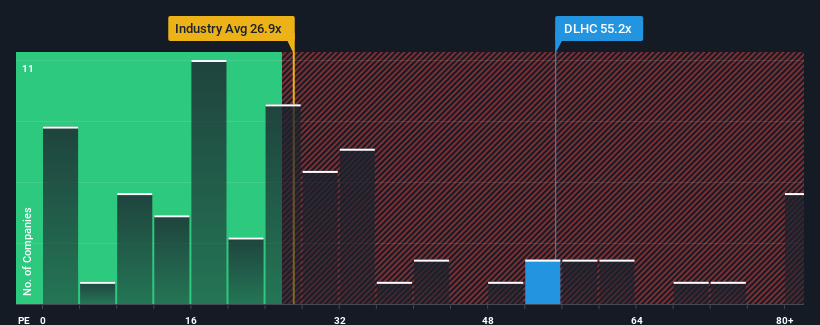

DLH Holdings Corp.'s (NASDAQ:DLHC) price-to-earnings (or "P/E") ratio of 55.2x might make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 18x and even P/E's below 10x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

DLH Holdings has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for DLH Holdings

Does Growth Match The High P/E?

In order to justify its P/E ratio, DLH Holdings would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 73% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 66% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 237% over the next year. That's shaping up to be materially higher than the 12% growth forecast for the broader market.

In light of this, it's understandable that DLH Holdings' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that DLH Holdings maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 4 warning signs we've spotted with DLH Holdings (including 1 which is potentially serious).

Of course, you might also be able to find a better stock than DLH Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DLHC

DLH Holdings

Provides technology-enabled business process outsourcing, program management solutions, and public health research and analytics services in the United States.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives