- United States

- /

- Professional Services

- /

- NasdaqCM:DLHC

Here's Why We Think DLH Holdings (NASDAQ:DLHC) Is Well Worth Watching

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like DLH Holdings (NASDAQ:DLHC), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for DLH Holdings

DLH Holdings's Improving Profits

In the last three years DLH Holdings's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a wedge-tailed eagle on the wind, DLH Holdings's EPS soared from US$0.43 to US$0.60, in just one year. That's a impressive gain of 38%.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. DLH Holdings maintained stable EBIT margins over the last year, all while growing revenue 20% to US$215m. That's a real positive.

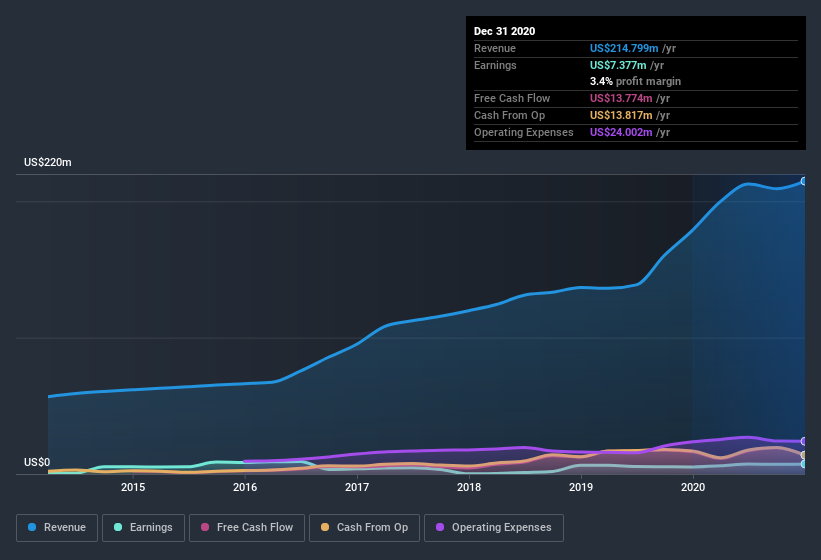

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for DLH Holdings's future profits.

Are DLH Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Over the last 12 months DLH Holdings insiders spent US$72k more buying shares than they received from selling them. On balance, that's a good sign. We also note that it was the President, Zachary Parker, who made the biggest single acquisition, paying US$95k for shares at about US$10.38 each.

Along with the insider buying, another encouraging sign for DLH Holdings is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$20m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 15% of the company; visible skin in the game.

Does DLH Holdings Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about DLH Holdings's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So it's fair to say I think this stock may well deserve a spot on your watchlist. Even so, be aware that DLH Holdings is showing 1 warning sign in our investment analysis , you should know about...

The good news is that DLH Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade DLH Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:DLHC

DLH Holdings

Provides technology-enabled business process outsourcing, program management solutions, and public health research and analytics services in the United States.

Proven track record slight.

Similar Companies

Market Insights

Community Narratives