- United States

- /

- Commercial Services

- /

- NasdaqGS:CTAS

Should You Rethink Cintas After This Month’s 7% Slide?

Reviewed by Bailey Pemberton

If you’re looking at Cintas and wondering whether to make a move, you’re definitely not alone. Investors are debating if the recent swings in the stock’s price are signals to jump in or warnings to hold back. Over the past week, Cintas dropped by 5.5%, building on a 7.0% slide for the month. However, if you widen your lens, the dips look less dramatic, with the stock still up 3.4% for the year and a significant 92.3% return over the past three years. Even after a 10.0% slip over the last twelve months, anyone who had faith five years ago is sitting on a 131.2% gain.

It’s tough to ignore that volatility like this often comes when investors’ sense of risk or optimism about a company’s sector shifts. For Cintas, recent changes in broader market sentiment, along with a touch of caution given the company’s strong long-run performance, may be driving the current pullback. When it comes to how Wall Street thinks about valuation, though, the data is clear. According to a standard six-point valuation analysis, where each undervalued measure adds one to the score, Cintas clocks in at zero out of six. That means, by these yardsticks, the stock is not considered undervalued right now.

So, with recent market movements in mind and a valuation score that suggests caution, should you stick with Cintas or wait for a better entry point? Let's break down those valuation approaches next. Later, I’ll share a way of assessing value that many investors overlook.

Cintas scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Cintas Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and then discounting those amounts back to today. This method aims to reflect the present value of what Cintas could generate for shareholders in the future, based on realistic expectations about the business’s ability to keep producing cash.

For Cintas, current Free Cash Flow is $1.7 billion. According to analyst forecasts, Free Cash Flow is projected to grow over the next few years, reaching around $2.4 billion by 2028. Beyond that, cash flow is modeled to continue rising modestly through 2035, based on general industry trends and Simply Wall St’s extrapolations.

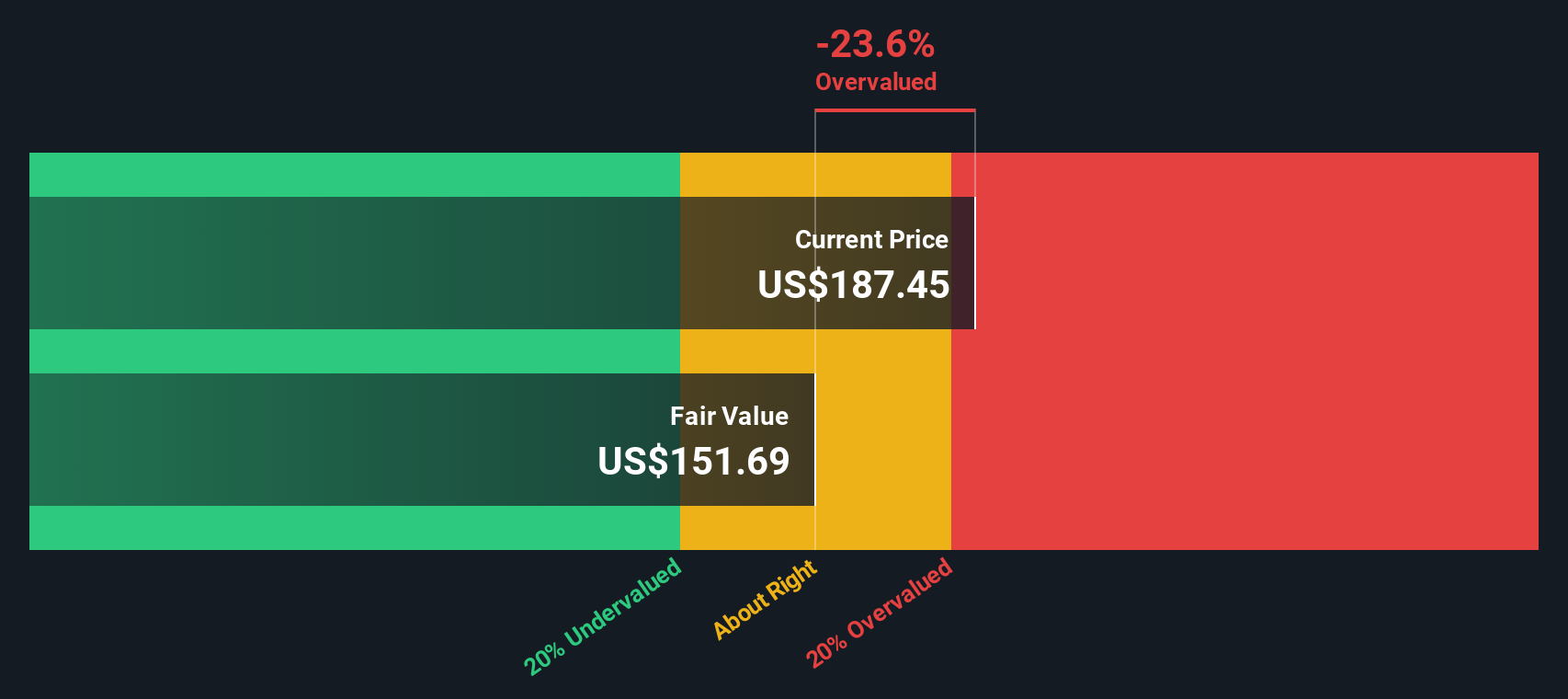

Based on these projections, the DCF model arrives at an intrinsic value of $151.72 per share. Compared to the current market price, this suggests the stock is trading at a 24.1% premium to its estimated fair value, indicating it appears overvalued on this metric.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cintas may be overvalued by 24.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Cintas Price vs Earnings

For consistently profitable companies like Cintas, the Price-to-Earnings (PE) ratio is a go-to tool for investors. It puts the company’s share price in context with its earnings, making it easier to assess if the stock’s current price reflects reasonable growth prospects and risk levels. Higher PE ratios are often seen in companies expected to deliver above-average growth or those viewed as lower risk. Lower PEs may point to more conservative expectations or higher perceived risks.

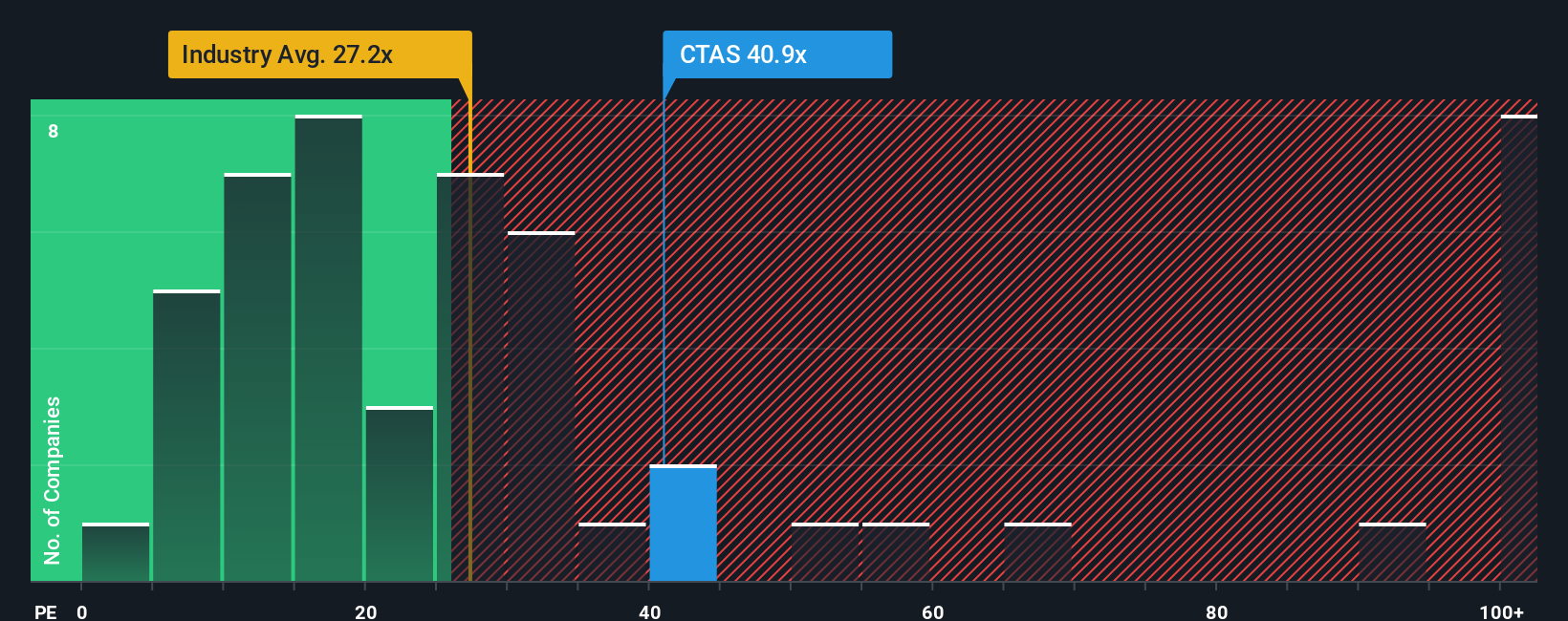

Cintas currently trades at a PE ratio of 41x. That is well above the Commercial Services industry average of 27.4x, and higher than the average among its direct peers at 33.7x. At first glance, this difference might suggest the stock is priced for exceptional growth or resilience, but a more tailored metric helps shed further light on this comparison.

This is where Simply Wall St’s Fair Ratio steps in. Unlike typical benchmarks, the Fair Ratio is a proprietary metric that weighs Cintas’s earnings growth, profit margin, industry standing, market cap, and specific risks to calculate a more individualized PE benchmark. For Cintas, the Fair Ratio comes in at 32.5x, which adjusts for all those unique business qualities much more effectively than a simple peer or industry average.

Given the current PE ratio of 41x and a Fair Ratio of 32.5x, Cintas is trading about 8.5 points higher than what Simply Wall St’s model considers justified by its fundamentals. This suggests that based on earnings, Cintas appears somewhat richly valued.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cintas Narrative

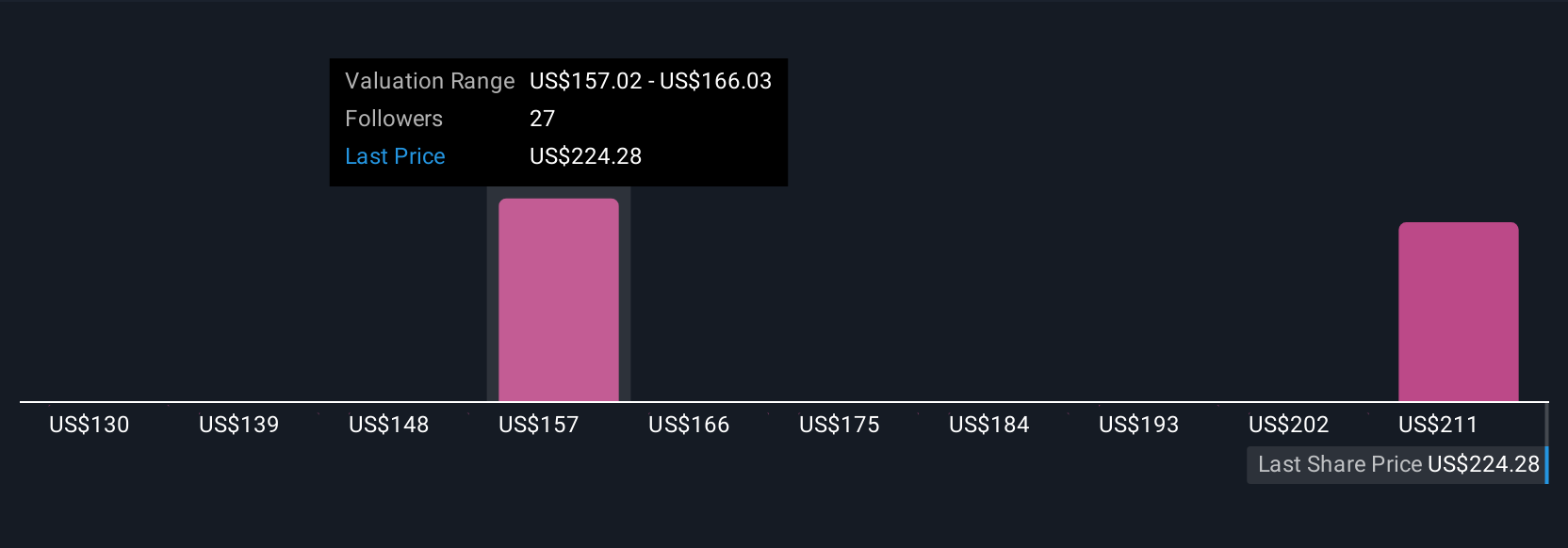

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your personal story about a company, tying together what you believe about its future, such as revenue growth, profit margins, and risks, into a single, clear outlook and fair value estimate. By blending your expectations and research behind the numbers, Narratives reveal why you think a stock like Cintas is worth buying or holding, going beyond static price targets.

On Simply Wall St’s Community page, millions of investors use Narratives as an intuitive tool to capture these perspectives, linking their company insights directly to dynamic forecasts and valuations. Narratives make it easy to compare your Fair Value, which is what you see as a reasonable price, to the current market price, helping you decide whether to buy, hold, or sell with greater confidence. The best part is that Narratives automatically update as new news or earnings are released, so your thesis is always current and actionable.

For Cintas, this means that one investor might be bullish and set a fair value of $257 if they believe in sustained margin expansion and recurring revenue. Another may be more cautious and see $172 as fair due to concerns about remote work and industry shifts.

Do you think there's more to the story for Cintas? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTAS

Cintas

Engages in the provision of corporate identity uniforms and related business services primarily in the United States, Canada, and Latin America.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives